Oracle Q2 mixed, says it will be neutral on GPUs

Oracle reported a mixed second quarter and said it has sold its Ampere unit because it's not strategic to design and manufacture its own chips. Oracle CTO Larry Ellison said, "we are now committed to a policy of chip neutrality where we work closely with all our CPU and GPU suppliers."

Ellison noted that it will continue to buy the latest GPUs from Nvidia but "we need to be prepared and able to deploy whatever chips our customers want to buy," said Ellison, who added that "there are going to be a lot of changes in AI technology over the next few years and we must remain agile in response to those changes."

The shift from Oracle is interesting given Google Cloud has gained with its custom TPUs and AWS is leveraging its Trainium processors.

The company reported second quarter earnings of $6.13 billion, or $2.10 a share, on revenue of $16.06 billion, up 14% from a year ago. Non-GAAP earnings were $2.26 a share. Wall Street was looking for non-GAAP earnings of $1.64 a share on revenue of $16.19 billion. Oracle's earnings got a $2.7 billion pre-tax boost due to the sale of Ampere.

Oracle's closely watched cloud infrastructure sales were $4.1 billion, up 68% from a year ago. Cloud revenue overall in the second quarter checked in at $8 billion, up 34%. SaaS revenue was $3.9 billion in the quarter, up 11% from a year ago.

The company said that remaining performance obligations were $523 billion, up 438% from a year ago, due to large contracts with OpenAI. How Oracle will finance its data center buildout has been a hot topic for the company.

Oracle CEO Clay Magouyrk said Oracle is halfway through building 72 multi-cloud data centers embedded in AWS, Google Cloud and Microsoft Azure. Mike Sicilia, Oracle's other CEO, said the company is embedding AI and automation throughout its applications.

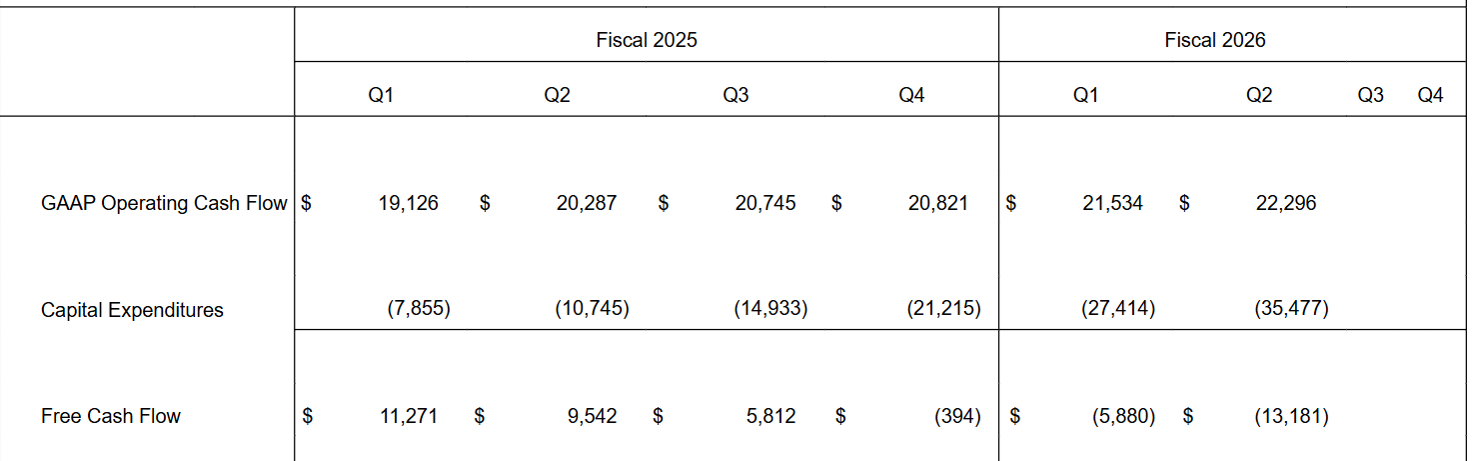

On a conference call with analysts, Doug Kehring, Principal Financial Officer, said Oracle said the fiscal year revenue expectation remains at $67 billion, but the added RPO this quarter will bump up revenue by $4 billion for fiscal 2027. Kehring said fiscal 2016 capital expenditures will be $15 billion higher than forecasted last quarter due to contracts that can be monetized quickly.

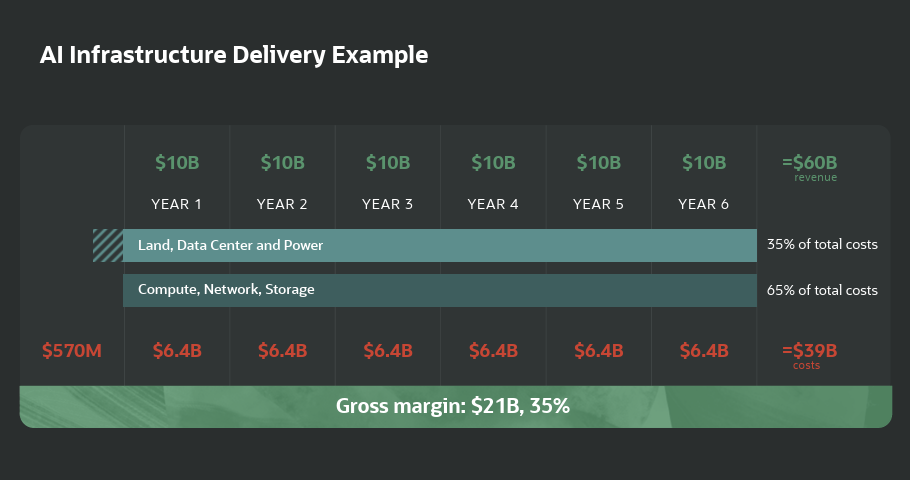

“While we continue to experience significant and unprecedented demand for our cloud services, we will pursue further business expansion only when it meets our profitability requirements and the capital is available on favorable terms,†said Kehring. He said third quarter total cloud revenue will be up 37% to 41% in constant currency.

According to Kehring, third quarter revenue will be up 16% to 18% with non-GAAP earnings between $1.64 and $1.68 a share in constant currency or $1.70 to $1.74 per share in US dollars.

Key points from the call, which revolved around noting that Oracle plans to be investment grade and build out when the infrastructure can be monetized. After all, Oracle spent $35 billion in capital expenditures for the third quarter with $13 billion in negative cash flow.

- Magouyrk said it was difficult to put a number on funding needs. “We actually have a lot of different options for how we go about delivering this capacity to customers. There's obviously the way that people think about it, which is we buy all the hardware up front. But we don't actually incur any expenses for these large data centers until they're actually operational.â€

- Oracle’s capital expenditures can also change based on whether customers bring their own GPUs or decide to rent capacity, said Magouyrk.

- Magouyrk said: “We continue to see strong demand for AI infrastructure across training and inferencing. We follow a very rigorous process before accepting customer contracts. This process ensures that we have all the necessary ingredients delivered to customer success at margins that make sense for our business. We continue to carefully evaluate all future infrastructure investments, invested only when we have alignment across all necessary components to ensure profitable delivery for our customers.â€

- “Over the next month, we see increasing customer demand with billions in identified pipelines,†said Magouyrk.

- Sicilia said: “In our healthcare business, we now have 274 customers live in production on our clinical AI agent, and that number continues to rise daily.â€