HPE reports strong Q3 with Juniper Networks in the fold

HPE, reporting earnings for the first time since it closed the acquisition of Juniper Networks, delivered better-than-expected fiscal third quarter results with a fourth quarter outlook that was a bit light.

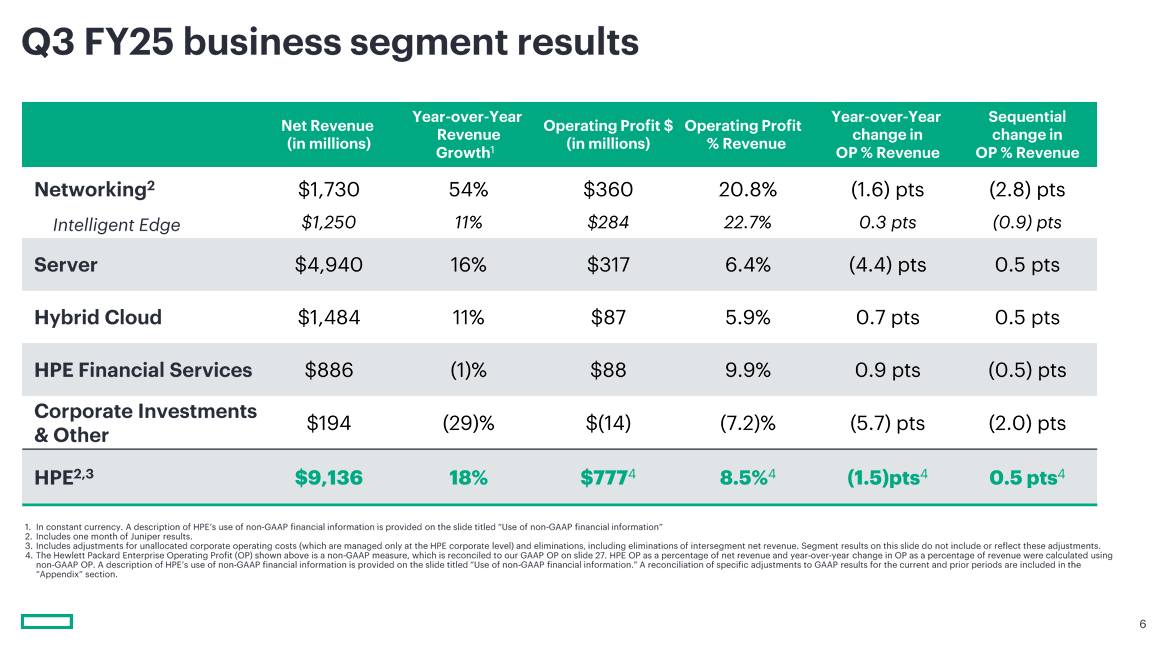

The company reported third quarter earnings of 21 cents a share on revenue of $9.1 billion, up 19% from a year ago. Non-GAAP earnings were 44 cents a share.

Wall Street was looking for non-GAAP earnings of 42 cents a share in the third quarter on revenue of $8.83 billion.

- HPE ups savings targets for Juniper Networks integration

- HPE completes Juniper Networks purchase, eyes integration next

- HPE launches GreenLake Intelligence, adds AI agents throughout hybrid cloud stack

CEO Antonio Neri said "customer demand stretched broadly across our portfolio and was particularly strong in our server and networking segments." CFO Marie Myers said Juniper Networks added to results with "with more profit accretion expected."

By the numbers:

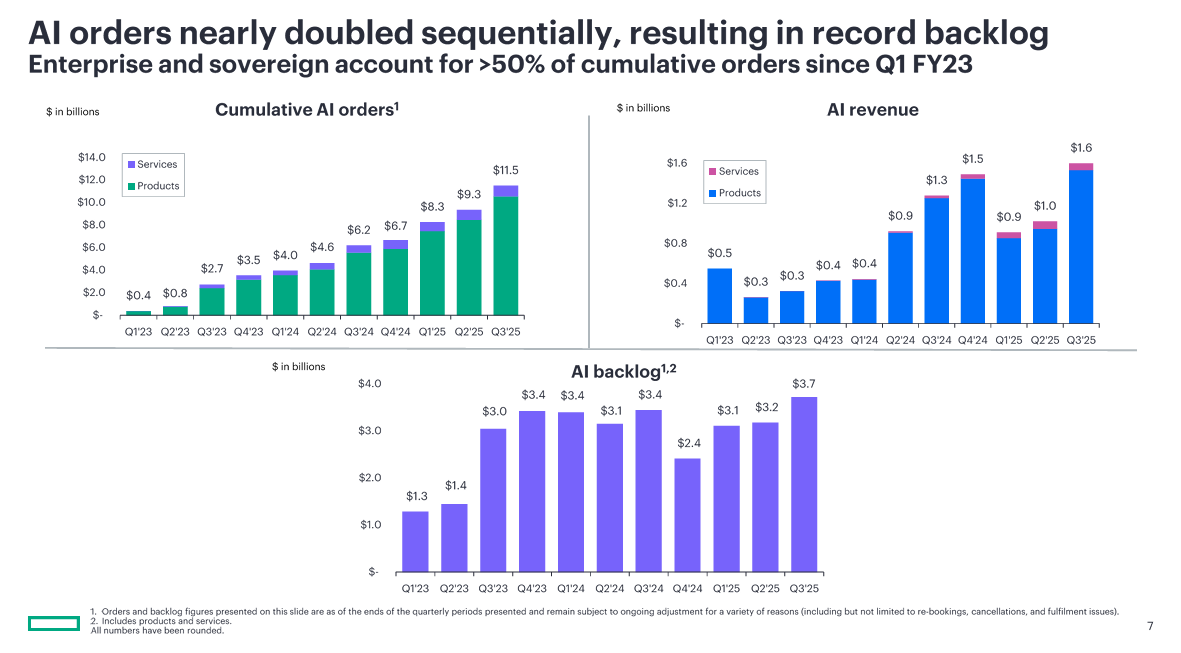

- AI revenue in the third quarter was $1.6 billion with AI backlog of $3.7 billion.

- Sequential AI orders nearly doubled in exiting the third quarter.

- Sovereign AI orders were up 250% sequentially.

- Server revenue was $4.9 billion in the third quarter, up 16% from a year ago. Operating profit for the server unit was $317 million.

- Networking revenue in the third quarter was $1.7 billion, up 54% from a year ago due to the Juniper Networks acquisition. Operating profit in the quarter was $360 million.

- Hybrid cloud revenue was $1.5 billion, up 12% from a year ago. Operating profit was $87 million.

For the fourth quarter, HPE projected non-GAAP earnings of 56 cents a share to 60 cents a share with revenue between $9.7 billion to $10.1 billion. Wall Street was expecting non-GAAP earnings of 59 cents a share on revenue of $10.1 billion.

HPE said fiscal 2025 revenue growth will be between 14% to 16% with non-GAAP earnings between $1.88 a share to $1.92 a share.

On a conference call, Neri said:

- "We significantly lowered our inventory driven by higher AI backlog conversion to revenue and strong supply chain execution. We continue to transform our business through Catalyst, the structural cost-saving program we announced last quarter, including enhancing operational efficiency, simplifying our portfolio, adopting AI and optimizing our workforce."

- "On the demand front, the networking market recovery continues. In enterprise, we continue to see robust demand in campus and branch, driven by the wire and wireless refresh, SASE and data center switching. Wi-Fi 7 demand is ramping with orders up triple digits sequentially. In cloud, we see strong demand for networking for AI, particularly in data center switching and Juniper PTX routing."

- "Server operating margin improved sequentially, benefiting from the changes we made in pricing and discounting early in the year, which returned traditional server product margins to historical levels. This was partially offset by higher AI mix, including a large deal."