Cisco delivers strong Q1, starts to capture AI infrastructure spend

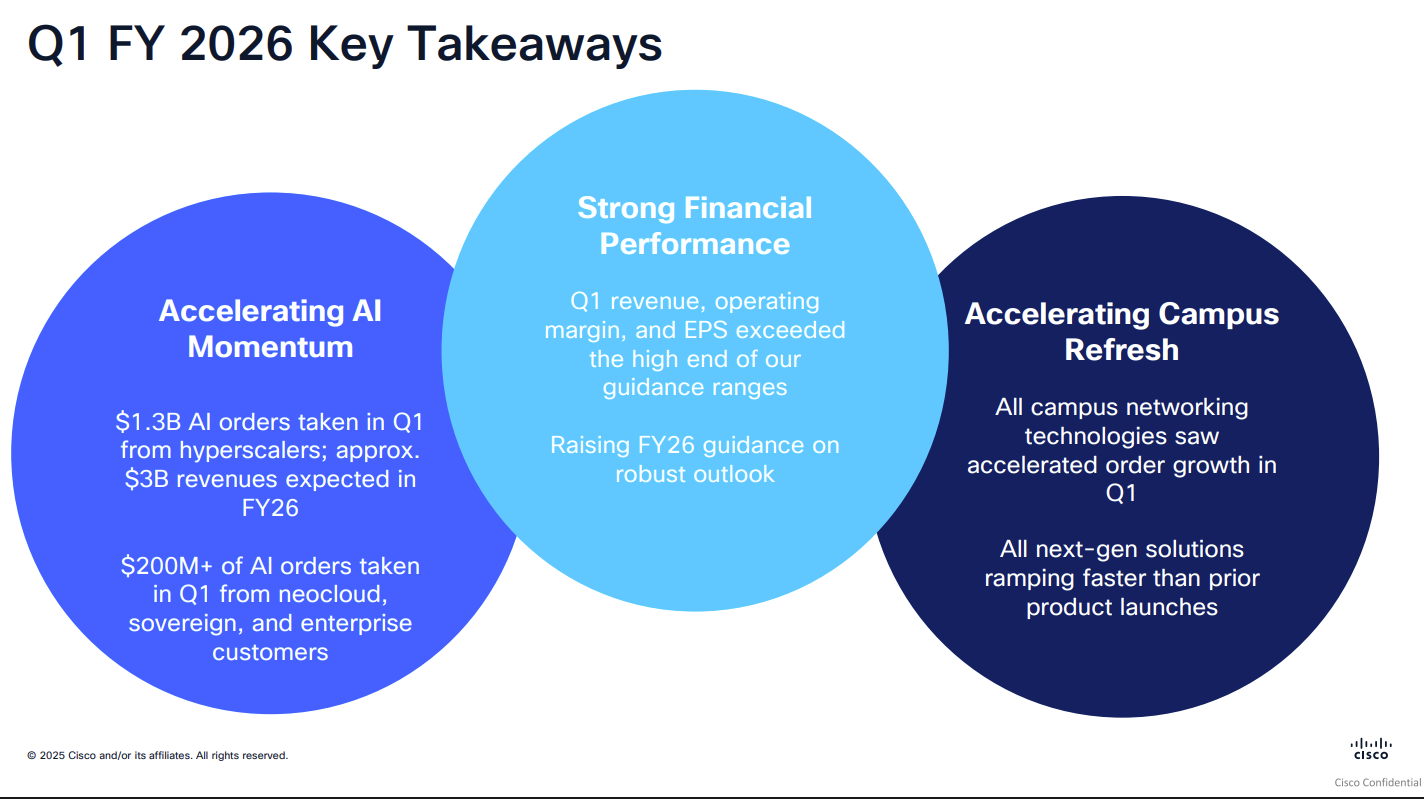

Cisco reported better-than-expected first quarter results, raised its outlook and said it landed more AI infrastructure orders from hyperscalers and posted strong networking growth.

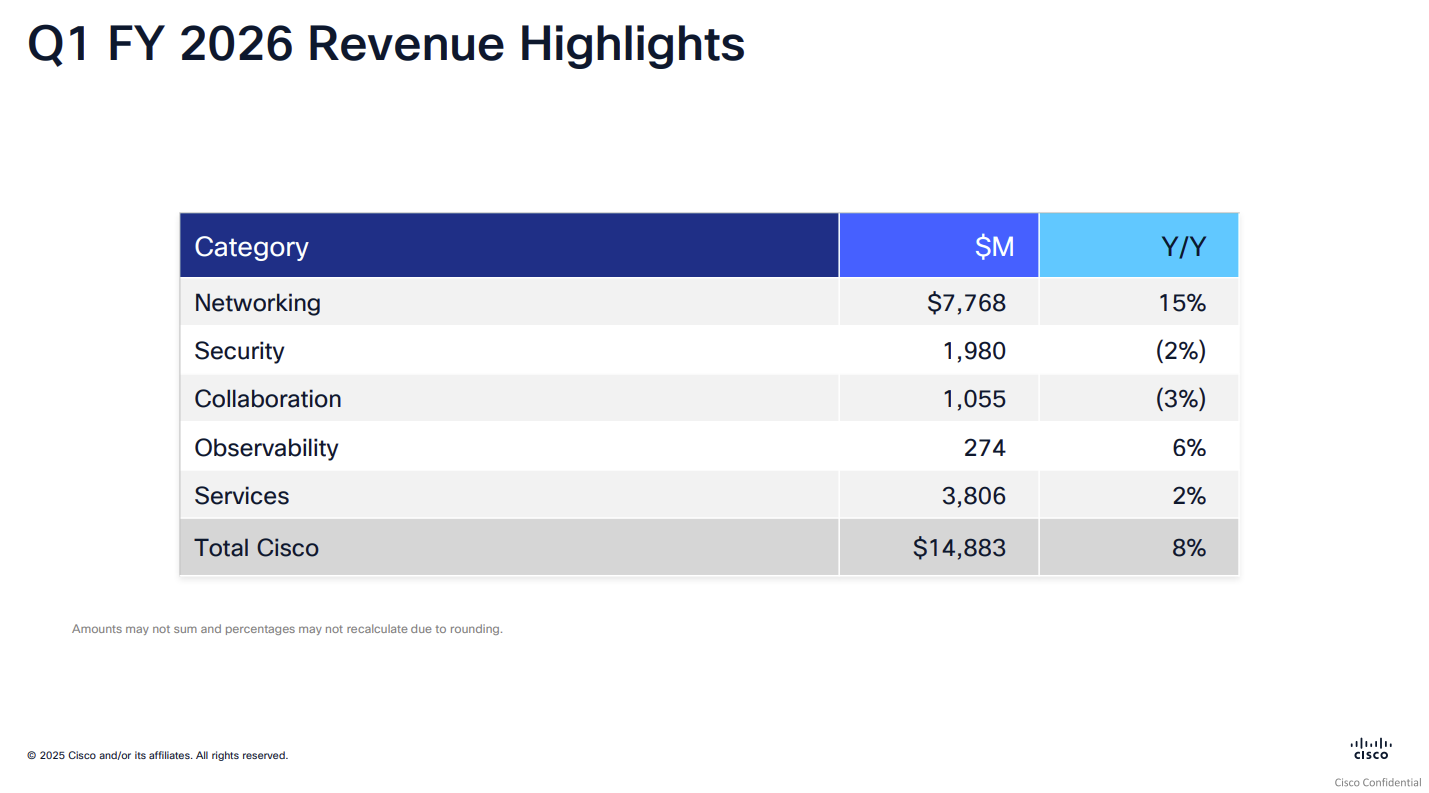

The company reported first quarter net income of $2.9 billion, or 72 cents a share, on revenue of $14.9 billion, up 8% from a year ago. Non-GAAP earnings for the first quarter were $1 a share.

Wall Street analysts were expecting Cisco to report non-GAAP fiscal first quarter earnings of 98 cents a share on revenue of $14.78 billion.

CEO Chuck Robbins said Cisco saw "widespread demand for our technologies."

Mark Patterson, Cisco CFO, said that the company's "relevance in AI continues to build and we have a multi-year, multi-billion-dollar campus refresh opportunity starting to ramp, with strong demand for our refreshed networking products."

By division, Cisco said its first quarter networking revenue was up 15% with observability up 6%. Security and collaboration were down 2% and 3% from a year ago, respectively. Security revenue was hampered by Splunk, which saw more customers opt for cloud deployments. That mix shift affected results this quarter, but is a long-term benefit for Cisco.

- Cisco tunes network portfolio, gear for AI agents, introduces AgenticOps

- Cisco launches quantum lab, unveils quantum networking chip

As for the outlook, Cisco projected second quarter revenue of $15 billion to $15.2 billion with non-GAAP earnings of $1.01 to $1.03 a share. For fiscal 2026, Cisco projected non-GAAP earnings of $4.08 a share to $4.14 a share on revenue of $60.2 billion to $61 billion.

Key points from Cisco executives from the earnings call:

- Robbins said, "we see a solid pipeline through the rest of the year." He said Cisco is seeing strong demand for routers, optical networking and switches. "We are beginning to see inferencing use cases where we are winning there," said Robbins. Four hyperscalers inked big deals with Cisco, which is also landing neo-cloud providers.

- "We expect Cisco's AI opportunity across sovereign neo-cloud and enterprise customers to ramp in the second half of fiscal year '26," said Robbins.

- The upside in AI infrastructure from enterprises should continue, said Robbins. "We know many customers still have a lot of work to do to ensure they have the modern, scalable, secure networking when they're supporting their AI goals," said Robbins.

- "We're also seeing consistent progress across our industrial IoT portfolio, including new ruggedized equipment, with orders growing more than 25% year over year. In Q1 infrastructure, we expect this demand to increase, driven by onshoring of manufacturing to the United States, the increase of AI workloads at the network edge and the emergence of physical AI infrastructure orders," said Robbins.