Apple’s Q1 iPhone sales surge has it chasing supply to rebuild inventory

Apple's first quarter shined amid strong iPhone revenue that was well ahead of expectations. Now the company sees too-lean inventories and the company is in "supply chase mode."

"iPhone had its best-ever quarter driven by unprecedented demand, with all-time records across every geographic segment," said Apple CEO Tim Cook.

Cook added that iPhone demand was "staggering" and the company's channel inventory was low after the December quarter.

"We exited the December quarter with very lean channel inventory due to that staggering level of demand," said Cook. "We're in a supply chase mode to meet the very high levels of customer demand. We are currently constrained, and at this point, it's difficult to predict when supply and demand will balance."

Cook said Apple is seeing constraints for its most advanced nodes for systems on a chip and higher memory costs ahead.

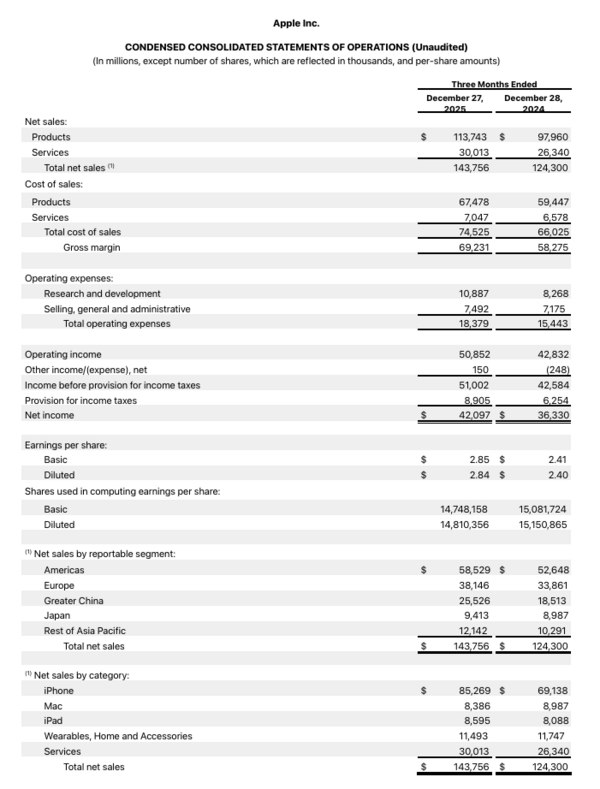

Apple reported first quarter earnings of $2.84 a share on revenue of $143.8 billion. Wall Street was expecting fiscal first quarter earnings of $2.67 a share on revenue of $138.48 billion.

The company said iPhone revenue was $85.27 billion in the first quarter, up from $69.14 billion.

Apple's results come amid a Financial Times report that it has acquired Q.ai, an Israeli startup that can analyze facial expressions and could enable non-verbal discussions with AI assistants. The deal is valued at $2 billion.

Although Apple's iPhone sales shined Mac and wearables were lower than a year ago. Apple iPad and services were up from a year ago. Services hit a revenue record of $30.01 billion, up 14% from a year ago.

CFO Kevan Parekh said Apple generated nearly $54 billion in operating cash flow.

As for the outlook, Parekh said:

"We expect our March quarter total company revenue to grow by 13 to 16% year over year, which comprehends our best estimates of constrained iPhone supply during the quarter."

In addition, services revenue will have a similar growth rate as the first quarter and R&D expenses will be higher compared to a year ago. Gross margins will be between 48% to 49%, which is strong considering memory pricing.

Key figures for the first quarter include:

- Americas revenue was $58.53 billion, up from $52.65 billion a year ago.

- China revenue of $25.53 billion were well ahead of $18.51 billion a year ago.

- Europe revenue was $38.15 billion, up from $33.86 billion.

- Installed base of active devices is not 2.5 billion.

- Apple hit all-time revenue records for advertising, cloud services, music and payment services.

- Mac revenue was down 7% due to a tough comparison with the M4 MacBook Pro, Mac Mini and iMac launches a year ago.

- Half of customers purchasing an Apple Watch during the quarter were new to the product.

On the conference call with analysts, Cook said:

- Apple executives repeatedly declined to answer questions about the terms of its Google Gemini deal. Cook said: “You should think of it as a collaboration. We independently continue to do some of our own stuff, but you should think of what is going to power the personalized version of Siri as the collaboration with Google.”

- "We were excited to see that the majority of users on enabled iPhones are actively leveraging the power of Apple intelligence. Since the launch of Apple intelligence, we've introduced dozens of features, including writing tools and cleanup and made it available in 15 languages."

- "Today, we're shipping servers to power Apple intelligence from our new manufacturing facility in Houston through our advanced manufacturing program, we're working with Corning in Kentucky to make 100% of cover glass for iPhone and Apple Watch."

- "We're working with Micron, which broke ground on a new, advanced chip packaging and test facility, and we continue to advance the development of an end-to-end silicon supply chain across the country, sourcing 20 billion US chips in 2025."