Databricks details Q4 figures, raises $7 billion to build out Lakebase, Genie

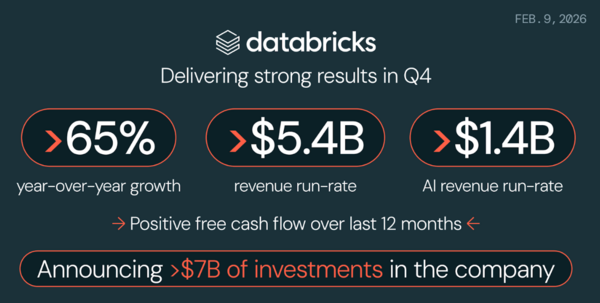

Databricks said its annual revenue run rate is $5.4 billion, up 65% from a year ago, and it has raised another $7 billion to invest in its Lakebase and Genie efforts.

The $5.4 billion annual run rate is above the $4.8 billion annual run rate disclosed in December.

Databricks valuation remains at $134 billion. The $7 billion capital raise includes $5 billion in equity and $2 billion in debt.

In a statement, Databricks said the finance included both new and existing blue-chip investors.

According to the company, the new funding will go to accelerate its Lakebase serverless Postgres database for AI agents and Genie, its AI assistant that connects to data.

- Databricks annual revenue run rate hits $4.8 billion with $134 billion valuation

- Google Cloud Gemini models go GA on Databricks

- Databricks, OpenAI form $100 million partnership

- Databricks valued at $100 billion

- Databricks Data & AI Summit Key Takeaways

- Databricks Summit 2025: The Lakehouse Becomes a Decision Platform

Key figures disclosed include:

- Positive free cash flow over the last 12 months.

- $1.4 billion in revenue run rate for AI products.

- More than 800 customers consuming at more than a $1 million annual revenue run rate.

- And more than 70 customers consuming more than $10 million annual revenue run rate.

Databricks is expected to be among 2026's hot IPOs.

Constellation Research analyst Holger Mueller said:

"2025 was the battle for the Data Lakehouse - and Databricks did all the right moves to position itself well. 2026 is about the AI frameworks that enterprises need to select. Databricks has less of an innate advantage in that market so we will see how 2026 will pan out. Nevertheless, you need the data for the AI."