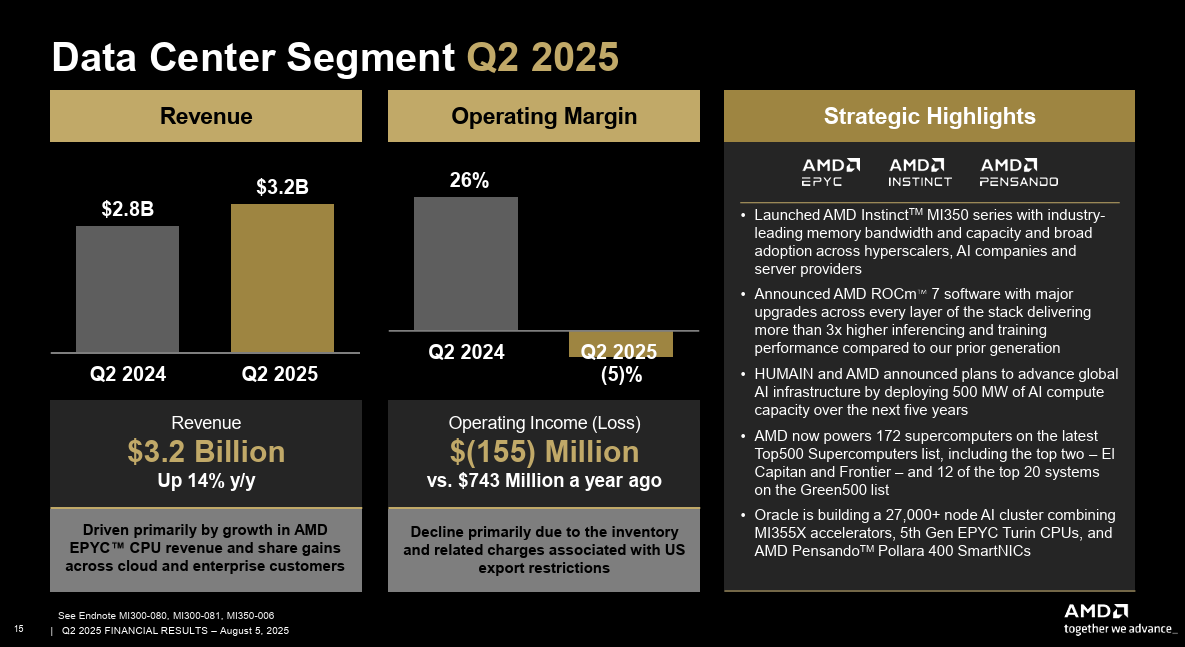

AMD's second quarter was in line with expectations as its data center unit delivered sales growth of 14%. The company said US restrictions on exports to China hurt sales.

The company reported second quarter earnings of $872 million, or 54 cents a share, on revenue of $7.68 billion, up 32% from a year ago. Non-GAAP earnings were 48 cents a share.

Wall Street was looking for non-GAAP second quarter earnings of 48 cents a share on revenue of $7.43 billion.

AMD said the quarter was hit by US government export control on its AMD Instinct MI308 data center GPUs. Those restrictions led to an $800 million inventory charge.

- AMD eyes AI inference gains with new Instinct accelerators, GPU, open rack systems

- AMD sells ZT Systems manufacturing business to Sanmina for $3 billion

Dr. Lisa Su, AMD CEO, said the company saw record server and PC processor sales and "robust demand across our computing and AI product portfolio." Su added that AMD expects more market share gains for its EPYC and Ryzen processors. Those chips are mostly benefiting from Intel's malaise. Intel recently reported a rocky quarter.

Key figures in the second quarter include:

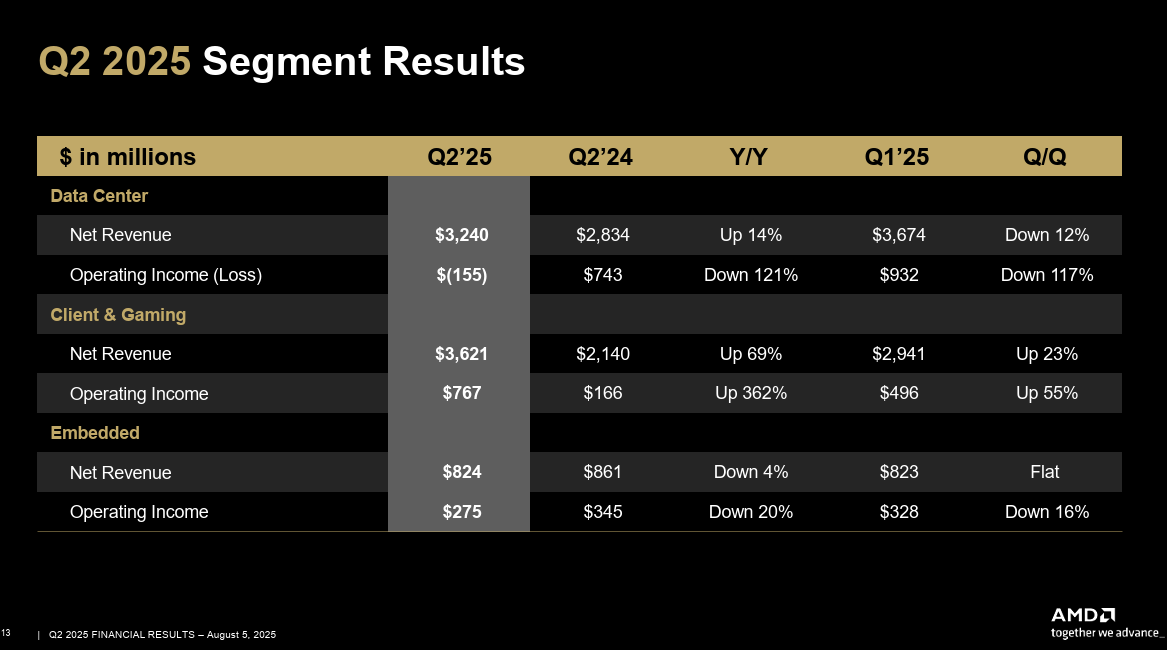

- Data center revenue was $3.2 billion in the second quarter, up 14%.

- Client and gaming revenue was $3.6 billion, up 69% from a year ago. PC chips surged due to AMD's latest Ryzen desktop processors. Gaming revenue surged 73% due to semi-custom revenue and AMD Radeon GPU demand.

- Embedded revenue was $824 million, down 4% from a year ago.

As for the outlook, AMD said third quarter revenue will be about $8.7 billion, give or take $300 million. The outlook doesn't include any revenue from AMD Instinct MI308 shipments to China.

Speaking on an earnings conference call, Su said:

- "There are now nearly 1,200 EPYC cloud instances available globally and providers continue expanding both the breadth and regional availability of their AMD offerings. EPYC enterprise deployment grew significantly from the prior quarter, supported by new wins with large technology, automotive manufacturing, financing services and public sector customers."

- "Our sovereign AI engagement accelerated in the quarter as governments around the world adopt AMD technology to build secure AI infrastructure and advance their economy. As one example, we announced a multi billion dollar collaboration with Germany to build AI infrastructure powered entirely on AMD GPUs, CPUs and software."

- "Demand for AMD powered notebooks was strong with sales growing by a large double digit percentage year over year. We drove a richer mix of higher ASP mobile cards year over year, as we expanded our share in a premium notebook segment where our Ryzen AI 300 CPUs deliver leadership, performance and value for both general purpose and AI workloads. We also closed new enterprise wins with Forbes 2000 pharma, tech, automotive, financial services, aerospace and healthcare companies."

Holger Mueller, an analyst at Constellation Research, said:

"AMD can't catch the break as it can't ignite data center revenue with its AI chips. And while it's fair they maybe affected by tariffs and export controls, the writing was on the wall. That client and gaming are the growth engine to save the quarter is good overall but doesn't help Su and team to play the data center and AI boom. Next quarter will be key the formation of AMD's personality."