HPE has big AI infrastructure plans that are 'going to take a little bit of time'

Hewlett Packard Enterprise gave an upbeat presentation on taking networking share and capitalizing on the AI infrastructure buildout, but its fiscal 2026 revenue growth forecast was lower than expected.

At its Security Analyst Meeting, HPE projected fiscal 2026 revenue growth of 5% to 10% and analysts were expecting about 17%. HPE projected adjusted earnings for fiscal 2026 of $2.20 a share to $2.40 a share compared to estimates of $2.42 a share.

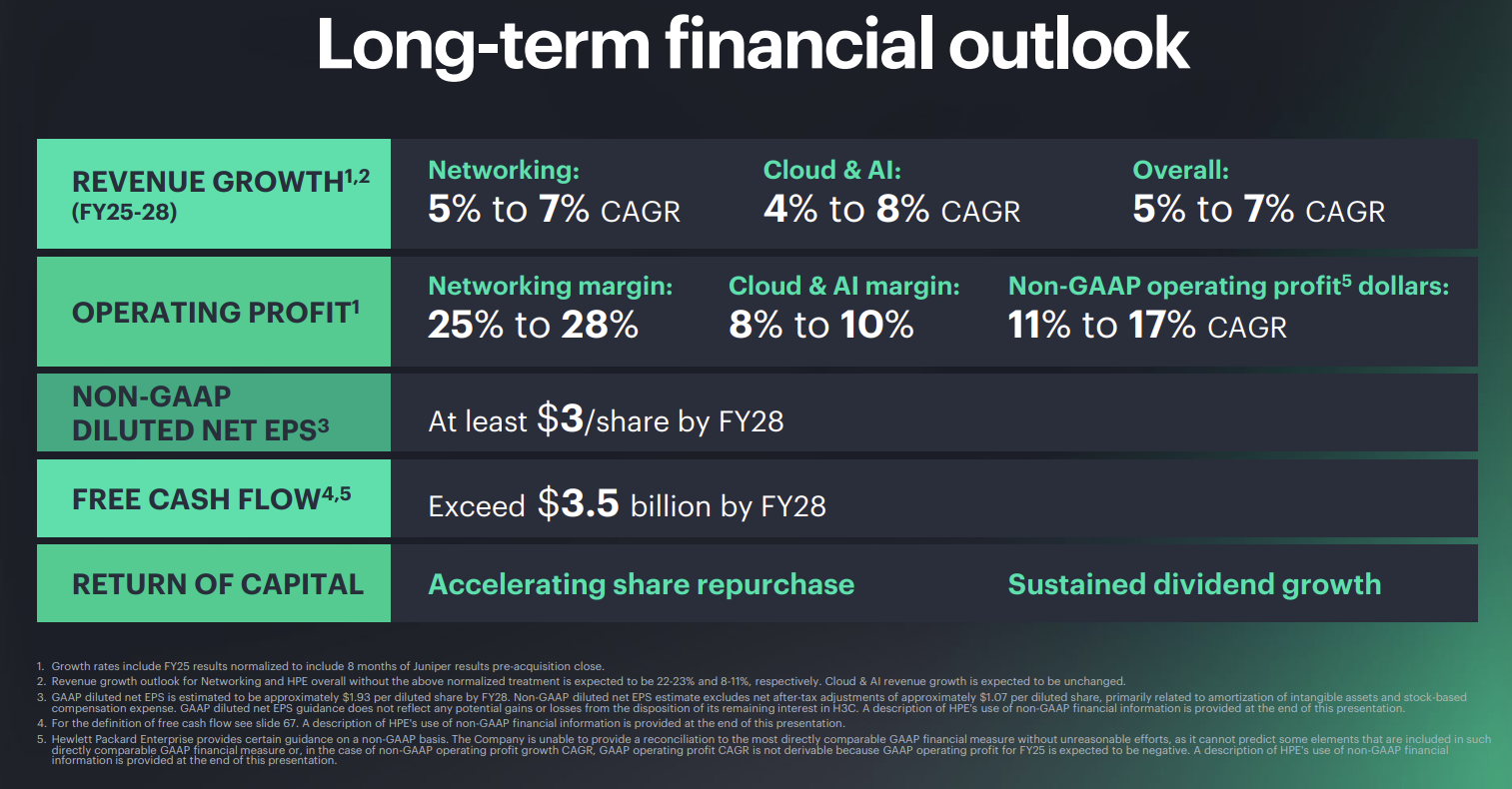

HPE also projected a 5% to 7% compound annual revenue growth rate with non-GAAP earnings of at least $3 a share for fiscal 2028. HPE did raise its dividend 10% and announce a $3 billion share repurchase plan.

- HPE reports strong Q3 with Juniper Networks in the fold

- HPE completes Juniper Networks purchase, eyes integration next

- HPE launches GreenLake Intelligence, adds AI agents throughout hybrid cloud stack

CEO Antonio Neri emphasized that HPE was focusing on its operating margins and capturing profitable share of AI infrastructure. Neri was joined by Rami Rahim, who gave an overview of the networking plan.

"HPE strategic priorities over the next 3 years are clear. We will build a new networking industry leader, capture AI infrastructure growth profitably, with a focus on sovereign and enterprise customers, accelerate our high-margin software and services growth through our HPE GreenLake Cloud, capitalize on unstructured data market growth with our own IP through Alletra MP Storage and drive customer transition to next-generation server platforms," said Neri.

Neri said the company will deliver annual run rate savings by 2028 of at least $600 million through the Juniper integration and another $350 million from its efforts to optimize efficiency under a program called Catalyst.

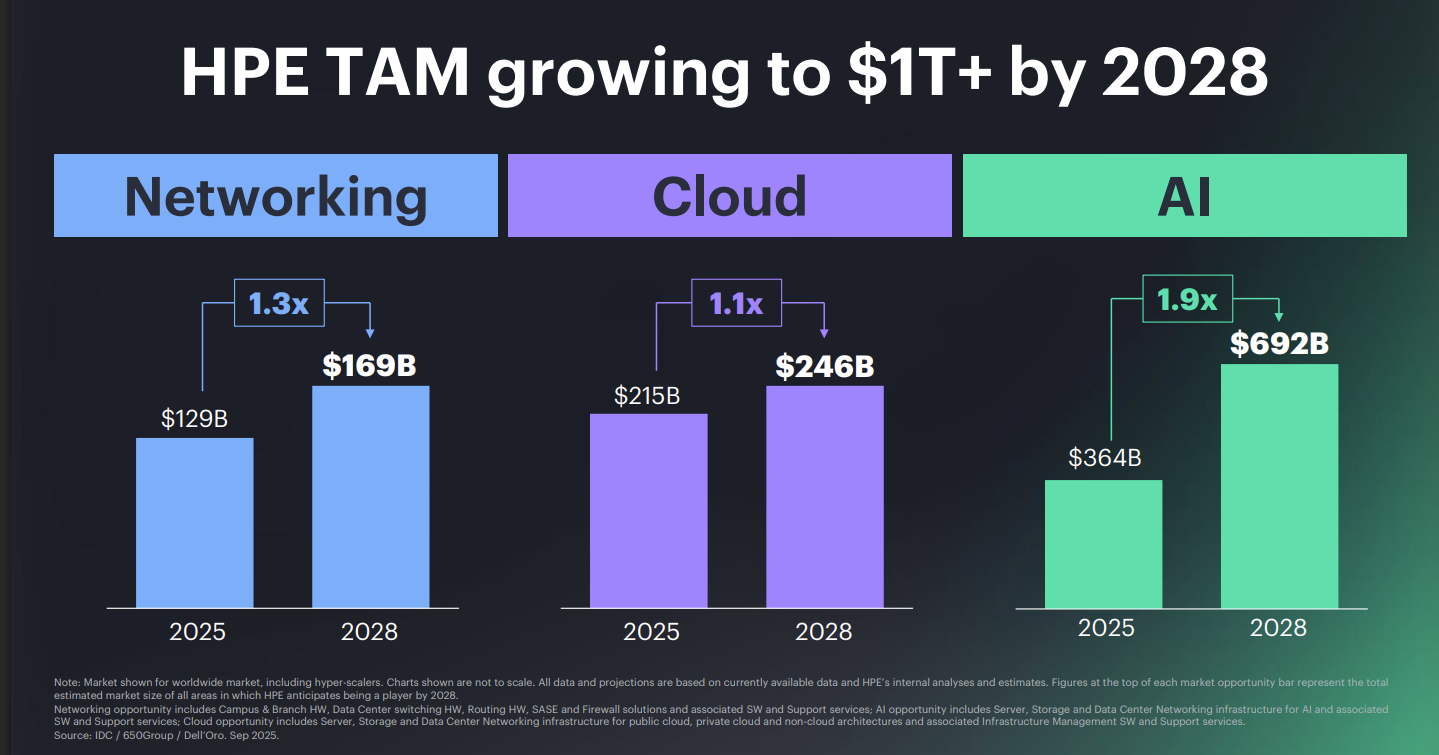

"HPE is playing to win in 3 strategic IT markets: networking, cloud and AI, each one serves as an essential building block for modern IT. These markets are all growing at an accelerated pace, driven by advancement in AI and the swift expansion in data center build-outs," said Neri. "We anticipate the overall total addressable market across our portfolio will increase to over $1.1 trillion by fiscal year 2028."

Rahim added that networking will be a critical part of HPE's growth engine for AI infrastructure. "In this new AI era, networking has become mission critical. And as a result, we expect to capture market share in key network product segments that are both large and growing," said Rahim.

Rahim added that HPE's networking business will focus on data center needs for industries, locations, enterprise and AI factories. He said data centers will become more diverse and the era of one-size-fits-all is over.

HPE's presentation was bullish, but the guidance from CFO Marie Myers didn't line up with the expansion plans. Myers explained that HPE is looking to lower its debt load, invest in its products and increase capital returns.

Wall Street analysts weren't thrilled about the outlook, but Neri and Rahim explained that the sales cycles for networking are longer, neo cloud providers are a new market and reference accounts take time.

"We did not bake revenue synergies into 2026 for a specific reason. I have a lot of work in 2026 to integrate 2 businesses together without disrupting any customers. I think I can do that. So we were a bit cautious about expecting too much in that time frame. I think over time, through both commercial and technical integrations, we can see revenue synergies, but that's just going to take a little bit of time," said Rahim.