CFOs grow appetite for risk going into 2026

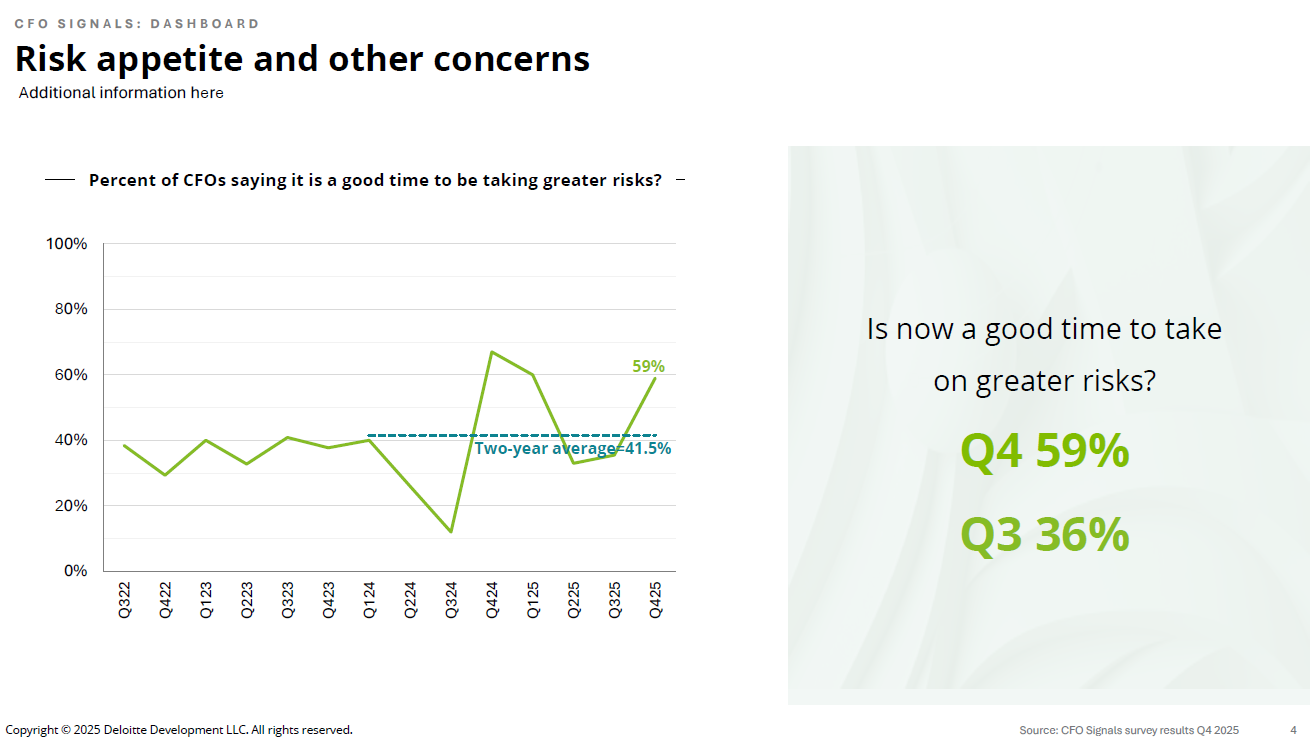

CFO confidence has it its highest point in four years as 59% of CFOs say it's a good time to take risks, according to Deloitte's fourth quarter CFO Signals report.

Deloitte's survey found that external risks to the economy are still plentiful, but also manageable. CFOs are optimistic about their companies' growth prospects. Deloitte said the fourth quarter CFO confidence score was 6.6 out of 10 possible, the highest since the fourth quarter of 2021.

CFOs globally expect their respective economies to be better a year from now. Fifty-five percent of North American CFOs expect the economy to be better a year from now, followed by 58% of CFOs in Europe and 46% of China CFOs. Asia CFOs excluding China are the most bullish with 61% seeing a better economy a year from now.

Also see:

- Enterprise Technology Intelligence Monthly Update: December 2025

- Constellation Research's CXO Confidence Survey

- How CxOs are thinking about IT budgets, AI in 2026

- Constellation Research's 2025 AI Survey

Meanwhile, 86% of CFOs are more optimistic about their companies prospects than they were 3 months ago.

With that optimism surging among CFOs, it's not surprising that those execs want to take more risks. According to Deloitte, 59% of CFOs think it's a good time to take on greater risk, up from 36% in the third quarter.

And cuts in interest rates are beginning to make debt financing more attractive say 53% of CFOs.

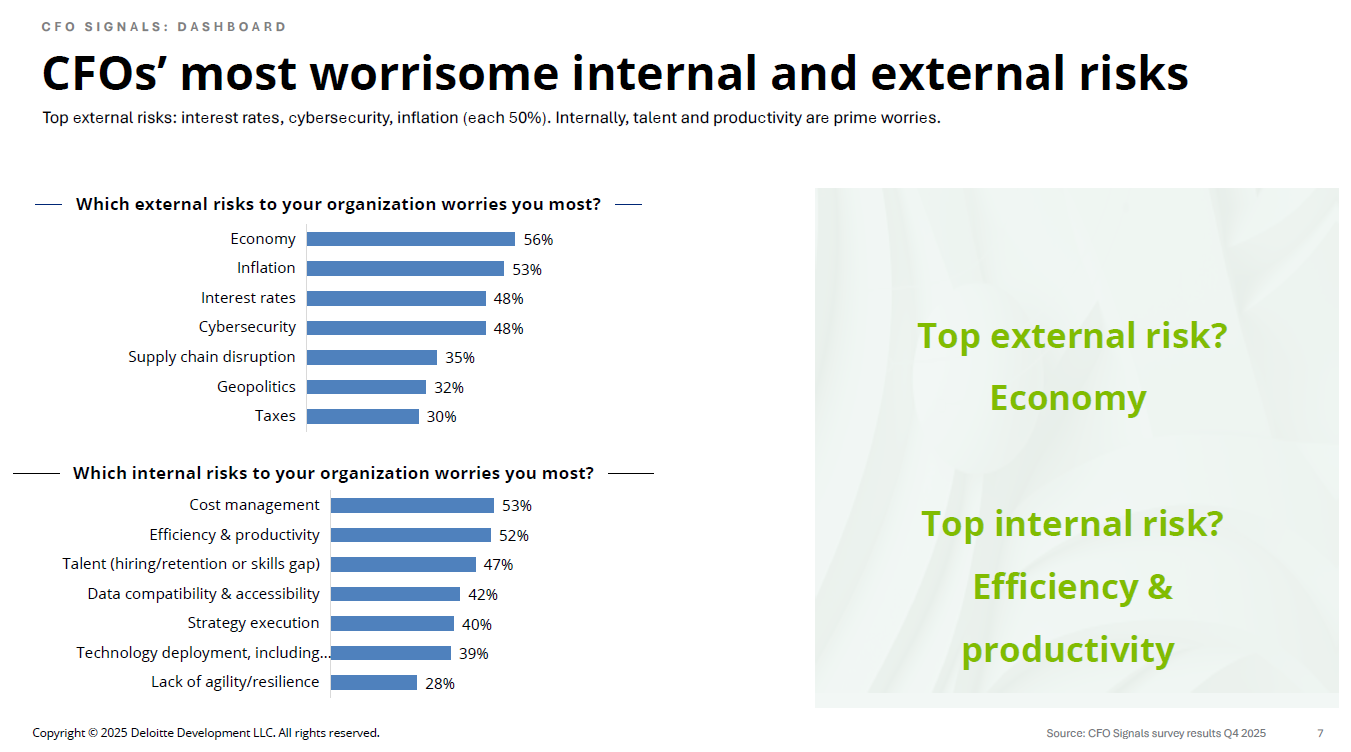

As for risks, CFOs have plenty of them that could curb their risk appetite. The highest external risks were economy, inflation, interest rates and cybersecurity. Internal risks were cost management, efficiency and productivity, talent and data strategies.