Cisco delivers strong Q4 on AI infrastructure surge

Cisco said it saw strong orders for AI infrastructure as the company reported a strong fourth quarter.

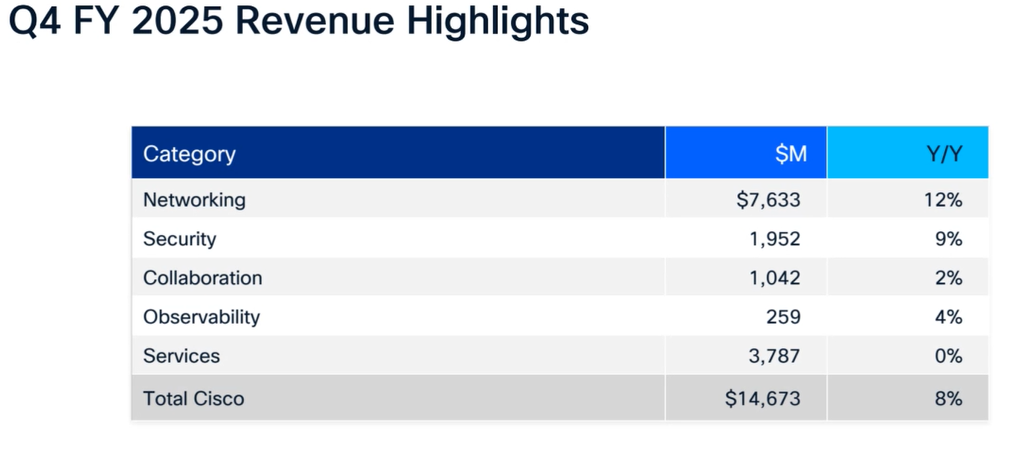

The company reported fourth quarter earnings of $2.8 billion, or 71 cents a share, on revenue of $14.7 billion, up 8% from a year ago. Non-GAAP earnings in the fourth quarter were 99 cents a share.

Wall Street was looking for fourth quarter earnings of 98 cents a share on revenue of $14.62 billion.

Chuck Robbins, CEO of Cisco, said "the AI infrastructure orders we received from webscale customers in fiscal 2025 were more than double our original target." He added that the company expects to see strong demand form sovereign AI deployments and emerging AI cloud providers. Robbins added that Cisco’s sales scale is boosting its Splunk unit and security strategy.

- Cisco tunes network portfolio, gear for AI agents, introduces AgenticOps

- Cisco launches quantum lab, unveils quantum networking chip

Cisco rival Arista surged last week after it said revenue growth will be about 25% in 2025 to $8.75 billion due to strong enterprise and AI demand. Jayshree V. Ullal, CEO of Arista, said during the company's second quarter earnings call that "we recognize the potential to build a truly transformational networking company." Juniper, another Cisco rival, has been acquired by HPE.

Here's a look at Cisco by the numbers:

- Fourth quarter orders were up 7% from a year ago, across multiple regions. AI infrastructure orders from webscale customers topped $800 million in the fourth quarter for a fiscal 2025 total of more than $2 billion.

- Cisco's networking business delivered revenue growth of 12% to $7.63 billion in the fourth quarter.

- Security revenue was up 9% in the fourth quarter to $1.95 billion.

- For fiscal 2025, Cisco reported earnings of $2.61 a share on revenue of $56.7 billion.

As for the outlook, Cisco projected first quarter non-GAAP earnings of 97 cents a share to 99 cents a share on revenue of $14.65 billion to $14.85 billion. Fiscal 2026 revenue will be between $59 billion to %60 billion with non-GAAP earnings of $4 a share to $4.06 a share.

Key items from Robbins during the conference call:

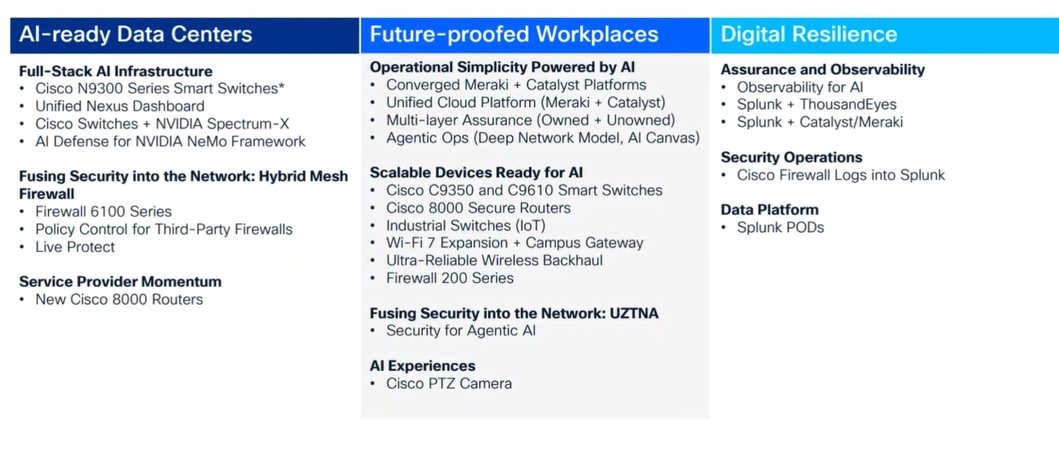

- “Our new smart switches are powered by Silicon One and deliver enhanced performance, quantum secure networking and radically simplified cloud native and AI driven operations, all supporting the new realities as AI changes how it work and collaborate. The introduction of our new switches marks the beginning of a major multiyear refresh cycle opportunity for Cisco's large installed campus switching base.â€

- “AI orders are ramping and we have a growing pipeline in the hundreds of millions of dollars as these customers look to Cisco to provide simple, scalable and secure solutions.â€

- “The Cisco secure AI factory with Nvidia provides a trusted blueprint for building secure AI ready data centers for enterprises, sovereign cloud providers and newly emerging neo cloud providers.â€

- “While we have some clarity on tariffs, we are still operating in a complex component environment. Our Q1 and fiscal year 2026 guide assumes current tariffs and exemptions remain in place for the end of fiscal 2026.â€

- “We're pretty confident that we haven't seen any indication of any pull forwards in AI infrastructure among backend networks of the cloud providers.â€