IonQ acquires SkyWater for $1.8 billion, bulks up with quantum chip foundry

IonQ will acquire SkyWater Technology in a deal valued at $1.8 billion, or $35 a share. The move will give it a foundry to make quantum computing chips as well as other US-based semiconductors.

The deal immediately bulks up IonQ's revenue, which has already been helped by a series of acquisitions, and makes it a vertically integrated quantum computing company. IonQ said SkyWater will continue to operate as a semiconductor foundry.

What will be interesting is to how IonQ's acquisition of SkyWater impacts the foundry's deals with other quantum companies. The company has partnerships with D-Wave and PsiQuantum, but is really a US semiconductor sovereignty play and offers a foundry for multiple chips.

SkyWater reported third quarter revenue of $150.7 million and 2024 revenue of $342.3 million. During its third quarter earnings call, SkyWater projected $600 million in 2026 revenue.

IonQ said its 2025 revenue will be at the high end of its $106 million to $110 million projection.

"We believe the future of quantum computing will not be defined by a single winning technology. Just as classical computing evolves into a diverse landscape of CPUs, GPUs, FPGAs and custom accelerators optimized for different workloads, we expect Quantum to follow a similar path where different modalities specialize around unique application requirements," said CEO Thomas Sonderman on SkyWater's third quarter earnings call.

IonQ's deal for SkyWater is cash and stock and is part of a strategy to create a large quantum supplier to the US government. IonQ plans to take SkyWater and create a quantum stack that covers compute, networking, security and sensing technologies.

Niccolo de Masi, CEO of IonQ, said the deal "enables IonQ to materially accelerate its quantum computing roadmap and secure its fully scalable supply chain domestically." He added that the SkyWater purchase will accelerate quantum computing commercialization.

Sonderman said the IonQ deal will enable the combined company to "accelerate multiple engineering pathways for next-generation quantum chips." He added the SkyWater is "fully committed to all of our semiconductor foundry customers and will continue as the quantum merchant supplier of choice."

SkyWater will operate as a wholly owned subsidiary and Sonderman will continue to run the company and report to de Masi.

As for the rationale behind the deal, the companies outlined the following:

- IonQ with SkyWater will be able to accelerate quantum platform roadmaps. The combined company is expected to functionally test 200,000 qubit QPUs in 2028 for 8,000 ultra-high fidelity logical qubits.

- The purchase of SkyWater strengthens IonQ's position as a US government supplier and support Department of War programs.

- Combined engineering teams and strong balance sheet.

- The structure of the deal--SkyWater shareholders get $15 in cash and $20 in IonQ stock--will give the company financial flexibility.

IonQ emphasized that SkyWater will remain committed to its current aerospace and defense customers as well as provider for AI, quantum, electrification, IoT and healthcare markets. SkyWater will need to keep its revenue base including IonQ rivals for the deal to work.

The Tesla of quantum?

On a conference call with analysts, de Masi outlined the deal and argued that SkyWater will continue to support new and existing customers.

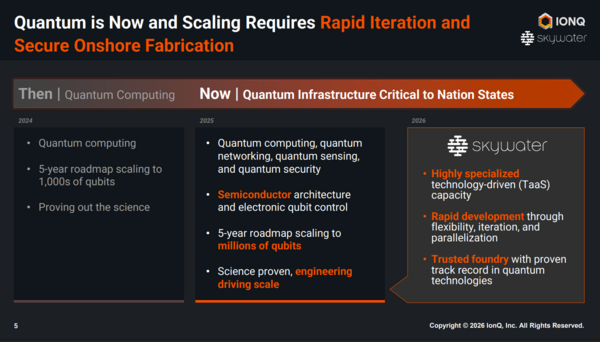

He said IonQ's business has evolved to a full-stack approach to quantum computing. "Our business has evolved quickly from just quantum computing to today's full stack platform of quantum computing, quantum networking, quantum sensing and quantum security," said de Masi. "We are now at the stage where we have line of sight to scaling to millions of qubits based on a semiconductor architecture and electronics qubit control."

Sonderman made the case for SkyWater under IonQ ownership. He said:

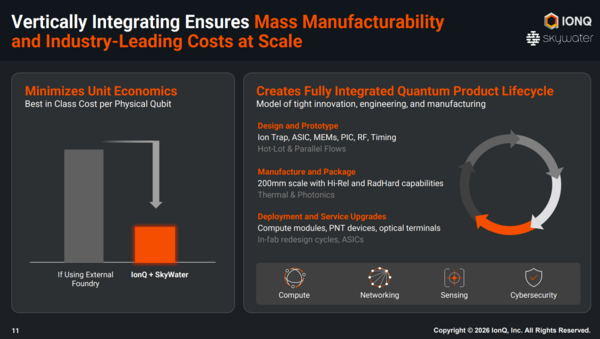

"SkyWater isn't just a foundry. What differentiates us is our technology as a service operating model. It supports volume production and high mix advanced technologies as well as foundational node wafer manufacturing, emerging technology, co-innovation and advanced packaging. In addition, this model enables massive parallel development, enriching learning and compounding innovation across chip generations. SkyWater also brings immense strategic relevance to IonQ's federal business."

Sonderman also made the case that "we have a broad customer base across aerospace and defense, auto and quantum boundary integrity will remain the same. There will be no changes to customer access and our IP protections," he said.

De Masi said that the SkyWater purchase will pull forward IonQ's plan to have a 2 million qubit chip by a year.

"We've spoken before about how our architecture enables lower cost per unit with SkyWater, we expect to have industry leading costs at scale. We will continue to lead the market, not only in terms of performance, but also in price. History shows how computing battles are won along vectors of miniaturization and cost per unit output," said de Masi. "We will now also have the full product life cycle, from design and prototype, manufacture and package to deployment and service updates. There are many examples across the industry of such vertical integration leading to a sustained advantage in innovation and economics. Tesla is perhaps the most powerful example of this over the past decade."