Microsoft delivers strong Q4, Azure delivers $75 billion in annual revenue

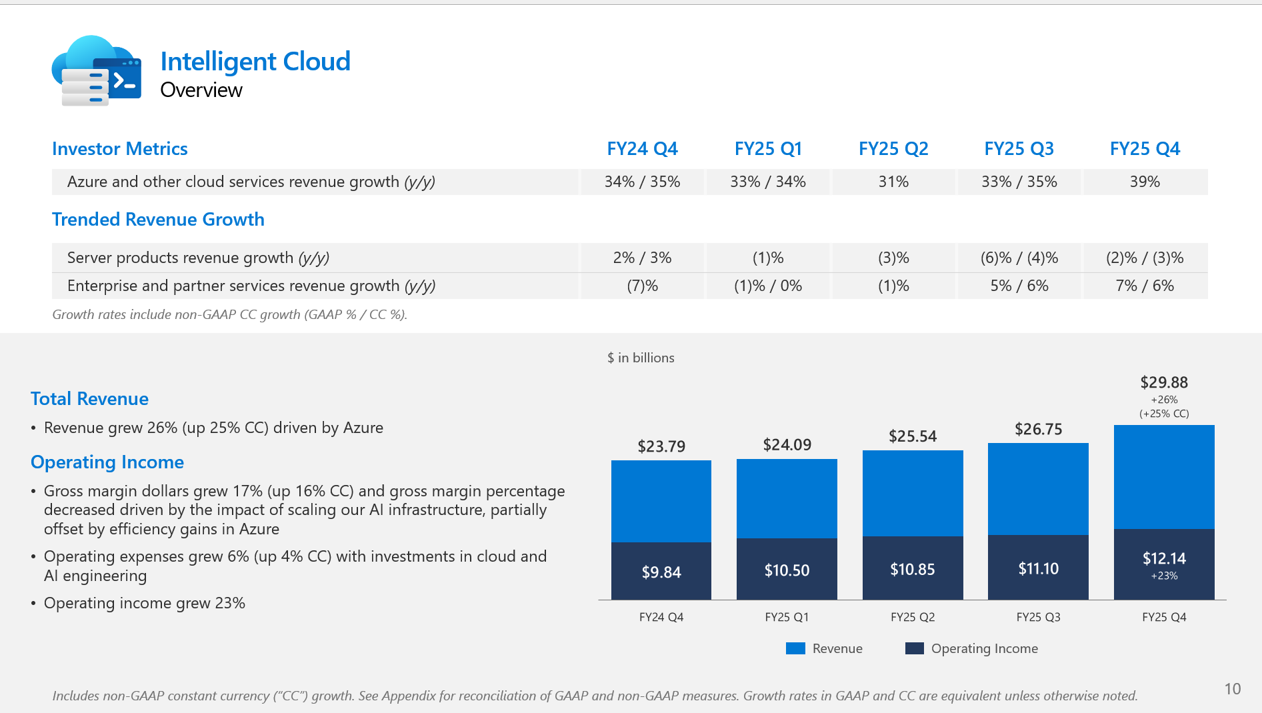

Microsoft delivered better-than-expected fourth quarter earnings results as Azure ended the fiscal year with $75 billion in revenue, up 34%.

The company reported fourth quarter net income of $27.2 billion, or $3.65 a share, on revenue of $76.4 billion, up 18% from a year ago.

Wall Street was expecting Microsoft to report fourth quarter earnings of $3.38 a share on revenue of $73.84 billion.

Microsoft also put some numbers on Azure revenue. CEO Satya Nadella said “Azure surpassed $75 billion in revenue, up 34 percent, driven by growth across all workloads.†For comparison, AWS is on an annual run rate of $116 billion in annual revenue. Google Cloud annual revenue run rate is currently at $50 billion.

- Microsoft advances quantum computing error correction, sees on-premise traction

OpenAI vs. Microsoft: Why a breakup could be good - Nvidia adds AWS, Microsoft Azure to DGX Cloud Lepton marketplace

- Microsoft wants to be your agentic AI developer stack

- Microsoft supports Google Cloud's Agent2Agent standard

- Microsoft raises prices for Dynamics 365 Business Central

- Microsoft: Human, AI agent ratios will be critical to success as new roles emerge

CFO Amy Hook said Microsoft Cloud revenue was strong in the fourth quarter, up 27% to $46.7 billion.

By the numbers:

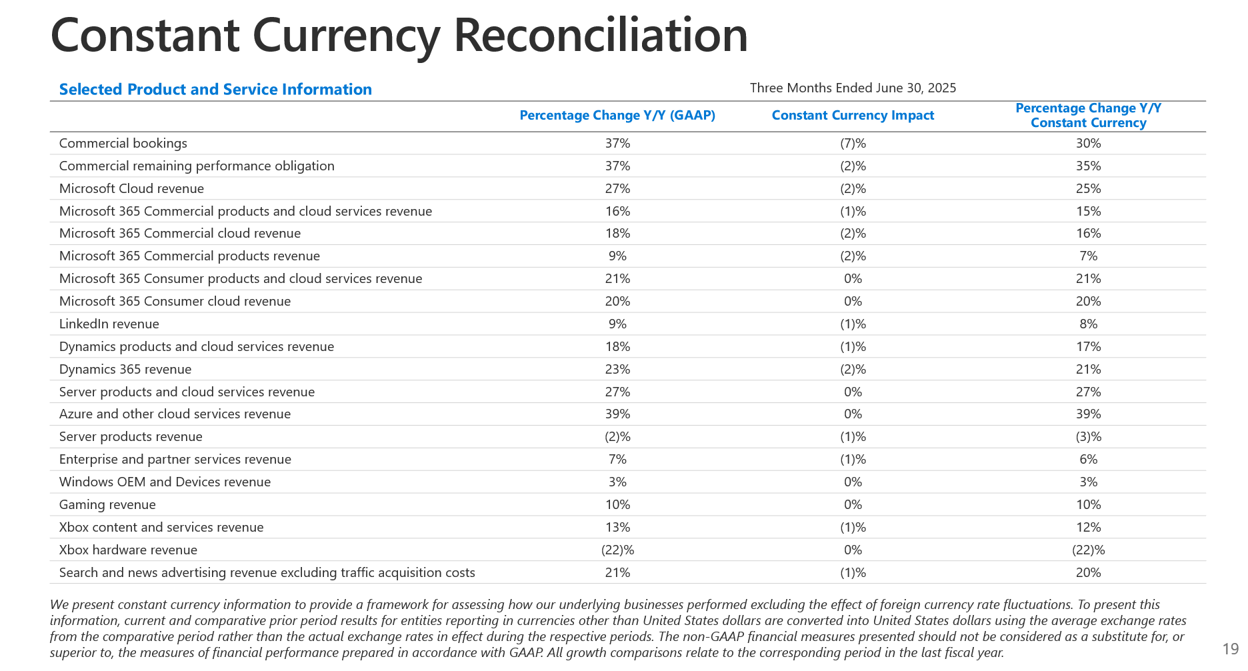

- Azure and other cloud services revenue in the fourth quarter surged 39%.

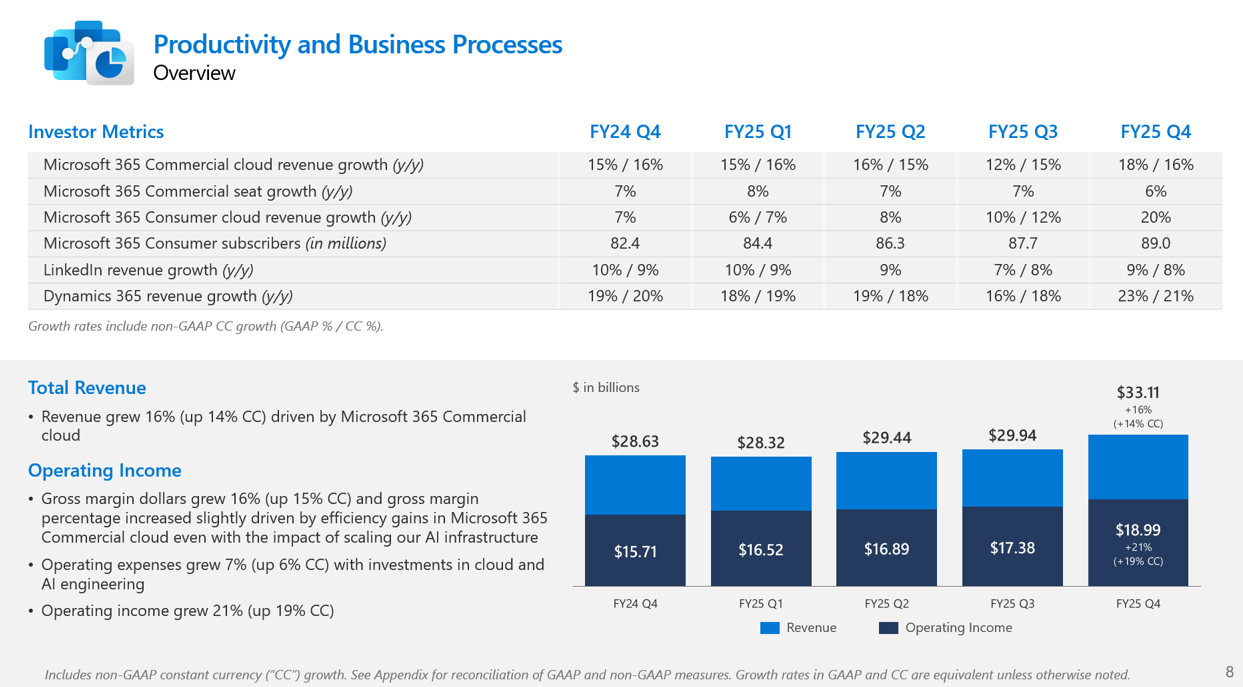

- Microsoft 365 Commercial Cloud products and cloud services revenue in the fourth quarter was up 16%.

- Microsoft 365 Consumer products and cloud services revenue was up 21% in the fourth quarter.

- LinkedIn revenue was up 9% from a year ago.

- Dynamics product and cloud services revenue was up 18%.

- For the fiscal year, Microsoft reported net income of $101.8 billion, or $13.64 a share, on revenue of $281.7 billion.

On a conference call with analysts, Nadella said:

- "Azure surpassed $75 billion in annual revenue, up 34%, driven by growth across all workloads. We continue to lead the AI infrastructure wave and took share every quarter this year. We opened new DCs across 6 continents and now have over 400 data centers across 70 regions."

- "Every Azure region is now AI-first. All of our regions can now support liquid cooling, increasing the fungibility and the flexibility of our fleet. And we are driving and riding a set of compounding S curves across silicon, systems and models to continuously improve efficiency and performance for our customers."

Constellation Research analyst Holger Mueller said:

"Microsoft is growing well but with three speeds. Intelligent Cloud is striving for 30%, Productivity and Business processes is going for 20% and More Personal Computing is aiming for 10%. Microsoft is translating revenue growth well into profit, as it has three speeds on cost as well. R&D is about 10% of revenue, sales & marketing is at 5% and Microsoft noticeably reduced general & administrative costs. Now let's see if Microsoft can build on this in its fiscal Q1."