Custom AI processors mean Broadcom printed money in Q4

Broadcom reported better-than-expected fourth quarter results as it continued to see a revenue surge due to custom AI chips.

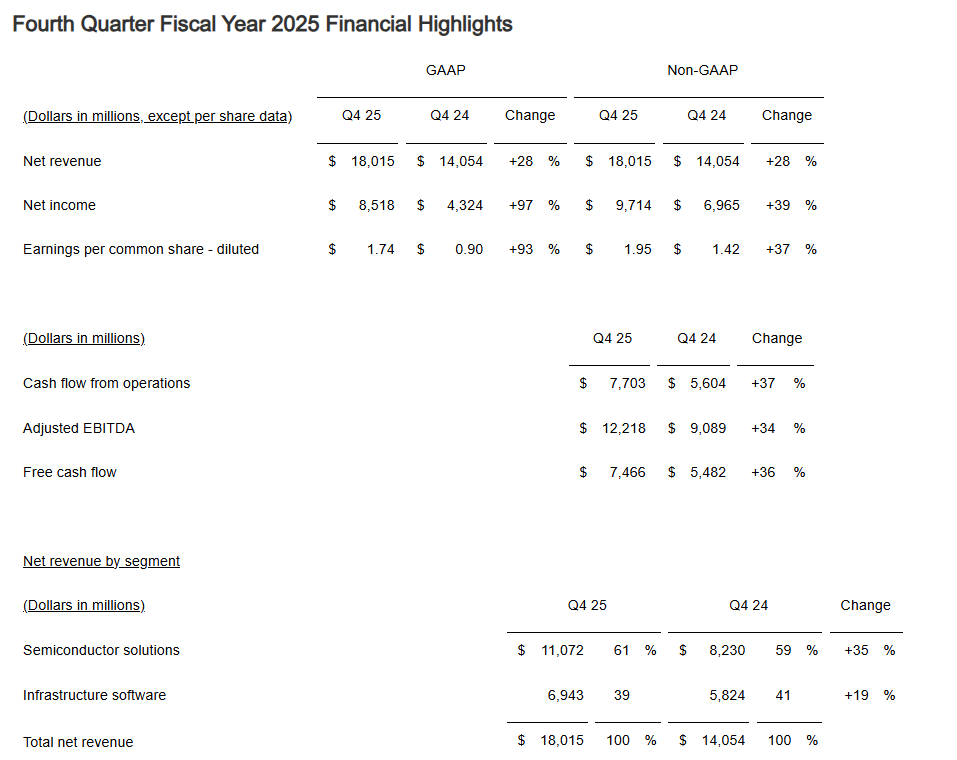

The company reported fourth quarter net income of $8.52 billion, or $1.74 a share, on revenue of $18.01 billion, up 28% from a year ago. Non-GAAP earnings for the fourth quarter were $1.95 a share.

Wall Street was expecting non-GAAP earnings in the fourth quarter of $1.86 a share on revenue of $17.49 billion.

As for the outlook, Broadcom projected first quarter revenue of $19.1 billion, up 28% from a year ago.

Broadcom, despite acquiring VMware to beef up its software business, is still a hardware story. CEO Hock Tan said revenue growth was "driven primarily by AI semiconductor revenue increasing 74% year-over-year." Broadcom makes chips for Google and inked a deal for custom processors for OpenAI.

Tan added that it expects momentum to continue in the fourth quarter driven by demand for custom AI accelerators and Ethernet AI switches.

In the fourth quarter, Broadcom's semiconductor business was 61% of sales and infrastructure software was 39%. Chip revenue was up 35% in the quarter and software was up 19%.

As a result, Broadcom is just printing money. Cash flow from operations in the fourth quarter was $7.7 billion, up 37% from a year ago. Free cash flow was up 36%. Broadcom's cash and cash equivalents checked in at $16.18 billion, up from $10.72 billion in the previous quarter.

For fiscal 2025, Broadcom reported net income of $23.13 billion, or $4.77 a share, on revenue of $63.89 billion, up 24% from fiscal 2024.

Tan said on the earnings call:

- "Our custom accelerated business more than doubled year-over-year, as we see our customers increase adoption of XPUs, as we call those custom accelerators in training their LLM and monetizing their platforms through inferencing APIs and applications."

- "These XPUs, I may add, are not only being used to train and inference internal workloads by our customers, the same XPUs in some situations have been extended externally to other LLM peers, best exemplified at Google, where the TPUs use in creating Gemini, have also been used for AI cloud computing by Apple, Coherent and SSI as an example."

- "Last quarter, Q3 '25, we received a $10 billion order to sell the latest TPU Ironwood racks to Anthropic. And this was our fourth customer that we mentioned. And in this quarter Q4, we received an additional $11 billion order from the same customer for delivery in late 2026."

- "That does not mean our other two customers are using TPUs. In fact, they prefer to control their own destiny by continuing to drive their multiyear journey to create their own custom AI accelerators or XPU racks, as we call them. And I'm pleased today to report that during this quarter, we acquired a fifth XPU customer through a $1 billion order placed for delivery in late 2026."