Softbank invests $2 billion in Intel: Why?

Softbank will invest $2 billion into Intel at $23 a share in a deal may be a value-oriented investment as well as a head scratcher. Perhaps the biggest question for Softbank is this: Why?

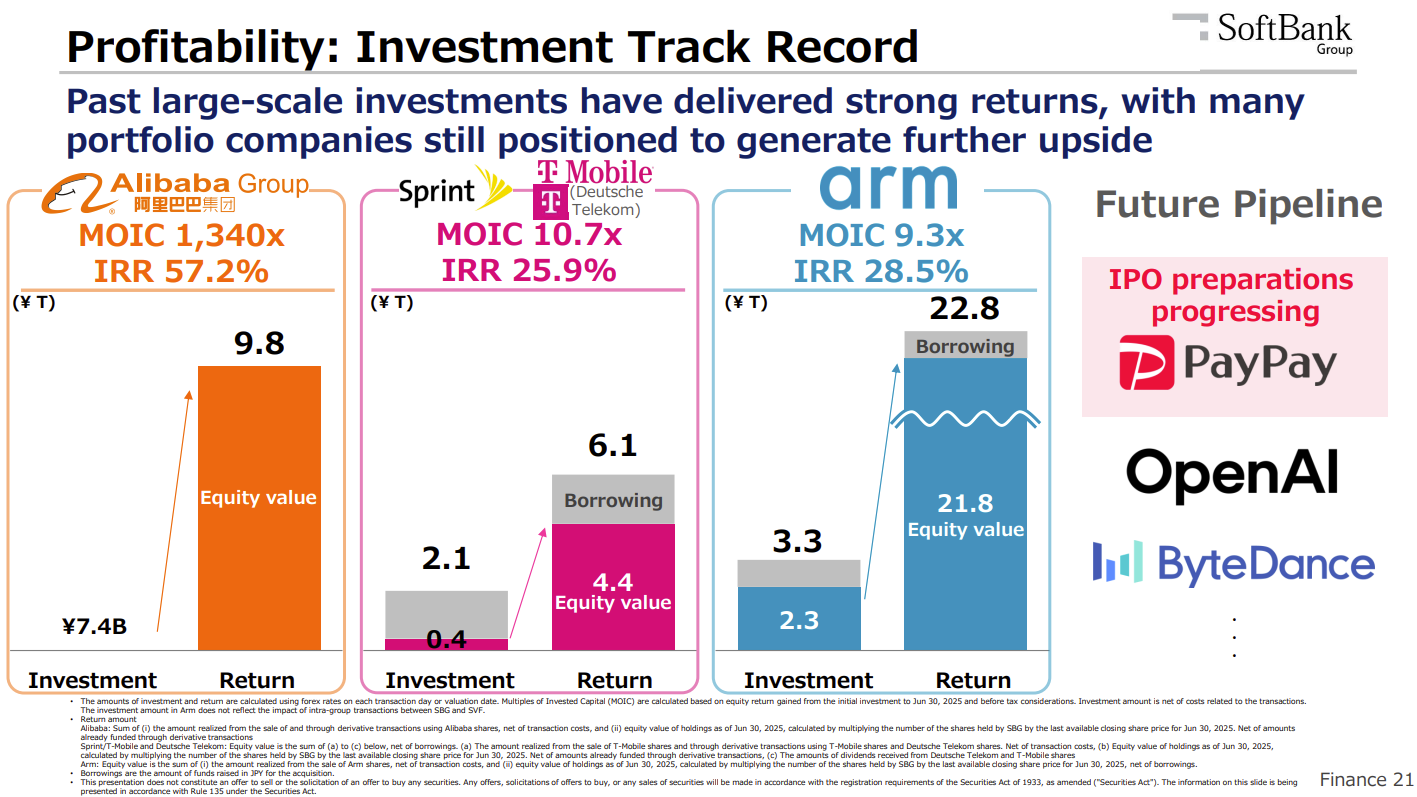

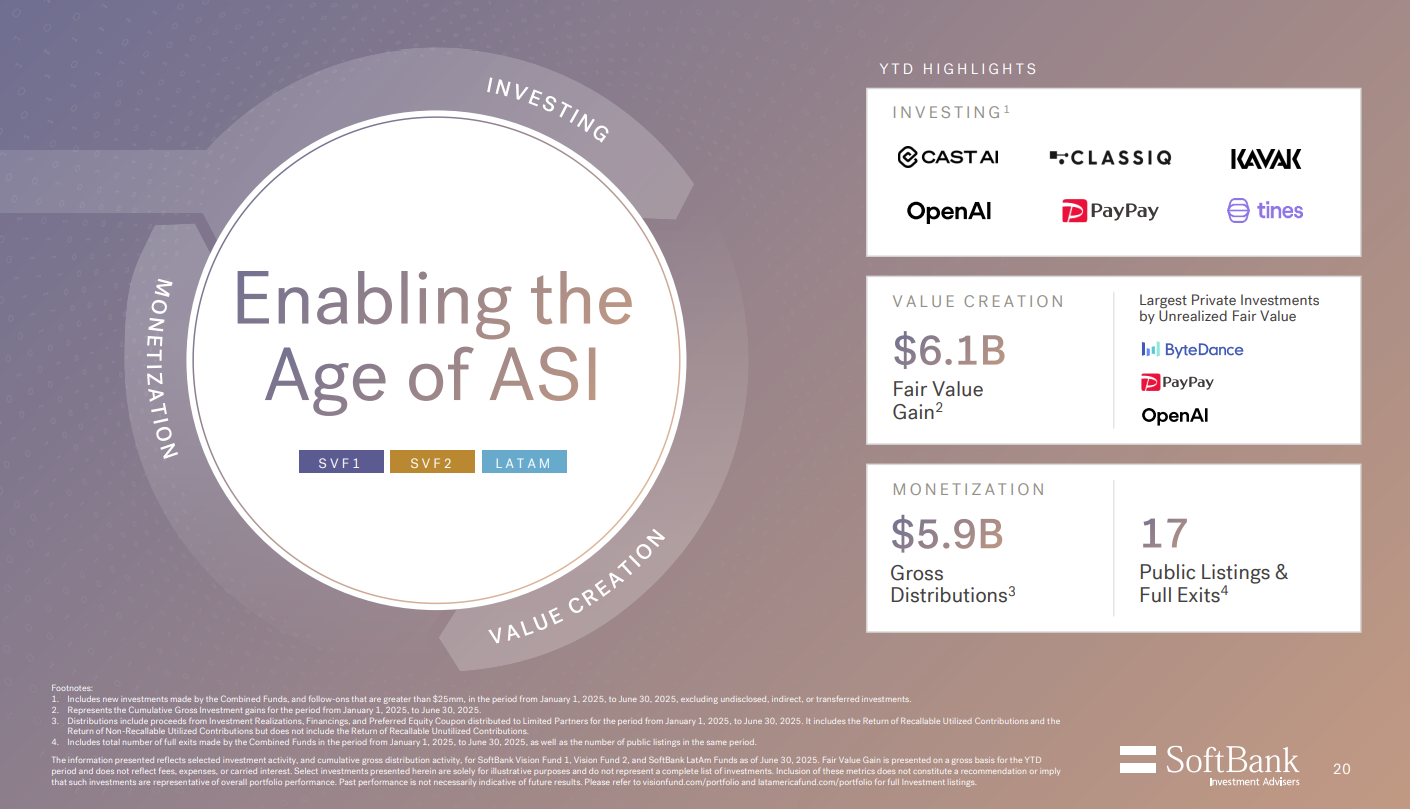

After all, Softbank already has skated to where the puck is going. Softbank has bet big on AI, owns Arm and a big chunk of OpenAI. Arm is the architecture beating Intel into a pulp in recent years. Nvidia and AMD have been running circles around Intel on servers, PCs and GPUs too. By the way, Softbank has an investment in Nvidia too and is closing a $6.5 billion purchase of Ampere.

Unless Softbank just wants to collect chipmaker stocks there has to be a reason right?

The statement from Intel on the Softbank investment wasn't all that helpful.

Softbank CEO Masayoshi Son said: "For more than 50 years, Intel has been a trusted leader in innovation. This strategic investment reflects our belief that advanced semiconductor manufacturing and supply will further expand in the United States, with Intel playing a critical role."

Son would be believable if it didn't already bet on the winning semiconductor horses.

Softbank Group CFO Yoshimitsu Goto, who is also CISO, Head of legal, Admin & Finance Unit and Group Compliance Officer & Director, spent a lot of time talking about Arm on its second quarter earnings call. Arm plans to pour money into R&D and design its own processors.

Goto said:

"We actually encourage Arm to spend the money for future growth. From business perspective, compute subsystem, or CSS, is a key driver, and CSS is an integrated IP package that includes multiple Arm CPUs. And CSS helps customers shorten development time and reduce cost."

Goto noted that about half of the server chips launched by major hyperscalers will be Arm based this year. Enterprises are also gravitating to Arm. "Arm is quickly becoming the core platform for the AI era, cloud infrastructure," said Goto.

Why buy Intel then? Maybe it's just $2 billion among friends.

Lip-Bu Tan, CEO of Intel, said: "SoftBank, a company that’s at the forefront of so many areas of emerging technology and innovation and shares our commitment to advancing U.S. technology and manufacturing leadership. Masa and I have worked closely together for decades, and I appreciate the confidence he has placed in Intel with this investment."

Tan had been on Softbank's board from 2020 to 2022 before he stepped down.

There's probably some truth to Softbank helping out Intel for the good of the ecosystem and Tan. But there are some other reasons worth pondering. Here are a few thoughts.

- Intel has manufacturing assets in the US and needs a bailout. Softbank is involved with AI heavily and may need future capacity for Stargate. Sure, Intel Foundry is a sinkhole right now, but if the AI boom plays out then that capacity will be useful to Arm or any one of Softbank's investments. Stargate Project sites under due diligence, says SoftBank

- The investment buys goodwill so it's politically savvy. Intel, and Tan, has been in the political crossfire of late. Softbank is playing ball and investing in the US. The investment in Intel buys some US credibility.

- Downside risk is limited. Softbank plays on a massive boom-bust scale and $2 billion is a paltry sum. Intel may recover and if it does Softbank will do well. If Intel doesn't Softbank has paid $2 billion for intangibles. Either way it doesn't matter much since $2 billion is spare change.