Accenture says advanced AI is so pervasive it won’t break it out anymore

Accenture said that AI is so pervasive in enterprise transformation that it won't break out figures going forward. And although AI is everywhere, Accenture noted that half of the advanced AI projects also require a data project.

The consulting giant broke out advanced AI--a category with generative AI, agentic AI and physical AI--bookings were $2.2 billion in the first quarter, double from a year ago. Accenture also said that it has reached its goal of 80,000 AI and data professionals.

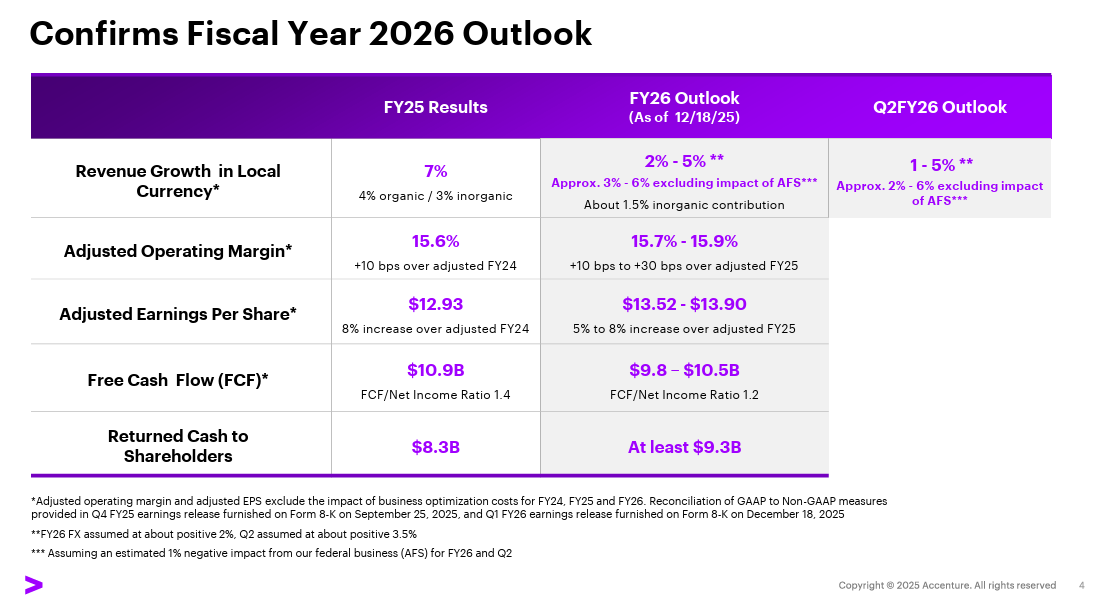

Accenture reported first quarter earnings of $3.54 a share on revenue of $18.7 billion, up 6% from a year ago. For fiscal 2026, Accenture is projecting revenue growth of 2% to 5%.

CEO Julie Sweet explained how AI is now everywhere just like cloud is.

"As we think about the advanced AI opportunity ahead, as you know, we were the first in our industry to share our bookings and revenue from advanced AI, which we define as GenAI, Agentic AI and physical AI and does not include data, classical AI or RPA. "This will be the last quarter in which we share these specific metrics. The demand for AI is both real and rapidly maturing. We've now reached a point where advanced AI is being embedded in some way across nearly everything we do, and many of our clients are focusing on moving beyond standalone proof of concepts or initiatives."

Sweet said the AI disclosure made sense in late 2023 when bookings were $100 million across 100 projects. Today, Accenture has delivered about $11.5 billion in bookings across 11,000 projects with revenue of $4.8 billion. Advanced AI is being deployed in 1,300 of Accenture's 9,000 clients.

Accenture said its focus is scaled projects that integrate multiple forms of AI. In other words, it's difficult to separate AI from broader projects. Sweet said "demand for reinvention remains strong" and transformation projects include both digital core (cloud and data projects) as well as AI and cover everything from manufacturing to finance and insurance to supply chain.

"Starting with the demand environment, clients continue to prioritize their most strategic and large-scale transformational programs, which convert to revenue more slowly but position us at the center of the reinvention agendas. The pace of overall spending and discretionary spend in our market is at the same levels we have seen over the last year," said Sweet.

According to Accenture, AI projects almost inevitably mean data transformation. "When companies tell us they want to use AI, they quickly realize that AI is only as powerful as the data underneath it," said Sweet. "Most organizations have mountains of data spread across systems, stored in different formats, often unreliable or incomplete. Before AI can create value, underlying data and the processes connected to it need to be simplified, cleaned, connected and properly governed."

Accenture is using AI to modernize data platforms and improve quality at scale. Sweet said at least half of the advanced AI projects also require a data project.

Sweet cited projects with Essity and Bristol Myers Squibb as examples of clients leveraging AI agents to automate processes. "The real opportunity is not proving AI works, it is making it work everywhere. Scaling AI means working with all forms of AI and means embedding it across critical processes so it transforms outcomes," said Sweet.

Other takeaways from Accenture's first quarter earnings call:

- "Enterprise AI is fundamentally different than consumer AI. Consumer AI adoption is instant. In the enterprise, you can't adopt it unless you have the right security. You've done the right work around processes and most companies have fragmented and siloed processes. You have to have the right data and most companies have mountains of data with a lot of issues in the data, and we call it they have process debt, they have data debt. And of course, they need a modern digital core. And that's why so many companies are still early in the journey," said Sweet.

- Productivity isn't driving AI projects as much. "when you look at our bigger deals over the last quarter, for example, you see that advanced AI is a bigger part of those deals, but you also see that it's both growth and cost because clients are not only fixated on the productivity side. You cannot cut your way to growth. And in this market, they need to find more growth," said Sweet.

- Banking is leading in AI and finance and procurement are key use cases. Energy and utilities and pharmaceuticals are early in terms of scaling. "There are leaders in every industry who already had strong digital course who are leapfrogging. It's very different than cloud where you have some industries like, say, energy lagging behind for quite some time. It's quite different this time," said Sweet.