Why Microsoft's AI infrastructure deal with Nebius is savvy

AI cloud provider Nebius will provide GPU infrastructure capacity to Microsoft in a deal valued at $17.4 billion with an option to spend up to $19.4 billion.

The deal means that Microsoft will be among the largest customers of both Nebius and CoreWeave, two AI cloud specialists. In 2024, about two-thirds of CoreWeave's revenue came from Microsoft.

In an SEC filing, Nebius said GPU capacity will be provided to Microsoft through its Vineland, NJ data center over five years. Nebius will raise more capital to provide the GPU services to Microsoft as well as use cash flow from the deal. Nebius said it would raise $2 billion in debt and float more shares to fund the Microsoft deal.

Microsoft is certainly building its own data centers, but is also leasing capacity from so-called neo cloud providers. Microsoft's approach to data center capacity appears to be more hybrid between build and lease. Meta, Google and Amazon Web Services are more in the build mode. Oracle is building AI data centers at rapid clip, but has also delivered services from within data centers run by the big three cloud hyperscale providers.

- Coreweave's Q2: Takeaways on AI training, inference demand

- Watercooler debate: Are we in an AI bubble?

- Watercooler debate: Is it the data or the infrastructure?

- AI infrastructure matures, GPU supply and demand may even out

- The generative AI buildout, overcapacity and what history tells us

As long as demand for AI compute capacity is strong then how cloud providers are delivering GPU access won't matter. If demand dries up, Microsoft appears to be in a better position to cut capacity without being stuck with physical facilities. Of course, we all know demand for AI compute will never dry up (kidding, sort of).

In any case, Microsoft is managing its data center capacity in a way where it has options and won't be stuck holding the infrastructure bag. Microsoft in the fourth quarter said it has 400 data centers across 70 regions. In April, CEO Satya Nadella explained the company's approach:

“The reality is we've always been making adjustments to build, lease, what pace we build all through the last 10, 15 years, it's just that you all pay a lot more attention to what we do quarter-over-quarter nowadays.

Having said that, the key thing for us is to have our builds and leases be positioned for what the workload growth of the future. There's a demand part to it, there is the shape of the workload part to it, and there is a location part to it.

So you don't want to be upside down on having one big data center in one region when you have a global demand footprint. You don't want to be upside down when the shape of demand changes.

I need power in specific places so that we can either lease or build at the pace at which we want. And so that's the sort of plan that we're executing to."

That backdrop highlights why Microsoft's Nebius deal is a smart way to get the compute and power in the right place at the right time.

Key details of the Nebius deal include:

- Either party can terminate the deal due in the event of material breach if not remedied in 60 days. Nebius has to meet agreed delivery dates for a GPU service and the company cannot provide alternative capacity.

- Nebius has to confirm to Microsoft that it has secured additional financing to fund the infrastructure for the services.

- Once funding confirmation is given to Microsoft the deal commences.

For Nebius, the Microsoft deal is huge. Arkady Volozh, CEO of Nebius, said the Microsoft deal complements the long-term committed contracts with AI labs and tech giants. "The economics of the deal are attractive in their own right, but, significantly, the deal will also help us to accelerate the growth of our AI cloud business even further in 2026 and beyond," said Volozh.

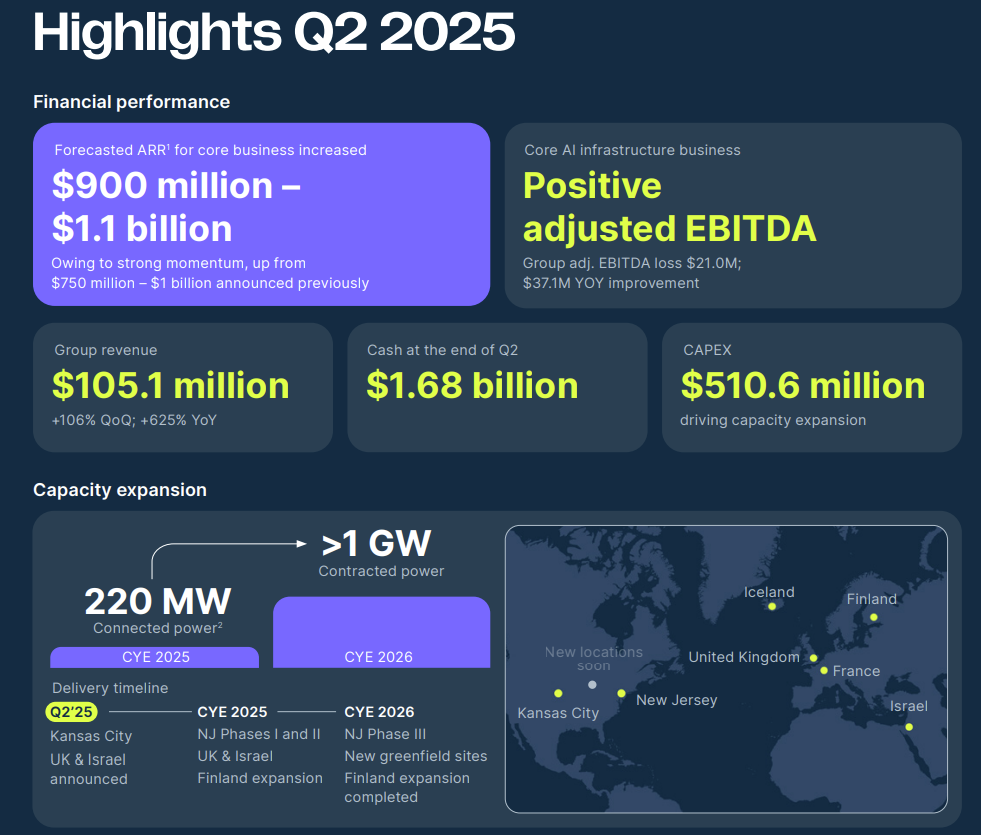

Indeed, Nebius' growth will accelerate from here. On Aug. 7, Nebius increased its annual run-rate revenue guidance to $1.1 billion from $900 for 2025. The company delivered second quarter revenue of $105.1 million, up 625% from a year ago, with net income of $584.4 million due to revaluing equity investments and a gain from discontinued operations. Nebius added that it was in the process of securing more than 1 GW of power by the end of 2026.

Constellation Research's take

Holger Mueller, an analyst at Constellation Research, said:

"This is a smart deal for both sides, as Microsoft balances out Capex needs, and Nebius is getting stable demand to build out capacity. But smart deals have potential downsides as well: Microsoft already has the most heterogenous data center landscape already (compared to its three key competitors) and is adding another level of complexity. It also has to find a way to get its [AI] software stack to at least run partially on Nebius. At some point this goes back to the Microsoft Windows DNA - build the software asset, partner with anyone including GPU clouds (include CoreWeave here). For Nebius it may be the proverbial too big bite to chew off, and have repercussions on its other clients, who certainly will have concerns of being crowded out by a tech giant. It's nothing that both Microsoft and Nebius can't handle - but these are areas to watch - for their customers and partners."

Here's a look at Nebius' footprint.