Amazon sees $200 billion in capex ahead, AWS sales surge 24%

Amazon met fourth quarter earnings estimates, slightly topped revenue targets and saw AWS sales jump 24% from a year ago. The real whopper was Amazon's capital expenditure projection of $200 billion in 2026.

CEO Andy Jassy said the capital expenditure projection covers AI, chips, robotics and low earth orbit satellites. "Growth is happening because we’re continuing to innovate at a rapid rate, and identify and knock down customer problems," said Jassy in a statement. "With such strong demand for our existing offerings and seminal opportunities like AI, chips, robotics, and low earth orbit satellites, we expect to invest about $200 billion in capital expenditures across Amazon in 2026."

Simply put, Amazon saw Google's capital expenditures of $175 billion to $185 billion and decided to up the ante. Keep in mind that Amazon's capital spending also covers distribution centers and buildings.

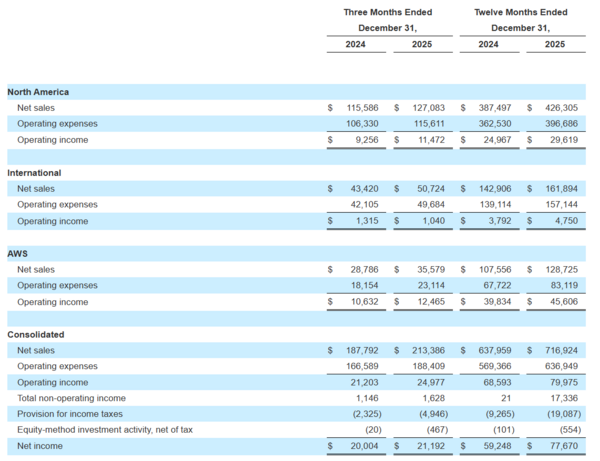

Amazon reported fourth quarter net income of $21.2 billion, or $1.95 a share, on revenue of $213.4 billion, up 14% from a year ago.

Wall Street was looking for non-GAAP earnings of $1.95 a share on revenue of $211.23 billion.

By the numbers:

- Amazon's North American unit delivered fourth quarter operating income of $11.5 billion on revenue of $127.1 billion, up 10% from a year ago.

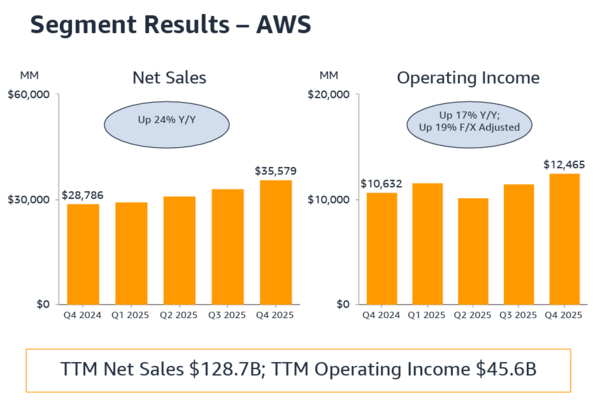

- AWS operating income in the fourth quarter was $12.5 billion on revenue of $35.6 billion, up 24% from a year ago.

- International operating income was $1 billion on revenue of $50.7 billion, up 17% from a year ago.

- Advertising revenue was up 22% in the fourth quarter from a year ago to $21.32 billion.

- Subscription revenue in the fourth quarter was $13.12 billion, up 12% from a year ago.

- Physical store revenue was $5.85 billion, up 5%, with online store revenue of $82.99 billion, up 10%.

- For 2025, Amazon reported net income of $77.7 billion, or $7.17 a share, on revenue of $716.9 billion, up 12% from a year ago.

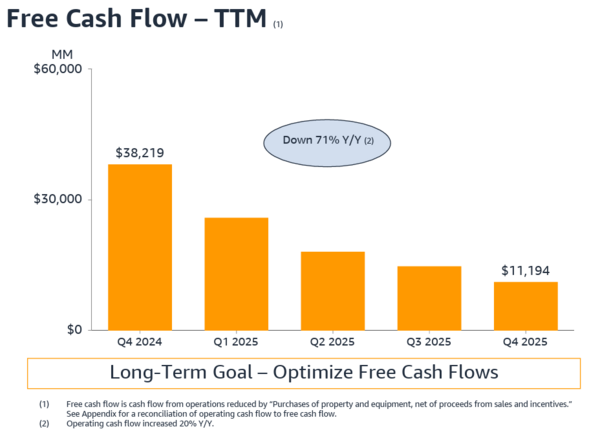

- Free cash flow in the fourth quarter was $11.2 billion, down 71% from a year ago.

- Amazon ended the fourth quarter with 1,576,000 full-time and part-time employees, up 1%. That tally excludes contractors.

As for the outlook, Amazon projected first quarter sales of $173.5 billion and $178.5 billion, up 11% to 15% from a year ago. Operating income will be between $16.5 billion and $21.5 billion. That outlook includes $1 billion in higher Amazon Leo costs.

- AWS CEO Garman said space data centers likely to take longer

- AWS European Sovereign Cloud available with EU AWS Local Zones on deck

- AWS launches AI factory service, Trainium 3 with Trainium 4 on deck

- Live from AWS re:Invent: Partner Award Interviews

- AWS re:Invent 2025: This one was different

- From "Legos" to Solutions: AWS re:Invent 2025 Takeaways with Constellation Research Analysts

On a conference call with analysts, Jassy said the following about AWS:

- "AWS is now a $142 billion annualized run rate business and our chips business, inclusive of Graviton and Trainium, is now over $10 billion in annual revenue run rate and growing triple digit percentages year over year."

- "We're continuing to see strong growth in core non AI workloads as enterprises return to focusing on moving infrastructure from on premises to the cloud."

- "We're adding significant EC2 computing capacity each day, and the majority of that new compute is using our custom CPU silicon, Graviton. Graviton itself is a multi-billion dollar annualized run rate business growing more than 50% year over year."

- "Bedrock is now a multi-billion dollar annualized run rate business and customer spend with 60% quarter over quarter."

- "A significant impediment today is the cost of AI chips. Customers are starving for better price performance, and typically and understandably, the dominant early leaders aren't in a hurry to make that happen as they have other priorities. It's why we built our own custom silicon and Trainium has really taken off. We've landed over 1.4 million Trainium 2 chips, our fastest ramping chip launch ever."

- "We're seeing very strong demand for Trainium 3, and expect nearly all

of our Trainium 3 supply of chips to be committed by mid-2026 even though we're still building Trainium 4 we're seeing very strong interest already." - "We expect to invest about a $200 billion in capital expenditures across Amazon, but predominantly in AWS, because we have very high demand."

Jassy said the $200 billion investment in AWS capacity is due to a unique opportunity.

"If you look at what's happened in the early innings of AI over the first few years, you see a lot of usage, but customers are really thirsty for better price performance," said Jassy. "We see this as an unusual opportunity, and we're going to invest aggressively here to be the leaders. This AI movement is not going to be a couple companies. It's going to be 1,000s of companies over time."

Regarding Leo, Amazon's satellite broadband service. Jassy said:

"The team is making rapid progress on Amazon Leo, which will bring connectivity to consumers, enterprises and governments in places where they don't have broadband connectivity. Leo will offer enterprise grade performance and advanced encryption with secure private networking that bypasses public Internet, connecting directly to AWS. We've launched 180 satellites, have more than 20 launches planned in 2026 and more than 30 in 2027. We expect to launch commercially in 2026 we have dozens of commercial agreements already signed."