CrowdStrike Q3 strong, puts outage in rear view mirror

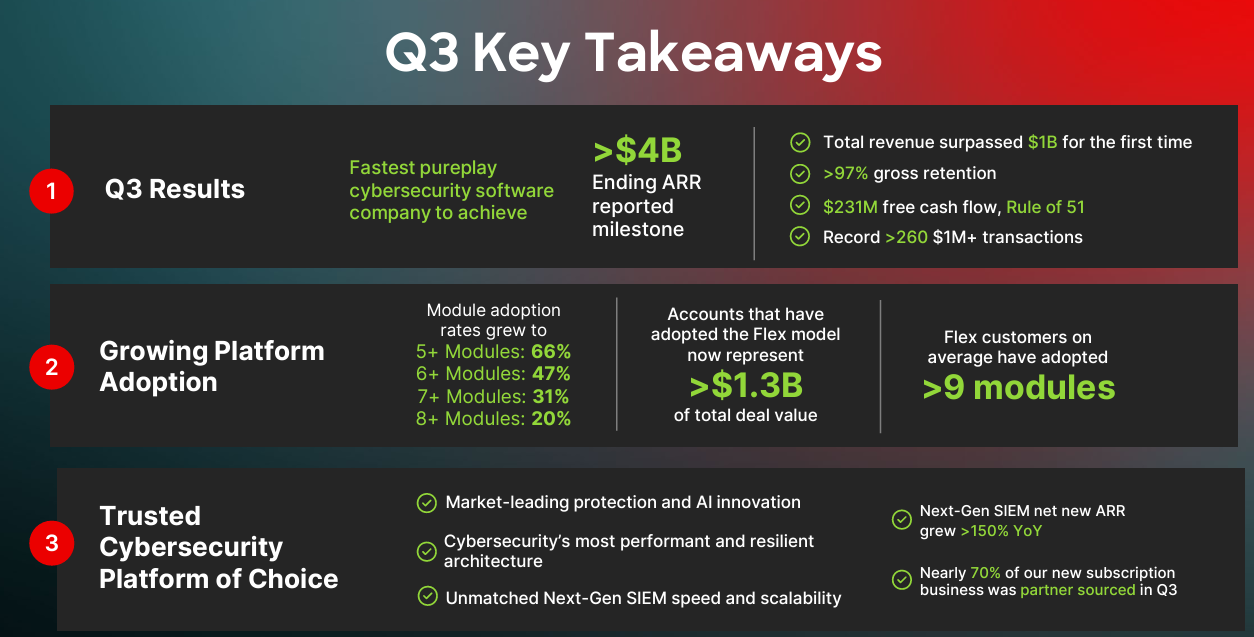

CrowdStrike reported a better-than-expected third quarter results and said it retained 97% of customers as it moved past its July outage.

The company reported a third quarter net loss of $16.8 million, or 7 cents a share, on revenue of $1.01 billion, up 29% from a year ago. Non-GAAP earnings were 93 cents a share. The company delivered annual recurring revenue of $4.02 billion, up 27% from a year ago.

Wall Street was expecting CrowdStrike to report third quarter earnings of 81 cents a share on revenue of $983.03 million. Analysts leading up to the earnings were confident that the company has put its July outage behind it without a hit to customer retention. CrowdStrike recently said it would acquire Adaptive Security.

CrowdStrike’s report comes a week after Palo Alto Networks report, which was better than expected as the company indicated its ongoing platformization strategy was winning share. CrowdStrike has also been seen as a company that can benefit as enterprises consolidate vendors and platforms.

- Enterprise security customers conundrum: Can you have both resilience, consolidation?

- Constellation ShortListâ„¢ Managed Detection and Response (MDR)

- Constellation ShortListâ„¢ Endpoint Protection Platforms

Module adoption rates for five or more modules was 66% in the third quarter.

As for the outlook, CrowdStrike projected fourth quarter revenue of $1.0287 billion to $1.035.4 billion with non-GAAP earnings of 84 cents a share to 86 cents a share. For fiscal 2025, CrowdStrike projected revenue of $3.923.8 billion to $3.930.5 billion. Non-GAAP earnings for the year will be $3.74 a share to $3.76 a share.

On a conference call with analysts, CrowdStrike CEO George Kurtz said Falcon Flex, the company's flexible licensing program launched a year ago, is resonating with customers:

"Our Falcon Flex subscription model is supercharging Falcon platform adoption. With CrowdStrike, cybersecurity consolidation is rapid and ROI is measurable. Falcon Flex is increasing both our share of wallet and enterprise real-estate, furthering CrowdStrike as cybersecurity' AI-native platform of record.

We closed more than 150 Falcon Flex transactions, with these customers representing more than $600 million in total deal value."

Kurtz added that Falcon Flex has increased the stakeholder conversations with the CFO most interested in the program as part of vendor consolidation efforts.

More CrowdStrike:

- CrowdStrike to Delta: Don't blame us for your IT outage response

- Delta puts numbers on CrowdStrike outage, sets up interesting discovery period

- CrowdStrike outage likely to hit cybersecurity's platformization pitch

- Constellation ShortListâ„¢ Cloud Native Application Protection Platforms (CNAPP)

- Cybersecurity platformization: What you need to know