Alphabet plots massive CapEx increase for 2026

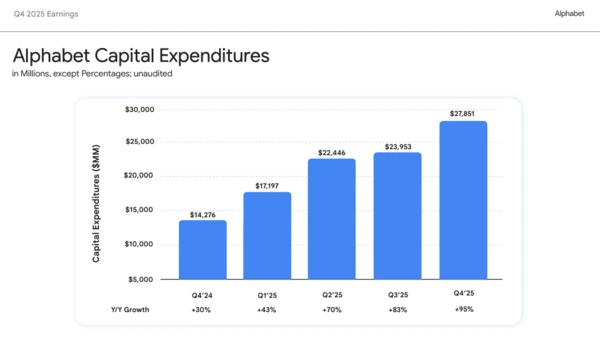

Google Cloud's fourth quarter revenue was $17.7 billion, up 48% from a year ago, as the company saw its Gemini usage spike. Alphabet, parent company of Google, Google Cloud and YouTube, said its 2026 capital expenditures will be between $175 billion to $185 billion, up from $91 billion in 2025.

Alphabet reported fourth quarter earnings of $34.45 billion, or $2.82 a share, on revenue of $113.83 billion, up 18% from a year ago. Wall Street was expecting Alphabet fourth quarter earnings of $2.64 a share on revenue of $111.48 billion.

For 2025, Alphabet reported earnings of $132.17 billion, or $10.81 a share, on revenue of $402.84 billion, up 15% from 2024. Alphabet has leveraged a vertically integrated stack and its TPUs to monetize AI.

- Google adds Gemini 3 to AI overviews with follow-up questions

- Google Gemini launches Personal Intelligence

- Google Gemini to power Apple Intelligence

- Google launches agentic commerce tools, Universal Commerce Protocol, Gemini Enterprise for Customer Experience

- Alphabet buys Intersect for $4.75 billion to boost its data center energy options

CEO Sundar Pichai said Gemini and other first-party models "now process over 10 billion tokens per minute via direct API use by our customers, and the Gemini App has grown to over 750 million monthly active users." Pichai added that the Gemini App has 750 million monthly active users. On a conference call, Pichai said Google Cloud backlog was $240 billion, up 55% from a year ago.

Google Cloud is benefiting from Gemini momentum in the enterprise and now is on more than a $70 billion annual revenue run rate.

The results from Alphabet follow big capital expenditure projections from Meta and Microsoft.

By the numbers:

- Google Cloud fourth quarter operating income was $5.31 billion on revenue of $17.66 billion. Fourth quarter operating income a year ago was $2.09 billion.

- Google Services, including search, ads and YouTube, delivered operating income of $40.13 billion on revenue of $63.07 billion.

- Alphabet spent $61.09 billion on R&D in 2025, up from $49.3 billion a year ago.

Pichai outlined the following on the earnings call:

- "We were able to lower Gemini serving unit costs by 78% over 2025 through model optimizations, efficiency and utilization improvements next world class AI research, including models and tooling."

- "The number of Google Cloud deals in 2025 over $1 billion dollars surpassed the previous three years combined. We continue to deepen our relationships with existing customers, who are outpacing their initial commitments by over 30%. Nearly 75% of Google Cloud customers have used our vertically optimized AI from chips to models to AI platforms and enterprise AI agents."

- "Ninety five percent of the top 20 and over 80% of the top 100 SaaS companies use Gemini, including Salesforce and Shopify."

- Google Cloud will be among the first to offer Nvidia's Vera Rubin GPU platform.

- "We have sold more than 8 million paid seats of Gemini Enterprise to more than 2,800 companies. Gemini Enterprise managed over 5 billion customer interactions in Q4 growing 65% year over year for customers."

- "Search saw more usage in q4 than ever before. As AI continues to drive an expansionary moment. We have executed with incredible speed. We shipped over 250 product launches within AI mode and AI overviews. Just last quarter, we have integrated Gemini three directly into AI mode and search. Now search can better understand your query, dive deeper on the web and generate interactive UI experiences."

- "We have also made the search experience more cohesive, ensuring the transition from an AI Overview to a conversation in AI Mode is seamless."

- Pixel 10a will be introduced soon.

CFO Anat Ashkenazi outlined a series of Google Cloud metrics:

- Google Cloud saw strong demand in enterprise AI products that are generating "billions in quarterly revenues."

- "We had strong growth in both enterprise AI infrastructure, driven by deployment of TPUs and GPUs and enterprise AI solutions."

- "We also had double digit growth in Workspace driven by an increase in average revenue per seats."

- As for the outlook, Ashkenazi laid out the following:

- Alphabet expects the normal seasonal pattern for advertising.

Google Cloud is "seeing significant demand for products and services, which we expect and continue to drive strong growth despite the tight supply environment we're operating in." - "The significant increase in our investments in technical infrastructure will continue to put pressure on the P&L in the form of higher depreciation expense and related data centers operations costs such as energy."