Enterprise technology 2026: 15 AI, SaaS, data, business trends to watch

Enterprises will get all-you-can eat agentic AI pricing, data tools are going to be a headache, AI agents will look more like a feature than a revolution and physical AI will matter. Those are some of the trends to watch in 2026.

Here’s a look at the trends and predictions in enterprise technology for 2026 grouped by confidence levels.

High confidence

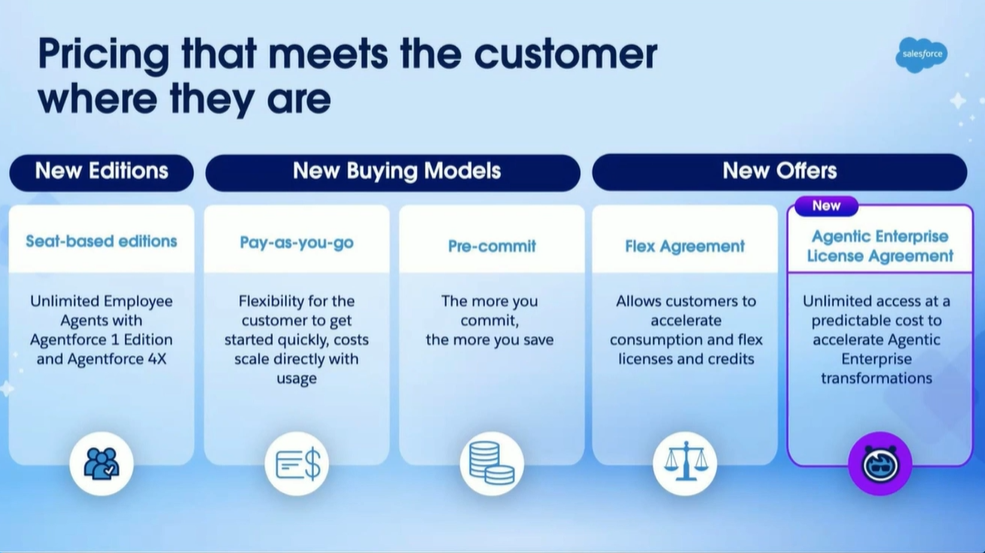

Agentic enterprise license agreements will become the norm as CxOs push back. In 2025, enterprise software vendors, which were worried about losing seats, introduced consumption models. The idea was that a hybrid approach would be the best of both worlds for CIOs. However, consumption models were unpredictable and CIOs, not to mention CFOs wanted predictability. Enter the agentic AI enterprise license.

Salesforce's Miquel Milano, president chief revenue officer, laid out the rationale behind Salesforce's AELA, Agentic Enterprise License Agreement. "AELA is for customers that have already experimented. They're ready to scale. They want to go all in so we agree on a flat fee, and then it's a shared risk," said Milano.

ALEA is all you can eat with Agentforce or whatever other cloud is thrown in. Of course, once you're all in Salesforce can better monetize the platform next contract. In 2026, it's highly likely you'll see similar arrangements from SaaS providers.

Here's the catch: SaaS providers may ink ALEAs at a loss as they play for the renewal (when you're completely locked in). Milano is looking at lifetime value of a customer. "If the customers are smart, they can rob the bank. They can really make a great deal out of that. We take the risk because we want our customers to be successful. I would love to have a customer where I price an AELA at $5 million incremental, and the customer has deployed so much that the deal is not profitable for me. If the deal isn't profitable for me, it means that the customer is the happiest customer in the world. And then I have another 20 years to monetize that customer," said Milano.

Enterprise data tolls and API economics are going to be a headache. Celonis is suing SAP over data access. In October, U.S. District Judge Vince Chhabria in San Francisco ruled the SAP must face the Celonis lawsuit. Toward the end of 2025, The Information reported that Salesforce was raising prices on apps that tap into its data. CIO.com noted that these connector fees are likely to trickle down to IT budgets.

- Celonis, SAP reach data access cease fire amid litigation

- Enterprise AI: It's all about the proprietary data

As agentic AI is deployed and agents connect, there will be multiple skirmishes in 2026 over these data tolls. There will need to be some standard toll to cover compute costs, but enterprises need to keep in mind that they own the data. In some cases, your vendor may feel otherwise.

Connection fees are going to be the new cloud egress to move data. I'd argue that data fees are going to be the biggest risk to scaling AI agents.

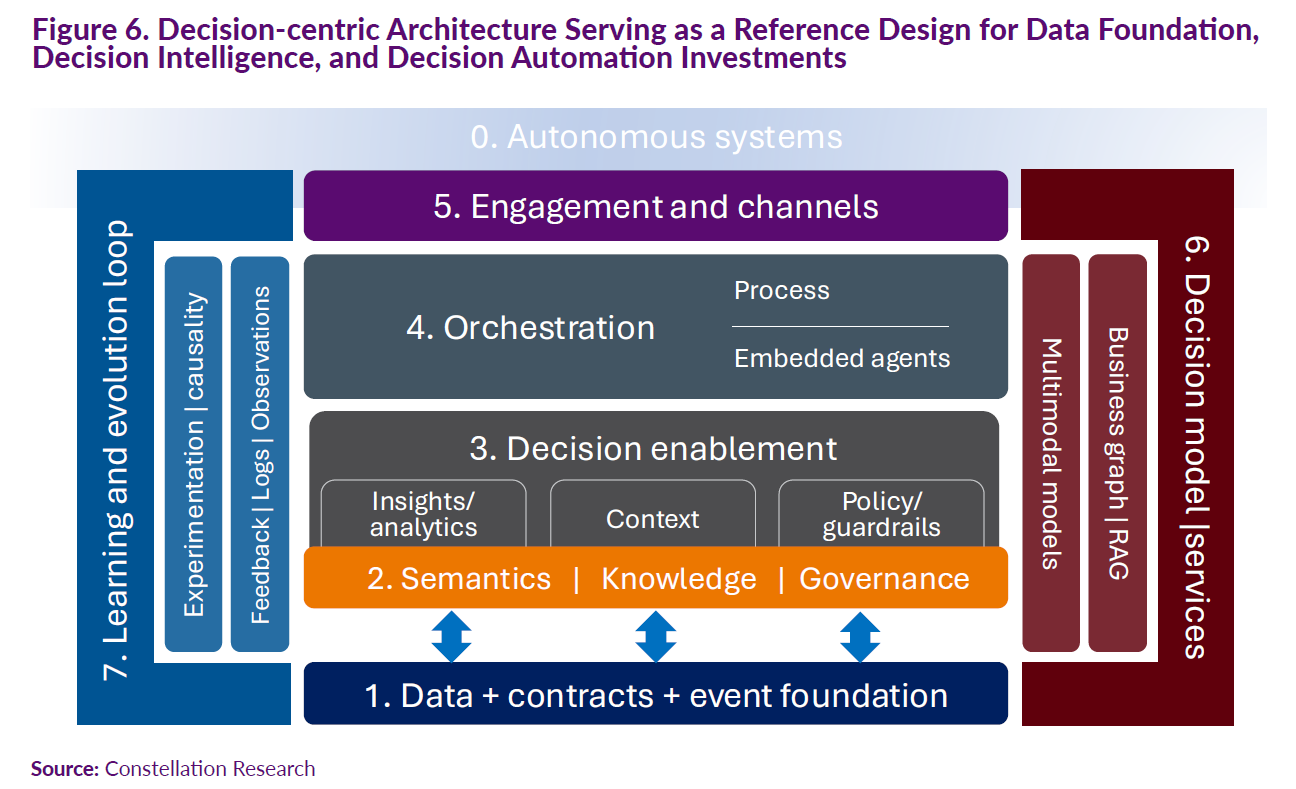

Agentic AI is a feature and the real deal is decision velocity. This theme is Michael Ni's department, but decision velocity--how quickly smaller decision trees and processes can be automated at scale--will be a core theme. When Ni, in a video chat, said agentic AI was merely a feature I had two reactions. First reaction: How many pixels have been spent on a feature?!? Second reaction: Mike has a point. The game is decision velocity and you're task in 2026 will be to put the pieces in place to get there.

"What we're seeing is the first decisions are smaller decisions, automations on the backside of that leading to human engagement. Then we start to collapse these decision trees to get to some of the 5x, 10x improvements. We're seeing leaders actually able to achieve with decision automation," said Ni, who noted that 2025 was a year where a lot of the decision velocity building blocks were put in place.

In-house forward-deployed become a necessity. Software vendors—all cribbing a play from Palantir—talked up forward deployed engineers almost every time executives talked agentic AI deployments. In 2026, enterprises are going to realize they need their own forward-deployed engineers to work through data, process, architecture and AI automation. These engineers will know the business and industry better than the ones you’ll borrow from software vendors and services firms.

Medium confidence

The AI market will bifurcate as the bubble pops either in 2026 or 2027. Concerns about AI infrastructure capital expenses and debt will be what really scales in 2026. But don't get distracted with your AI plans. Chances are 2026 will highlight how the easy money in training LLMs, raising capital at a ridiculous clip and fabulous remaining performance obligations is over. That AI market, dominated AI's circular economy and OpenAI, will be completely different than the enterprise AI version. That productivity boom is just starting as AI and process automation converge.

Build will beat buy. The build vs. buy debate continues as AI agents make it easier to create applications you used to buy. In addition, build looks like a great option since customers are beginning to push back on SaaS deal inflation. SaaS costs go up annually. It's almost as bad as healthcare.

In 2026, there will be an inflection point where enterprises become convinced that applications custom to their use cases are the way to go. Sunk costs in enterprise systems will be abstracted away using agentic AI as a user interface.

- The road to AI Exponential will be bumpy

- Rimini Street’s second act will include heavy dose of agentic AI, UX

- CCE 2025: AI agents: Dreams, reality and what's next

AI benefits broaden out to more levels of the enterprise stack. Software vendors are going to show revenue and productivity gains from AI. On Wall Street, enterprise software vendors finally join the AI rally. Nvidia and AI infrastructure plays will be flattish in 2026.

Physical AI gets its moment. Manufacturing and industrial sectors start to leverage physical AI to deliver real value. In addition, physical AI breakthroughs will begin to rival the early days of LLMs. This physical AI focus drives optimism about robotics as well as edge AI applications.

Not absurd, but unlikely for 2026

- Nvidia shares close the year flat to down year, but the fall isn't enough to result in real selling. Sales growth begins to slow as hyperscalers increasingly rely on their custom silicon. There's a concentrated effort in the industry to break Nvidia's hardware and software moat around AI.

- AI infrastructure is overbuilt due to hardware and software advances that don't require as much compute and energy. Wall Street rewards companies like Apple that didn't go crazy building AI infrastructure. AI backlash builds as multiple NIMBY grassroots efforts thwart plans to build data centers in small towns and rural areas. Note I said something similar to this in 2025 to no avail.

- OpenAI realizes it can't continually raise money forever goes on with an austerity push to show it can generate cash flow and become profitable.

- Quantum use cases go mainstream in the enterprise as quantum supremacy comes early. It also becomes clear that superconducting quantum computing is the clear technology winner and that reality causes a mad scramble for companies focused on trapped ions, neutral atoms, annealing and other techniques.

- Meta revamps its AI operations again once it's clear that its new management team and focus doesn't yield results. Meta's AI operations resemble the New York Mets, a massive payroll that doesn't deliver wins.

- High memory costs create a buyers strike for PCs, servers and smartphones.

- 2026 becomes one of the biggest years ever. for IPOs as Databricks, Anthropic, OpenAI, SpaceX and Stripe all go public. Two of those five headliners trade under their IPOs prices after 3 months.

- TikTok usage plunges under new ownership as the US algorithm is tweaked.

Scorecard from 2025

Here's a look at my predictions for 2025 that worked out and other areas where my crystal ball was cracked. In 2025, I included probability of a prediction playing out.

On target:

- 2025 was more volatile than usual.

- AI productivity gains broadened in enterprises.

- OpenAI and Microsoft became frenemies without a doubt.

- Enterprises will try new SaaS revenue models and scream. Consumption sounds great...until you get the bill.

- ERP comes under fire. ERP didn't go anywhere but is being abstracted.

Off base:

- That alleged run on vendor consolidation never played out.

- Agentic AI will usher in autonomous processes. We're clearly still in the early stages. The buy side is still wary of lock-in.

- The AI data center buildout will stall. Actually, it just accelerated in a few days after I made that prediction.

- Nvidia growth slows. Nvidia still faces the law of large numbers and more competition, but 62% revenue growth is pretty sweet.

- Edge computing becomes more critical for AI workloads. It'll happen but sure didn't in 2025.