Oracle to raise $45 billion to $50 billion in debt, equity for data center buildout

Oracle said it will raise $45 billion to $50 billion in 2026 using a combination of debt and equity to build data centers for its cloud operations.

The news comes as Oracle's balance sheet is being closely watched on Wall Street. Oracle said it is raising funds to meet contracted demand for its Oracle Cloud Infrastructure business, which counts OpenAI, xAI, TikTok and others as customers.

Oracle is part of the joint venture for the US version of TikTok, which has been hampered by technical glitches and outages in recent days.

In a statement, Oracle said:

- The company is committed to maintaining an investment-grade balance sheet by using debt and equity to raise $45 billion to $50 billion.

- Half of the funding for 2026 will be raised via equity linked and common equity issuance and dilute shareholders.

- The company will use mandatory convertible preferred securities as well as a new at-the-market (ATM) equity program of up to $20 billion. MicroStrategy has frequently used ATM offerings to raise capital to buy bitcoin.

- For debt, Oracle will complete a single one-time issuance of investment-grade senior unsecured bonds early in 2026.

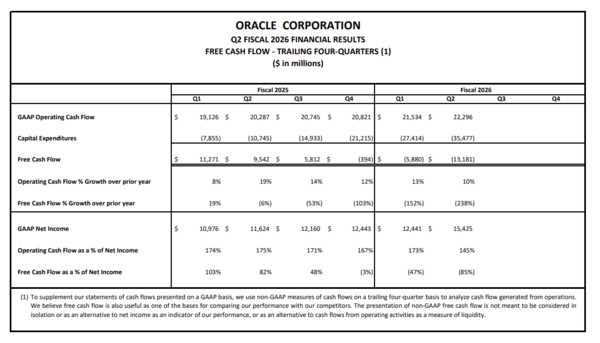

Oracle surged in September after announcing a 359% jump in remaining performance obligations, but the buzz didn't last as investors started to question whether OpenAI, which fueled the jump, could ultimately pay its bills. Oracle's second quarter was mixed and free cash flow was negative $13 billion due to $12 billion in capital spending.

Here’s a look at Oracle’s free cash flow for the trailing 12 months.

And the recent timeline:

- Oracle Q1 misses, but sees OCI revenue surging over next 4 years

- Oracle names Magouyrk and Sicilia co-CEOs as Catz moves to Vice Chair

- Oracle AI World 2025: Shifting left AND right into Oracle’s suite spot

- Oracle CTO Larry Ellison on AI use cases for healthcare, agriculture, climate change

- Oracle AI World 2025: Autonomous AI Lakehouse, AI Data Platform launched

- Oracle’s application strategy: Industries, AI, automation, integrated stack

- Oracle Q2 mixed, says it will be neutral on GPUs

Shares have taken a round trip over the last year.