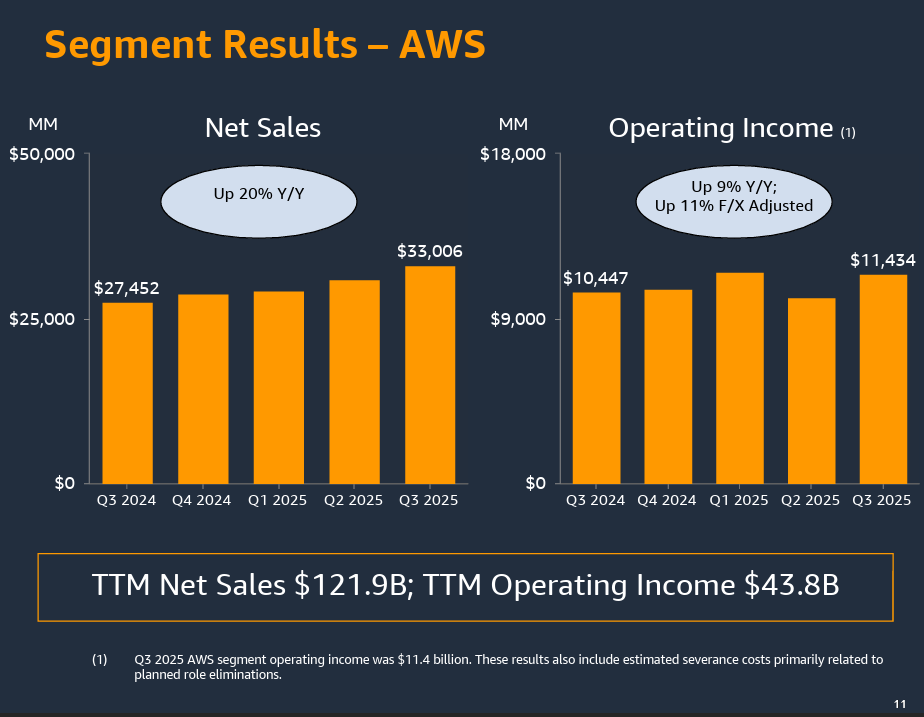

AWS Q3 revenue growth accelerates to 20%, best growth since 2022

Amazon Web Services' revenue growth in the third quarter accelerated 20% as the unit delivered operating income of $11.4 billion on revenue of $33 billion.

The AWS results landed in a better-than-expected quarter for Amazon overall. Amazon reported third quarter net income of $21.1 billion, or $1.95 a share, on revenue of $180.2 billion.

Wall Street was expecting Amazon to report earnings of $1.56 a share on revenue of $177.76 billion.

AWS' revenue growth of 20% was above expectations. Microsoft said Azure revenue was up 40% and Google Cloud delivered sales growth of 34%. Both of those rivals are operating off a smaller base than AWS, which is on a $132 billion annual revenue run rate.

- AWS fires up Project Rainier, Trainium2 cluster for Anthropic

- AWS delivers outage post mortem: When automation bites back

- AWS launches Amazon Quick Suite, aims to automate business workflows

- Amazon cuts 14,000 corporate jobs

- Amazon Bedrock AgentCore generally available

Andy Jassy, Amazon CEO, said:

"AWS is growing at a pace we haven’t seen since 2022, re-accelerating to 20.2% YoY. We continue to see strong demand in AI and core infrastructure, and we’ve been focused on accelerating capacity – adding more than 3.8 gigawatts in the past 12 months."

AWS fired up its Project Rainier data center cluster designed for Anthropic's AI workloads. AWS also said its Trainium2 custom AI chip is "fully subscribed and a multi-billion-dollar business."

In addition, AWS said it saw strong adoption of Transform, an AI agent that makes it easier to migrate to AWS. Transform has saved 700,000 hours in migration work.

As for the outlook, Amazon said fourth quarter revenue will be between $206 billion and $213 billion, or up 10% to 13%. Operating income will be between $21 billion to $26 billion.

On a conference call with analysts, Jassy said:

- Backlog in the third quarter was $200 billion and "doesn't include several unannounced new deals in October."

- "A lot of the future value companies will get from AI will be in the form of agents. AWS is heavily investing in this area. Companies will both create their own agents and use agents from other companies. For those building their own, it's been harder to build than shipping. For companies who successfully built agents, they hesitated putting them into production because they lack secure, scalable runtime services or memory or observability built specifically for agents. It's why we launched AgentCore instead of infrastructure building blocks that allow builders to deploy scalable agents."

- "AWS continues to earn most of the big enterprise and government transformations to the cloud. AWS is where the ponderance company's data and workloads reside, and part of why most companies want to run AI on AWS. We need to have the requisite capacity. We've been focused on accelerating capacity the last several months, adding more than 3.8 gigawatts of power in the past 12 months. To put that into perspective, we're now double the power capacity that AWS was in 2022 and we're on track to double again by 2027."

- "You're going to see us continue to be very aggressive investing in capacity, because we see demand as fast as we're adding capacity right now. As fast as we're bringing capacity in right now, we are monetizing it."

- "Starting with Trainium3, we're building Bedrock to be the biggest inference engine in the world. In the long run, we believe Bedrock will be as big a business for AWS as EC2."

- "We have a small number of very large customers on Trainium2, but because it is 30% to 40% better price performance, there are customers contemplating broader scale for AI focused workloads and inference. Trainium3 should preview at the end of this year and beginning of 2026 we have a lot of customers very interested. Trainium3 will be 40% better than Trainium2."

- "We buy a lot of Nvidia, but history shows there's never just one player that satisfies everyone's needs. But we have our own strong chip team. For our customers to use AI expansively, they're going to need better price performance."

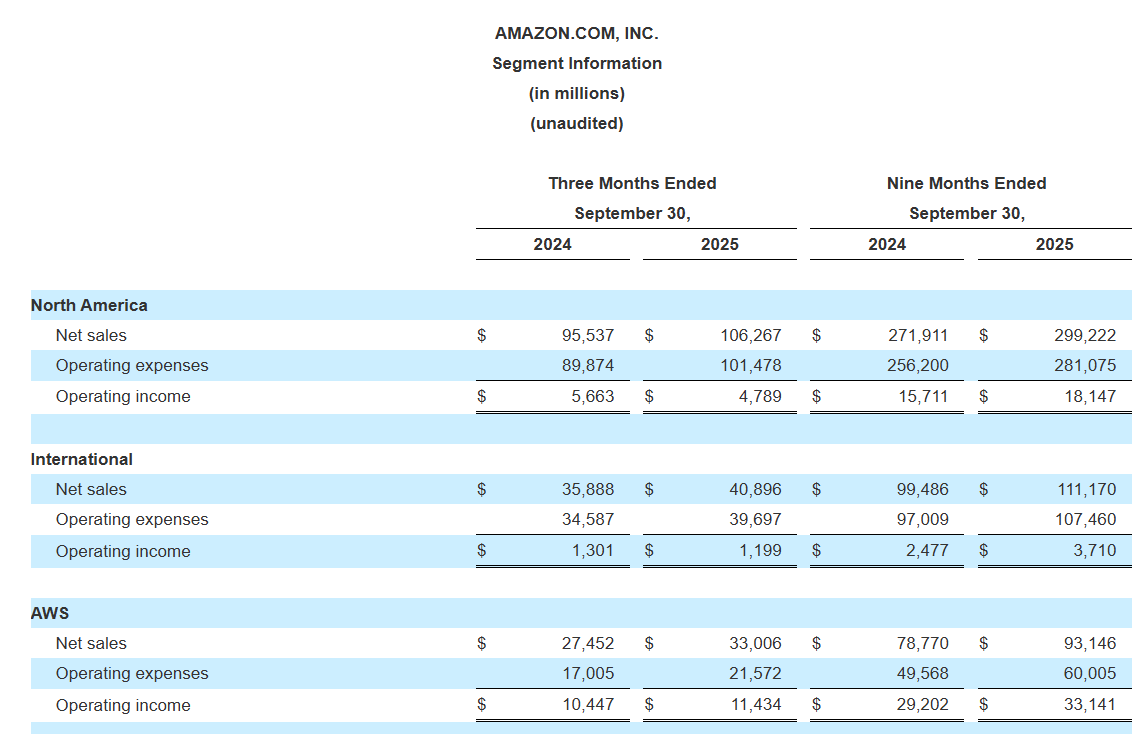

Here's a look at the third quarter numbers:

- North American commerce sales were $106.3 billion, up 11%, with operating income of $4.8 billion.

- International commerce sales were $40.9 billion, up 14% from a year ago, with operating income of $1.2 billion.

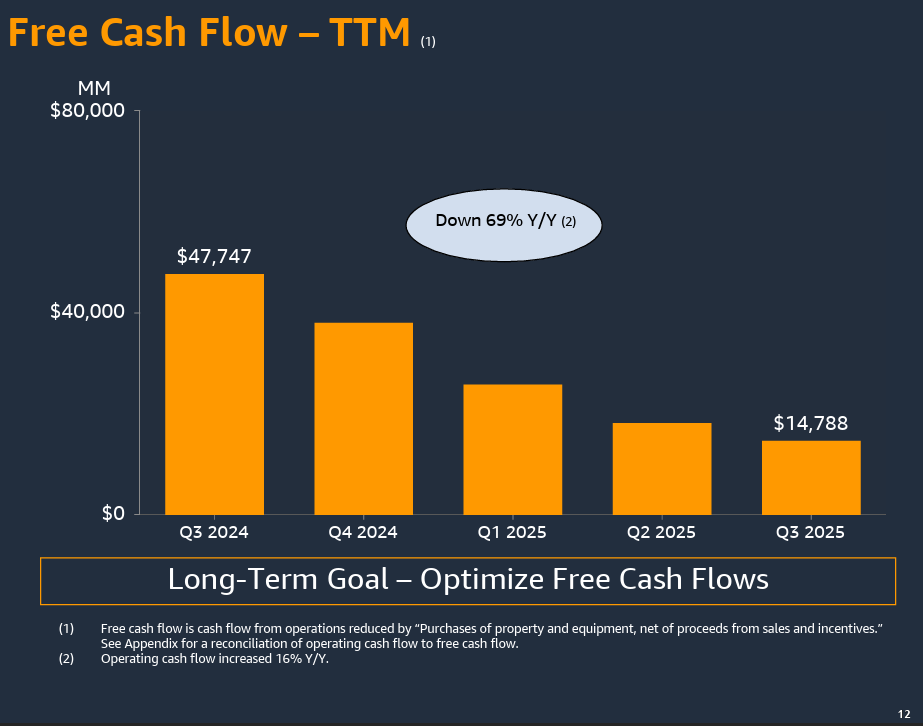

- Free cash flow for the third quarter was $14.8 billion for the trailing 12 months, down from $47.7 billion a year ago. Amazon said it has spent $50.9 billion on property and equipment--mostly GPUs, CPUs and data centers.

- Advertising revenue in the third quarter was $17.7 billion, up 24% from a year ago.

- Subscription services revenue was $12.57 billion, up 11% from a year ago.

- Amazon ended the quarter with 1,578,000 employees.

- Amazon took a $2.5 billion charge to settle a lawsuit with the Federal Trade Commission.

- The company took a $1.8 billion charge related to severance costs and layoffs. Operating income would have been $21.7 billion without those charges.

Constellation Research analyst Holger Mueller said:

"Amazon is picking up speed again, across all segments, with AWS leading the charge. But it didn't move on the profit side, due to regulatory fines and restructuring. Evidently, Andy Jassy is confident that Amazon can grow with less employees, a sign that the internal AI offerings are maturing. Jassy would not shift the hand to machine ratio if AWS AI wasn't ready. That is a very good confidence indicator for CxOs buying from AWS that they can start investing into the maturing AI offerings of AWS."