AWS Q2 sales growth 17.5%, nears $124 billion annual revenue run rate

Amazon Web Services' revenue in the second quarter jumped 17.5% to $30.9 billion, which is good for an annual revenue run rate approaching $124 billion.

The parent company of AWS reported second quarter net income of $18.2 billion, or $1.68 a share, on revenue of $167.67 billion.

Wall Street was looking for second quarter earnings of $1.33 a share on revenue of $162.09 billion.

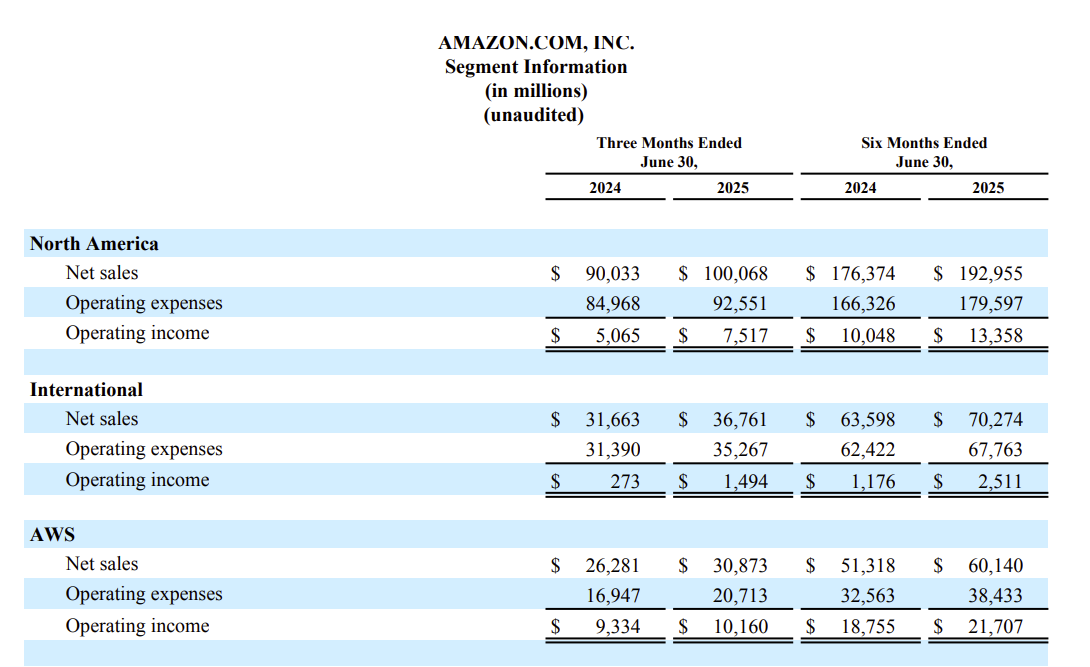

Not surprisingly, AWS delivered the most operating income for the parent company. AWS operating income in the second quarter was $10.2 billion. Amazon's North American commerce business delivered second quarter operating income of $7.5 billion on sales of $100.1 billion, up 11%. International operating income in the second quarter of $1.5 billion on revenue of $36.8 billion, up 16% from a year ago.

AWS run rate compares to $50 billion for Google Cloud and $75 billion in annual sales for Microsoft Azure.

CEO Andy Jassy said AI is affecting every part of Amazon's business from Alexa+ to AI models such as Nova and DeepFleet and options on AWS. "Our AI progress across the board continues to improve our customer experiences, speed of innovation, operational efficiency, and business growth," said Jassy.

On a conference call with analysts, Jassy said Amazon will continue to invest to expand its data center infrastructure to meet demand.

Jassy said electricity and chip availability were big hurdles for building AI infrastructure.

"I don't believe that we will have fully resolved the amount of capacity we need for the amount of demand that we have in a couple of quarters. I think it will take several quarters, but I do expect that it's going to get better each quarter," said Jassy.

In the second quarter, Amazon spent $31.4 billion in capital expenditures. That sum is representative of what Amazon will spend in the third quarter.

Constellation Research analyst Holger Mueller said:

"The questions about whether AWS would slow down are answered. The opposite is the case, and there's likely more growth next quarter as AWS gets momentum with Agent Core, its agentic AI platform. Similarly, AWS' just released S3 vector option is practically a money printing machine. Huge amounts of AI relevant data sit in S3 buckets and can now be leveraged for next-generation AI-powered enterprise applications."

Key items highlighted included:

- The launch of DeepFleet, an AI model that makes Amazon's fleet of robots more efficient to eliminate bottlenecks.

- Rolled out AI demand forecasting to improve inventory.

- Expanded water recycling to more than 120 US data centers by 2030.

- AWS launches Bedrock Agent Core, custom Nova models

- AWS' practical AI agent pitch to CxOs: Fundamentals, ROI matter

- Intuit starts to scale AI agents via AWS

- AWS launches Kiro, an IDE powered by AI agents

- AWS re:Inforce 2025: GenAI, AI agents and common sense security

- AWS re:Inforce 2025: Takeaways from the Amazon, AWS CISOs

- AWS re:Inforce 2025: How customers are using AWS security building blocks

- AWS re:Inforce 2025 Event Report: A Deep Dive on What You Need to Know

As for the outlook, Amazon projected third quarter sales of $174 billion to $179.5 billion, up 10% to 13% from a year ago. Operating income in the third quarter will be between $15.5 billion to $20.5 billion.