Nvidia delivers strong Q2, rides data center demand, but China a wild card

Nvidia reported better-than-expected second quarter results and said revenue for the third quarter will be about $54 billion. Nvidia recorded no sales of its H20 processors in China in the second quarter and doesn’t assume any shipments in the third quarter.

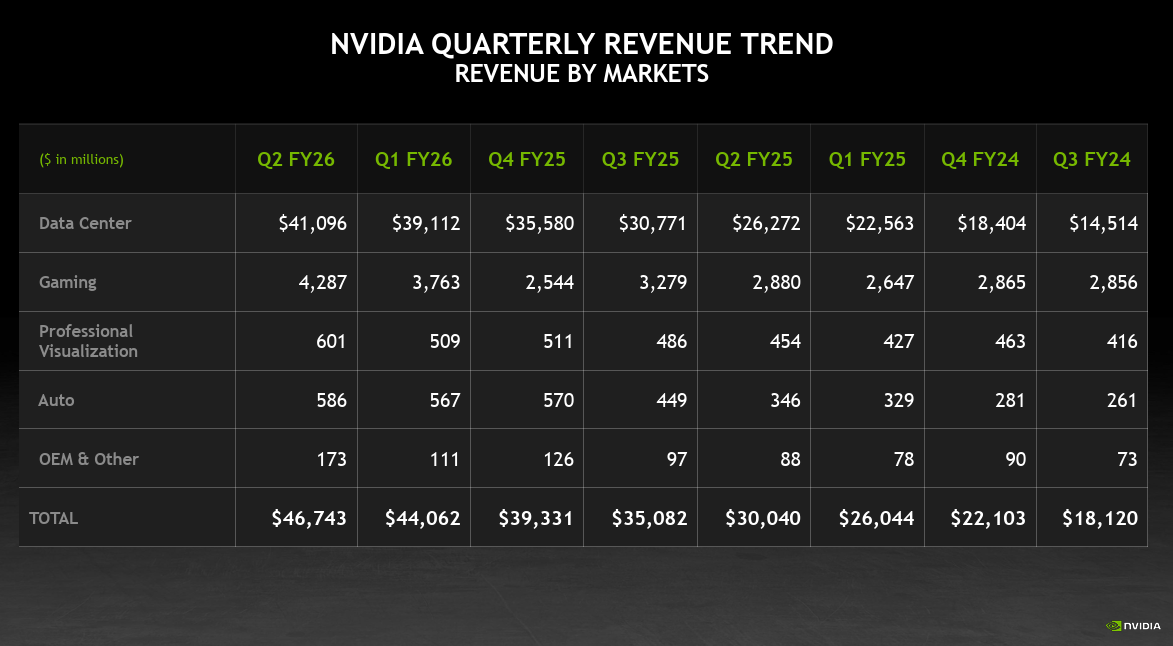

The AI chip giant reported second quarter earnings of $26.42 billion, or $1.08 a share, on revenue of $46.74 billion, up 56% from a year ago and up 6% sequentially. Non-GAAP earnings were $1.05 a share.

Wall Street was expecting Nvidia to report second quarter non-GAAP earnings of $1.01 a share on revenue of $46.13 billion.

- News Analysis: Nvidia Earnings Preview

- Nvidia adds AWS, Microsoft Azure to DGX Cloud Lepton marketplace

- Nvidia outlines EU AI expansion, ecosystem, sovereign models

Simply put, there is a lot of noise around Nvidia results given China sales, US government headlines and talk of an AI bubble.

Key takeaways:

- Nvidia released $180 million or previously reserved H20 inventory from $650 million unrestricted H20 sales to a customer outside of China.

- CEO Jensen Huang said, “production of Blackwell Ultra is ramping at full speed, and demand is extraordinary.â€

- The company approved an additional $60 billion in its stock repurchase program.

- Data center revenue was $41.1 billion, up 56% from a year ago.

- Second quarter gaming revenue was $4.3 billion, up 49% from a year ago.

- Professional visualization revenue as $601 million, up 32% from a year ago.

- Automotive and robotics revenue was $586 million, up 69% from a year ago.

- Networking revenue was $7.3 billion, up 98% from a year ago.

- Hyperscale cloud providers drove 50% of data center revenue.

- Data center revenue was a bit lighter than estimates.

- Inventory was $15.0 billion, up from $11.3 billion sequentially, to support the ramp of Blackwell Ultra.

As for the outlook, Nvidia projected third quarter revenue of $54 billion with non-GAAP gross margins of 73.3% to 73.5%.

- Nvidia launches NVLink Fusion to connect any CPU with its GPU, AI stack

- Nvidia NeMo Microservices generally available, aims for AI agent data flywheel

- Nvidia GTC 2025: Six lingering questions

- Nvidia launches DGX Spark, DGX Station personal AI supercomputers

- Nvidia launches Blackwell Ultra, Dynamo. outlines roadmap through 2027

CFO Colette Kress said in prepared remarks.

Data center growth was “driven by demand for our accelerated computing platform used for large language models, recommendation engines, and generative and agentic AI applications. We continue to ramp our Blackwell architecture, which grew 17% sequentially, including our newest architecture, Blackwell Ultra.â€

Constellation Research analyst Holger Mueller said:

"Nothing seems to be able to slow down Nvidia, which reported record revenue in each of their segments, with 'very little brother' gaming topping $4 billion in revenue. Closer to the data center, networking revenue practically doubled, and is now 1/7th of data center revenue. Headwinds are not foreseeable for the short term future - as Nvidia braved the China/H20 challenge. Things keep looking up for Nvidia."

On a conference call, Kress said:

- "The transition to the GB300 has been seamless for major cloud service providers due to its shared architecture, software and physical footprint with the GB200 enabling them to build and deploy GB300 racks with ease."

- "Factory builds in late July and early August were successfully converted to support the GB300 ramp, and today, full production is underway. The current run rate is back at full speed, producing approximately 1,000 racks per week."

- "Rubin remains on schedule for volume production next year."

- "We have not included H20 in our Q3 outlook as we continue to work through geopolitical issues. If geopolitical issues recede, we should ship $2 billion to $5 billion in H20 revenue in Q3 and if we had more orders, we can build more."

- "The market for AI inference is expanding rapidly with reasoning and agentic AI, gaining traction across industries."

- "We are on track to achieve over $20 billion in sovereign AI revenue this year, more than double than that of last year."

Huang's mission on the conference call was to allay concerns that the easy money has been made. He said the following:

- "The amount of computation that is that has resulted in agentic AI has grown tremendously. And of course, the effectiveness has also grown tremendously because of agentic AI."

- "Enterprises have been opened up as a result of agentic AI and vision language models. We now are seeing a breakthrough in physical AI, in robotics, autonomous systems. So the last year, AI has made tremendous progress and agentic systems, reasoning systems, is completely revolutionary."

- "The last couple of years, you have seen that capex has grown in just the top four CSPs by has doubled and grown to about $600 billion so we're in the beginning of this build out."

- "We're in every cloud for a good reason. Not only are we the most energy efficient, our perf per watt is the best of any computing platform, and in a world of power limited data centers, perf per watt drives directly to revenues."

- "About 50% of the world's AI researchers are in China. The vast majority of the leading open source models are created in China. And so it's fairly important, I think, for the American technology companies to be able to address that market. And open source, as you know, is created in one country, but it's used all over the world. The open source models have come out of China."