Apple Q3 strong ahead of iPhone launches

Apple's third quarter results were better-than-expected as the company delivered 10% revenue growth from a year ago.

The company reported earnings of $1.57 a share on revenue of $94 billion. Wall Street was looking for June quarter earnings of $1.43 a share on revenue of $89.54 billion.

In a statement, CEO Tim Cook said the company's June quarter saw strong growth across product lines and geographies.

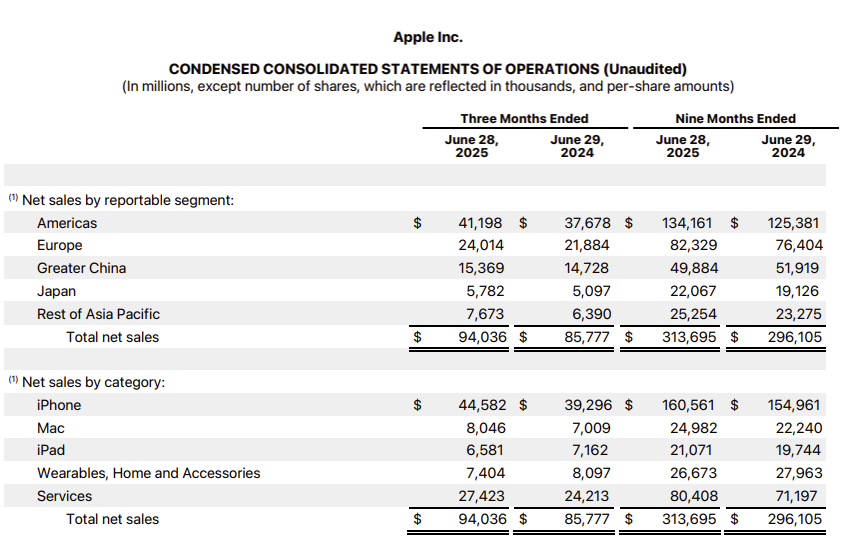

By the numbers in the third quarter:

- iPhone sales were $44.58 billion, up from $39.3 billion.

- Mac revenue was $8.05 billion, up from $7 billion.

- iPad revenue was $6.58 billion, down from $7.16 billion.

- Wearables revenue was $7.4 billion, down from $8.09 billion.

- Services sales were $27.42 billion, up from $24.2 billion.

Apple has been under fire for its slow moving AI strategy and progress with Apple Intelligence.

- Why Apple should buy Perplexity and possibly keep going

- Apple names new chief operating officer, Williams to retire

Cook said on Apple's conference call:

- "We saw an acceleration of growth around the world in the vast majority of markets we track, including Greater China and many emerging markets. And we had June quarter revenue records in more than two dozen countries and regions, including the U.S., Canada, Latin America, Western Europe, the Middle East, India and South Asia. These results were driven by double-digit growth across iPhone, Mac and Services."

- "We see AI as one of the most profound technologies of our lifetime. We are embedding it across our devices and platforms and across the company. We are also significantly growing our investments. Apple has always been about taking the most advanced technologies and making them easy to use and accessible for everyone. And that's at the heart of our AI strategy."

- "The situation around tariffs is evolving, so let me provide some color there. For the June quarter, we incurred approximately $800 million of tariff-related costs. For the September quarter, assuming the current global tariff rates, policies and applications do not change for the balance of the quarter and no new tariffs are added, we estimate the impact to add about $1.1 billion to our costs. This estimate should not be used to make projections for future quarters as there are many factors that could change, including tariff rates."