Dell Technologies delivers strong Q2 as AI system demand surges

Dell Technologies said demand for AI servers and systems remains strong, but the PC business is showing some weakness.

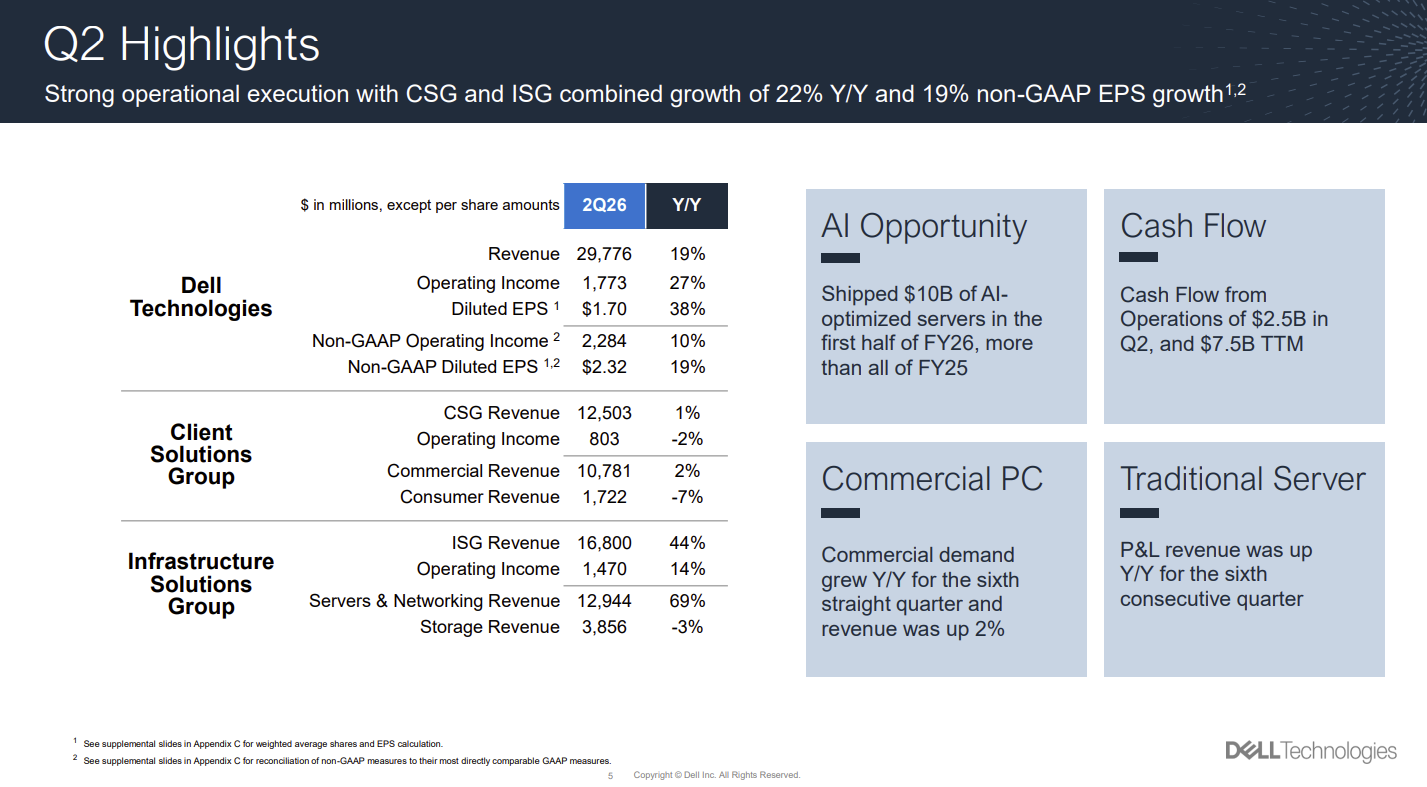

The company reported second quarter earnings of $1.70 a share on revenue of $29.8 billion, up 19% from a year ago. Non-GAAP earnings for the second quarter came in at $2.32 a share.

Wall Street was expecting Dell to report second quarter earnings of $2.29 a share on revenue of $29.19 billion.

The story for Dell remains the same: Strong demand for AI systems and adjacent hardware.

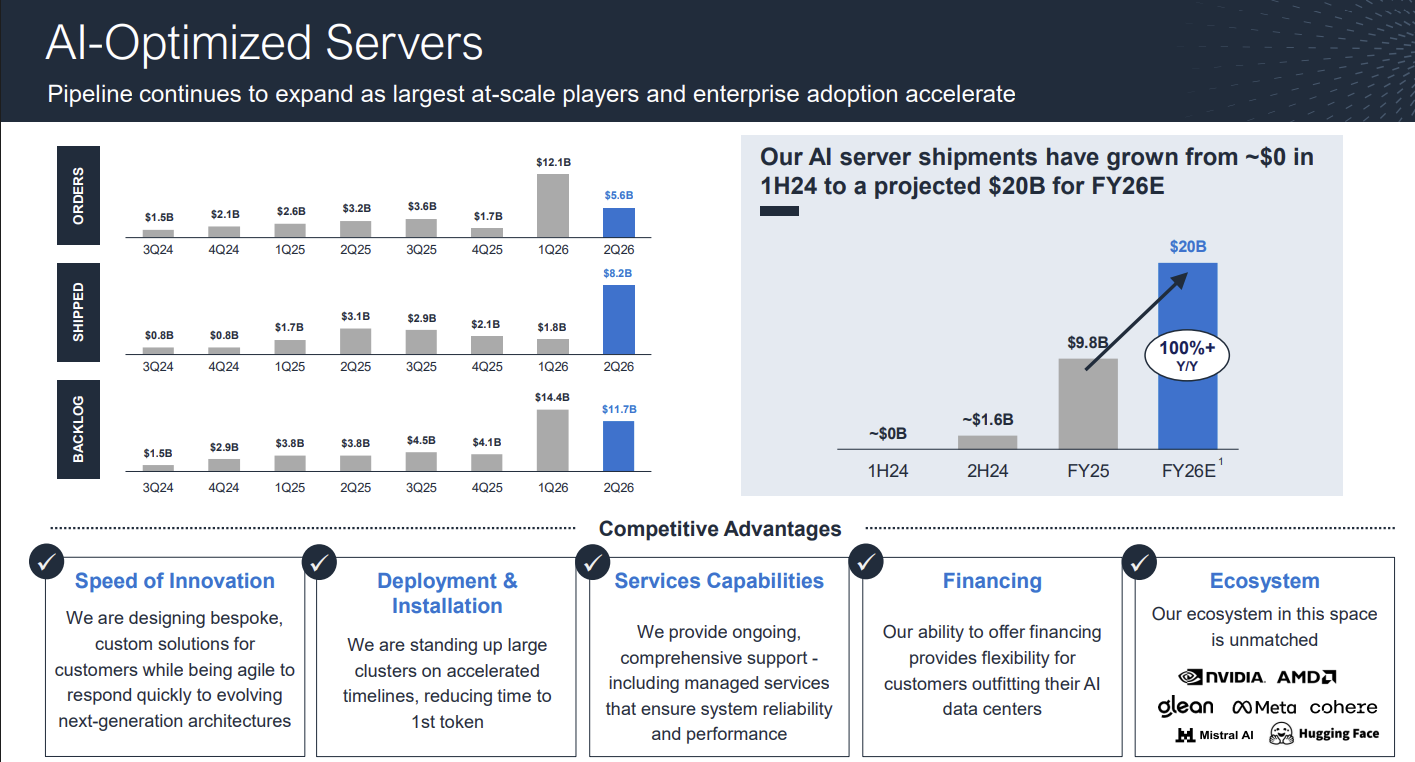

Jeff Clarke, chief operating officer of Dell, said the company shipped $10 billion in AI systems in the first half of fiscal 2026 and topped all shipments in fiscal 2025. Clarke said "demand for our AI solutions continues to be exceptional, and we’re raising our AI server shipment guidance for FY26 to $20 billion dollars."

Dell delivered record revenue in servers and networking. The company's infrastructure solutions group (ISG) delivered revenue of $16.8 billion, up 44% from a year ago. Server and networking revenue was $12.9 billion, up 69%. Operating income for ISG was $1.5 billion.

The PC business for Dell remains an issue. Dell's client solutions group revenue in the second quarter was $12.5 billion, up 1% from a year ago. Commercial revenue was up 2% and consumer revenue was down 7%. Operating income was $803 million.

As for Dell's outlook, the company projected third quarter revenue of $26.5 billion and $27.5 billion, up 11% from a year ago, with non-GAAP earnings of $2.45 a share. Fiscal 2026 revenue is expected to be between $105 billion and $109 billion, up 12% from a year ago at the midpoint. Non-GAAP earnings for the fiscal year is expected to be $9.55 a share.

In prepared remarks, Clarke noted the following:

- "We booked $5.6 billion in orders in the second quarter and shipped a record $8.2 billion, resulting in an ending backlog of $11.7 billion."

- "Our five quarter pipeline continued to grow sequentially, with double digit growth across enterprise and sovereign opportunities."

- "We are seeing strong Enterprise interest in our new Nvidia RTX Pro 6000 AI Factory solutions."

- "We expect moderate growth as the PC refresh continues, driven by an aging installed base and the Windows 10 end-of-life, which is now 48 days away. To fully seize the refresh opportunity, we’ve taken steps to improve execution and expand our PC TAM."

Constellation Research analyst Holger Mueller said:

"If an enterprise needs to run on premises, it's really down to two options with Dell and HPE. Those two are slowly but steadily outgrowing other competitors. AI is also the big sales point for Dell for on-premises servers, not surprisingly its strongest segment. Growing AI systems revenue from zero in the first half of 2024 to a projected $20 billion in fiscal 2026 is an accomplishment. It is clear that Dell customers are replacing traditional servers with AI servers."