Cognizant aims to solve "AI velocity gap"

Cognizant CEO Ravi Kumar said the company's strategy in 2026 revolves around solving the AI velocity gap between AI infrastructure spending and business value.

Kumar's comments on Cognizant's fourth quarter earnings call are worth noting. Indeed, the gap between actual returns on investment among enterprises and the trillions of dollars thrown at AI infrastructure is wide.

The Cognizant CEO, who has been at the helm for three years and credited with the company's turnaround, said:

"While AI technology is now mature enough to offer transformative value, the methodologies and tools to harness it are only just emerging and the value to enterprises hasn't drifted yet. Cognizant's mission is to be the AI builder bridging this gap to enterprise value by converting the technology to measurable returns on investments for our clients."

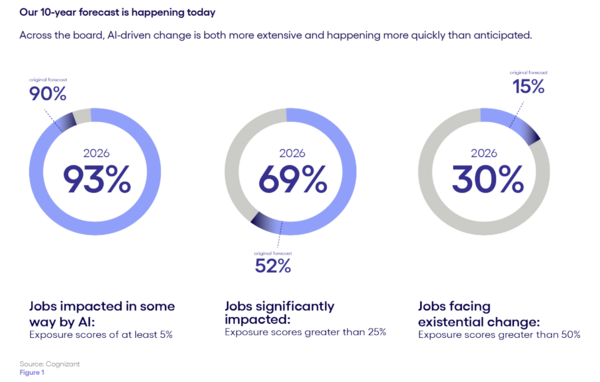

In September, Kumar outlined Cognizant's approach to three vectors of AI returns. The final vector is building agentic AI capital and digital labor that goes beyond the reach of legacy software. Cognizant recently released new research, updated from 2023, that AI's impact on work is accelerating. Cognizant's latest New Work, New World research estimates that AI today is capable of unlocking $4.5 trillion in U.S. labor value in the future.

- Constellation ShortList™ AI Services: Global

- Cognizant CEO Kumar: Agentic AI will create a reinforcing flywheel of ROI

- Cognizant eyes multiyear plan to 'agentify the enterprise'

- Cognizant: AI savvy consumers will drive spending, demand new experiences

- Constellation ShortList™ Digital Transformation Services (DTX): Global

Kumar's plan for Cognizant revolves around reinventing its role as an IT services firm and systems integrator. "Today's AI-led software, which is written around the frontier models, is probabilistic and contextual. This shift allows us to own the stack again and deliver to outcomes. We believe reinvention and reimagination of businesses will be driven by value at the intersection of AI-led agentic capital and classical software," said Kumar, who added that Cognizant's AI builder stack aims to be the connective tissue between AI compute, cloud, models and human capital services.

Closing the AI velocity gap will require a heavy dose of context engineering to give models situational awareness, operating principles, work knowledge and history to create agentic capital, said Kumar. In a nutshell, Cognizant is leveraging its own intellectual property and melding it with its ecosystem that includes partnerships with everyone from Anthropic and OpenAI to Palantir, ServiceNow, Salesforce and all the cloud hyperscalers.

Kumar added that new technologies such as AI agents won't magically generate value and enterprises need a bridge from legacy to modern systems as well as process reinvention. "You can't apply this technology on existing old processes. You have to reinvent and reimagine a process," said Kumar. "This is a technology which is very contextual in nature."

- Agentic Automation Doesn’t Fail at Reasoning. It Fails at Inputs.

- Welcome to the context chorus: There’s no AI without context

Internally, Cognizant is also shifting the way it works with its 340,000 employees. "We are shifting from traditional linear staffing model to an asynchronous autonomous software engineering model. In this framework, our associates are trained to delegate complex high-value macro tasks to agentic networks while they micro steer to outcomes using platforms like Cognition, Gemini, Cloud, GitHub and others, orchestrating through Cognizant Flowsource," said Kumar.

It's also notable that Kumar said Cognizant is broadening its talent base with non-STEM talent to develop interdisciplinary skills.

Perhaps the biggest takeaway from Kumar is that closing the AI velocity gap is a heavy lift. He added that the disruption will increase Cognizant's total addressable market. The reality is that the returns on AI haven’t hit the enterprise yet.

"We see this as a net new tailwind for us on two swim lanes on the traditional software, apply it and do more for less and get more consumption because of elasticity, take out technical debt, take out the backlog," said Kumar. "On the other end, apply this on a much new addressable spend, which classical software didn't penetrate. I see this as more of a bigger opportunity for us and a higher surface area for us to actually operate."

Cognizant's Q4, 2025 results

Cognizant's reinvention is ahead of schedule and it's showing up in the financial results.

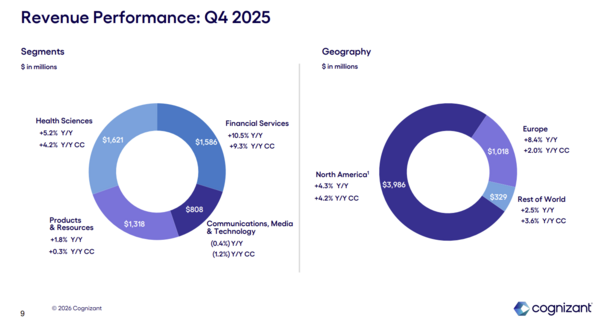

The company reported fourth quarter earnings of $1.34 a share on revenue of $5.33 billion, up 5% from a year ago. Non-GAAP fourth quarter earnings were $1.35 a share. For 2025, Cognizant reported earnings of $4.56 a share on revenue of $21.11 billion, up 7%.

Cognizant signed 28 large deals in 2025 with total contract value of nearly 50%.

As for the outlook, Cognizant projected first quarter revenue growth of 4.8% to 6.3%. For 2026, revenue is expected to be $22.14 billion to $22.66 billion, up 4.9% to 7.4%.

Jatin Dalal, CFO of Cognizant, said the company saw fourth quarter strength in financial services, up 10.5% from a year ago, and health sciences, up 5.2% from a year ago.

Dalal said Cognizant inked a dozen $100 million deals in the fourth quarter and is seeing projects shift from productivity to innovation.

"In this period of heightened uncertainty, we are helping customers reduce costs while improving patient experiences and accelerating productivity," said Dalal. "These cost savings are funding clients' future-focused investment across core platforms, cloud modernization and regulatory readiness. We are seeing GenAI projects grow in areas like claims efficiency, clinical documentation and customer experience."