SAP's Q4 cloud backlog spurs concerns

SAP current cloud backlog fell short of expectations in the fourth quarter even as results were better than expected.

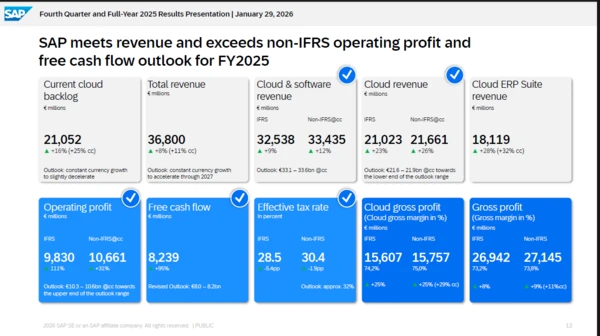

The company's current backlog was up 16% in the fourth quarter and up 25% in constant currencies. SAP CEO Christian Klein said in the third quarter that cloud backlog would be up at least 25%. Klein said in the third quarter that SAP had a strong pipeline and analyst should be "a bit more optimistic than the 25%."

Worries about SAP's cloud backlog dented shares. In premarket trading, SAP was down more than 15% and set to open at a 52-week low. SAP shares are now back to levels last seen in 2024. SAP, along with other software stocks, have been sold heavily on concerns that large language models will ultimately take share from SaaS.

SAP reported fourth quarter earnings of €1.9 billion, or €1.58 a share, on revenue of €9.7 billion, up 3% from a year ago. Cloud and software revenue was up 4% and SaaS/PaaS revenue was up 21%.

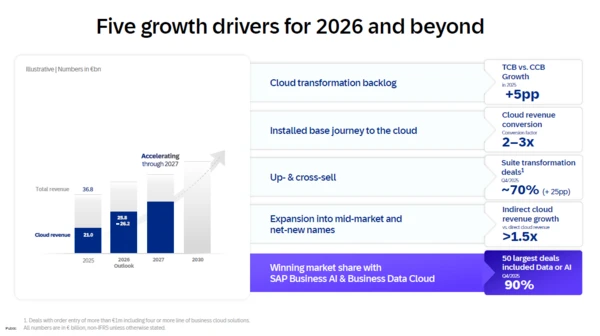

Klein said total cloud backlog was up 30% and that is creating a "strong foundation for accelerating total revenue growth through 2027. SAP Business AI has become a main driver for growth."

SAP said that SAP Business AI was included in two thirds of fourth quarter cloud orders and being adopted across its ERP offerings.

However, SAP did note that its current cloud backlog was hurt by larger deals that have cloud revenue that's backloaded. "Large transformational deals with high cloud revenue ramps in outer years and termination for convenience clauses required by law negatively impacted fourth quarter constant currency current cloud backlog growth by approximately 1 percentage point," said SAP.

For 2025, SAP reported earnings of €7.5 billion on revenue of €36.8 billion.

What to make of SAP's results? Here are a few points to ponder:

- First, a weaker US dollar has hit SAP revenue which is reported in Euros. The spread between constant currency revenue and reported revenue is usually within a few percentage points. SAP has a 9% spread between the two. For comparison, IBM has benefited from a weaker dollar with fourth quarter revenue growth of 12%, which would be 9% in constant currency.

- SAP is still moving large multinational customers to the cloud and that'll take a lot of work before revenue is actually recognized. SAP noted that its NPS score fell 3 points in 2025 to 9 due to "on-premise customers who have yet to transition to cloud." SAP noted NPS scores for cloud customers was steady.

- And enterprises are looking at their architectures going forward due to agentic AI. ServiceNow and Rimini Street are trying to abstract ERP systems away with a focus on process automation. The decades old practice where enterprises sign long-term deals and complain after are over. Even the models of vendors that used to be seen as enterprise software disruptors are being questioned.

SAP is arguing that its shares are a buy and announced a €10 billion buyback over two years.

As for the outlook, SAP laid out the following guidance for 2026:

- Cloud revenue growth of 23% to 25% in constant currency (€25.8 billion to €26.2 billion).

- Cloud and software revenue growth of 12% to 13% at constant currency.

- SAP said first quarter cloud revenue growth will take an 8% hit due to currency.

- About €10 billion free cash flow.

- Accelerating revenue growth through 2027.