Databricks annual revenue run rate hits $4.8 billion with $134 billion valuation

Databricks said it has raised $4 billion in a Series L investment for a $134 billion valuation and topped a $4.8 billion annual revenue run rate in the third quarter. For comparison, Snowflake’s annual revenue run rate exiting its third quarter was $4.84 billion.

The latest funding round is becoming an annual event where Databricks outlines its annual revenue run rate. In August, Databricks was valued at $100 billion. A year ago, Databricks said its annual revenue run rate was $3 billion.

Perhaps the biggest question in 2026 is whether Databricks will get to a Z Series of funding before going public. The latest round of funding for Databricks was led by Insights Partners, Fidelity and JP Morgan with participation from BlackRock, Blackstone and a bevy of others positioning to get in Databricks before an IPO.

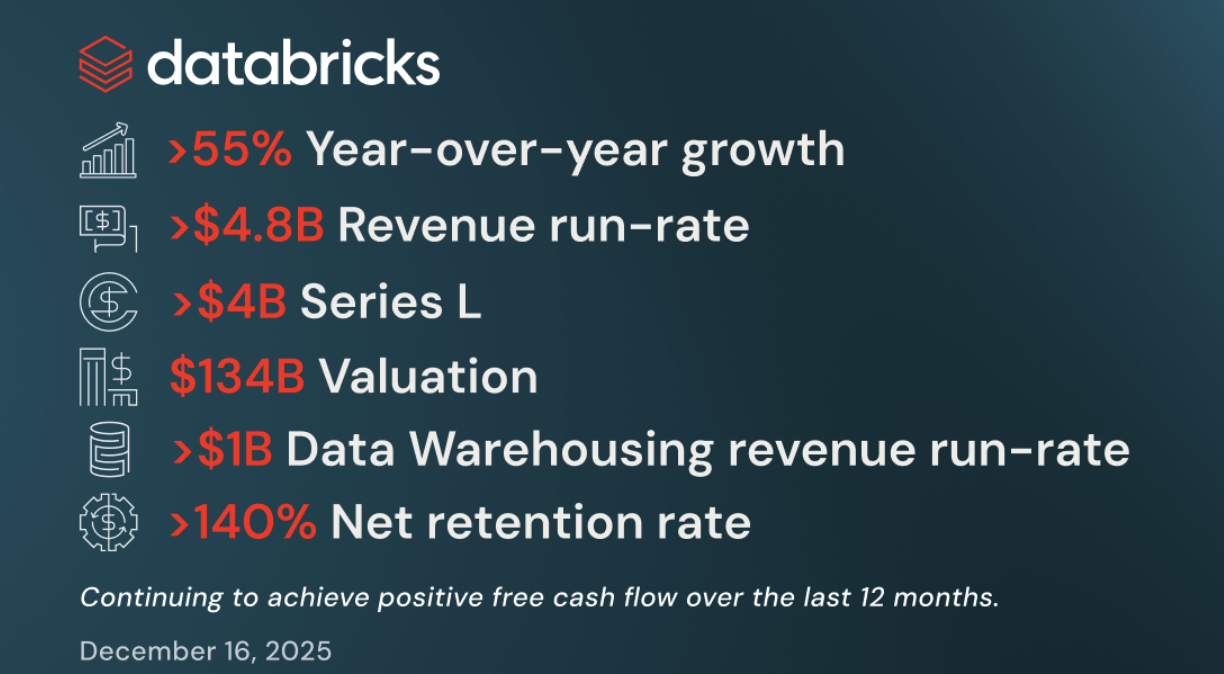

Databricks outlined a few key figures.

- Third quarter revenue growth topped 55%.

- Databricks' data warehousing business topped a $1 billion annual revenue run rate.

- AI products topped a $1 billion annual revenue run rate too.

- Databricks said vibe coding and genAI is accelerating data-intelligent apps built on Lakebase, Databricks Apps and Agent Bricks.

- The company has seen positive free cash flow over the last 12 months.

- Lakebase is growing revenue at twice the base of data warehousing.

- Databricks has more than 700 customers consuming more than $1 million in annual revenue run rate.

Databricks said it will use the capital to provide liquidity for employees, future acquisitions and AI research.

Databricks 2025:

- Google Cloud Gemini models go GA on Databricks

- Databricks, OpenAI form $100 million partnership

- Databricks valued at $100 billion

- Databricks Data & AI Summit Key Takeaways

- Databricks Summit 2025: The Lakehouse Becomes a Decision Platform

- Databricks natively integrates Google Cloud Gemini models

- Databricks launches Mosaic Agent Bricks, Lakeflow Designer, Lakehouse

- Databricks acquires Neon, sees Postgres scaling key to agentic AI

- Databricks forges partnership with Anthropic, adds innovative system to enhance open source LLMs

- Databricks forges partnership with Anthropic, adds innovative system to enhance open source LLMs

- SAP launches Business Data Cloud, partnership with Databricks: Here's what it means