Qualcomm outlook light, but preps on-device generative AI processors

Qualcomm said it will roll out a series of generative AI products at its Snapdragon Summit in October. The company is betting that its mobile processor units will be a must have for AI use cases on edge computing and devices.

The idea of using local compute power to run AI models has been picking up. Enterprises are pondering whether they can offload AI workloads to devices instead of running them on their dime.

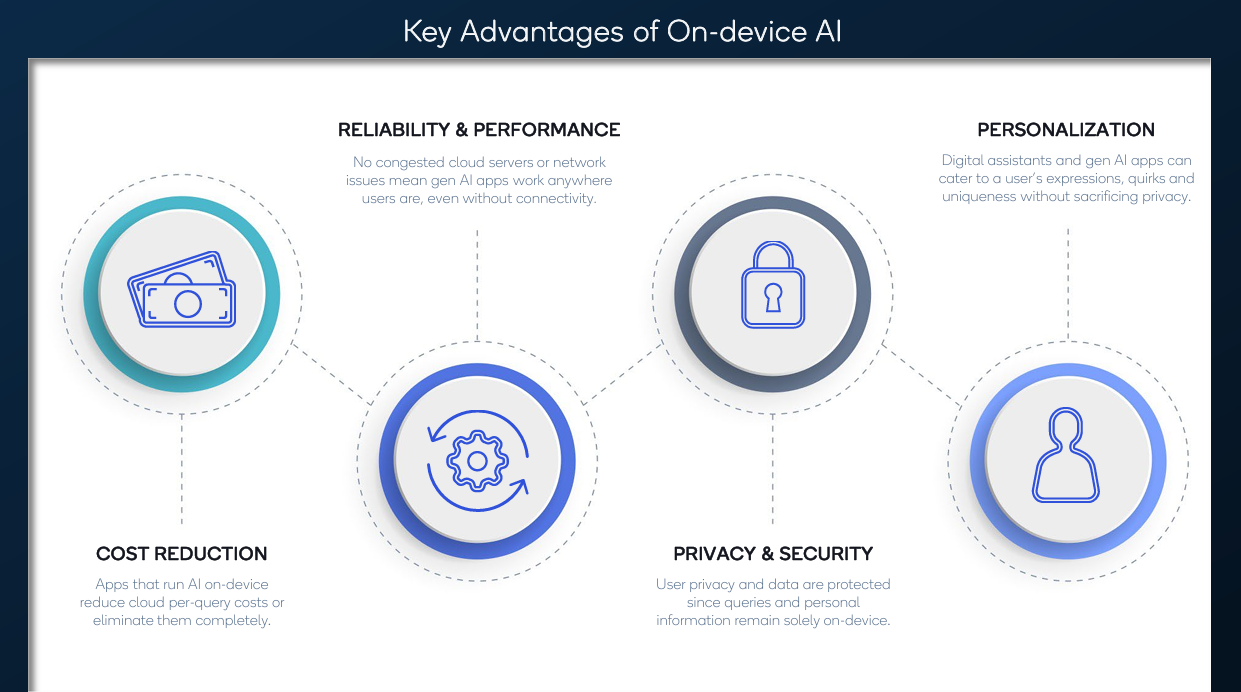

Cristiano Amon, CEO of Qualcomm, made the comments about AI use cases on the company's fiscal third quarter earnings conference call. Qualcomm outlined a collaboration with Microsoft to enable on-device generative AI applications. The aim would be to make generative AI more affordable and private. Qualcomm also is collaborating with Meta on running AI models like Llama 2 on Snapdragon devices.

"Our next-generation PC platform with integrated custom Orion CPUs in a significantly upgraded AI engine remains on track for commercial readiness. We look forward to sharing more information at our Snapdragon Summit in October," said Amon.

Amon said

"Everything that is real-time AI and requires context and low latency and personalization applies to all of our markets. We're going to announce a new set of products that will be generative AI compliant across use cases. If our customers and partners come up with new use cases and you have a gen AI capable smartphone it creates a upgrade cycle.

"GenAI on device needs a different computing platform that can enable AI continuously at low power."

While Amon's comments foreshadow the future focus for Qualcomm, the company has plenty of issues with its core business. Qualcomm's third quarter earnings topped estimates, but the outlook for the fourth quarter fell short of expectations. Handset chip sales fell 25% from a year ago.

Qualcomm reported third quarter non-GAAP earnings of $1.87 a share, above the $1.81 a share estimate. Revenue for the quarter was $8.44 billion, lower than the $8.5 billion expected for the third quarter. Net income was $1.60 a share. As for the outlook, Qualcomm said it expected non-GAAP earnings between $1.80 a share and $2 a share. Sales for the fourth quarter will be between $8.1 billion to $8.9 billion. That wide range was short of estimates calling for non-GAAP earnings of $1.91 a share on revenue of $8.7 billion.

Among the takeaways:

- Amon said Android device demand will be flat and Qualcomm is looking more toward expanding its reach into the mid-tier.

- Net income for the second quarter was down 52% from a year ago.

- Automotive revenue was up 13% in the third quarter.

- Amon said inventory among OEMs is bloated and "would be an issue through the end of the calendar year."

- Qualcomm gained share in Android devices. Qualcomm said Apple bought components earlier in the year, but will see a pickup in the next quarter.

- IoT revenue was down 24%.

- Handset units in 2023 will be down at least high-single digit percentage rates relative to 2022. That forecast reflects the economy and slow recovery in China.

- Qualcomm will cut costs and restructure in the first half of fiscal 2024.