Teradata's hybrid approach to AI agents starting to resonate

Teradata showed continued progress with its better-than-expected fourth quarter earnings report, but the biggest takeaway may be how the company is navigating on-premise AI and the use of agentic AI.

The vendor continued to grow its annual recurring revenue and CEO Stephen McMillan touted "revitalized execution" in 2025. "We stabilized the business, meaningfully improved retention, and saw customers choosing to expand their use of Teradata with a mix of both traditional and new types of workloads," said McMillan.

Teradata reported fourth quarter earnings of 38 cents a share on revenue of $421 million, up 3% from a year ago. Non-GAAP earnings were 74 cents a share, 18 cents a share above estimates. CEO Steve McMillan said the company's Autonomous AI and Knowledge platform is seeing strong demand.

For 2025, Teradata reported earnings of $1.35 a share on revenue of $1.66 billion, down 5% from a year ago. For 2026, Teradata projected revenue to fall 2% or be flat. Teradata shares surged following the results.

- Teradata eyes on-premises AI workloads in regulated industries

- Constellation ShortList™ DataLakeHouses for Next Generation Applications

- Constellation ShortList™ Next-Gen Databases: RDBMS for On-Premises

The bigger picture with Teradata is worth a look. Here's a look at the key points to note from Teradata's earnings call.

Teradata is an agentic AI play. McMillan said enterprises will be run by agentic AI systems and Teradata plans to be an enabler of context with its autonomous AI and knowledge platform.

Enterprises see AI as a hybrid deployment. "We saw a resurgence of interest in our hybrid model. We're seeing customers want to leverage both on-prem and cloud deployment options to meet their diverse business needs, driven by data sovereignty and increased regulatory environments around the globe," said McMillan.

On-premise AI is becoming a bigger option. "We see our potential and capability in terms of delivering AI solutions on-prem as something that's going to be a key growth driver as we move forward. And that's why our next generation of our hardware platform will actually have GPUs built right in," said McMillan. "We are definitely going to see AI and AI on-prem as a growing part of our portfolio. If we look at the POC activity that we executed in 2025, we actually doubled the number of POCs as we come out, and a number of those have moved into production on-prem, driving workload and usage of the Teradata platform."

Teradata is leveraging services to help customers reinvent their use of the company's platform. "Our forward-deployed engineers and AI Services consultants executed more than 150 engagements with customers, helping them operationalize AI to address high-value use cases," said McMillan.

The product cadence revolves around AI. McMillan touted Teradata's Enterprise Vector Store, new ModelOps tools and its Model Context Protocol (MCP) server that ties together data and multiple models. Teradata also launched AgentBuilder with prebuilt agents, Autonomous Customer Intelligence and Teradata AI Factory. In January, Teradata launched Enterprise AgentStack, a toolkit to production AI agent deployments.

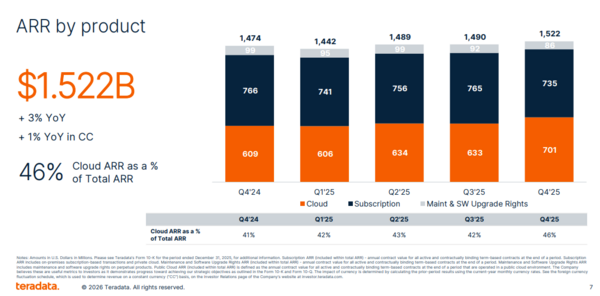

Teradata is landing more cloud workloads and fourth quarter cloud annual recurring revenue was up 15%. Cloud ARR is now 46% of Teradata's total ARR. Teradata is also leveraging cloud marketplaces and McMillan cited deals via Google Cloud. Overall, cloud marketplaces are expanding Teradata's total addressable market.

Related: