Enterprise AI: It's all about the proprietary data

Two distinct AI markets have emerged. There's the AI infrastructure, superintelligence chase and funding fest with projections that border on fictional. And then there's enterprise AI that revolves around process, automation, specific use cases and compute that’ll be spread around.

The divergence between the two AI markets has widened throughout 2025 but is now inescapable. The AI infrastructure boom is all about a chase for consumer AI. In this week's saga, OpenAI, Softbank and Oracle launched Stargate’s flagship AI factory and other sites, OpenAI entered a deal with Nvidia for $100 billion in funding where the LLM player builds data centers (on Nvidia GPUs) and then gets paid for every gigawatt deployed. Sam Altman hinted at big plans.

In a nutshell, consumer AI is more like covering a sports story. OpenAI pledges $300 billion to buy AI infrastructure from Oracle. Oracle buys GPUs. Nvidia backstops CoreWeave with purchase guarantees if it has extra capacity. OpenAI also appears to be a big future buyer of Broadcom XPUs (which probably led to the Nvidia deal). Meanwhile, Amazon, Google and AWS all have to buy Nvidia but building their own custom chips for AI workloads.

GPUs are essentially like Pokémon cards being traded among a handful of really rich kids. The trading game works until it doesn't. The reality is that the numbers may not work. According to a report by Bain & Co., $2 trillion in annual global revenue is needed to fund the computing power needed to meet anticipated AI demand by 2030. Bain estimated that even with anticipated AI savings, the world is $800 billion in short to keep pace with demand.

And then there's enterprise AI, which is slower moving but could deliver more value and result in on-prem and edge AI. Enterprise AI revolves around proprietary data sets and real returns (as opposed to the pie-in-the-sky possibly happening kind). Enterprises in multiple industries are starting to leverage their unique data and insights into new revenue streams driven by AI.

Frankly, enterprise AI can be more interesting and sustainable. Enterprise AI is what will be there when this AI bubble eventually bursts. Here's a look at a few scenes from the data and enterprise AI transformation front where thinking three- to five-years pays off big.

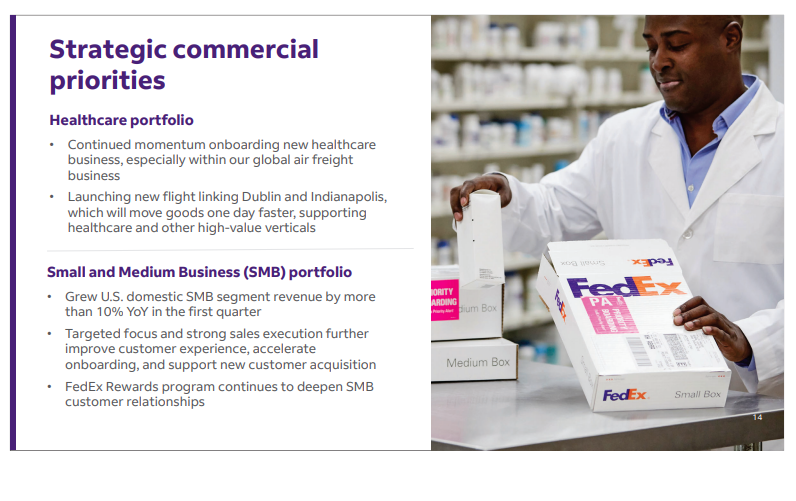

FedEx: The metadata about packages is more important than the actual package

Rajesh Subramaniam, CEO of FedEx, laid out the transformation that's either happening or needs to happen across every company and industry. Speaking on FedEx's first quarter earnings call, Subramaniam laid out the importance of the data ground game.

Subramaniam said that data and technology is the foundation of FedEx and "that information about the package is as important as the package itself."

"We moved 17 million packages through our network daily, generating 2 petabytes of data and 100 billion transactions across software applications," said Subramaniam. "But the real value is in the volume. It is in the unique nature of this data. Our position at the intersection of global commerce gives us an unmatched view of physical supply chain patterns, seasonal demand shifts and emerging trade corridors."

FedEx recently hired Vishal Talwar as chief digital and information officer and president of FedEx Dataworks. Talwar was the former chief growth officer at Accenture Technology and his remit at FedEx is to turn the company's physical digital assets into "next-generation AI-led capabilities."

Subramaniam said FedEx is looking to scale AI across operations and create new revenue models. For the core business, FedEx is ramping an expanded partnership with Best Buy and new Amazon business. Those logistics services will only add to the data pool.

The big takeaway from Subramaniam was that FedEx is set to reap the rewards from building out its data platform in 2020. That data platform is now "the fuel for AI," he said. FedEx has already launched its commerce platform FDX, which is used as a workflow tool and supply chain orchestrator.

"Our mission and vision has evolved to make supply chain smarter for everyone. It begins with our data platform and the insights that we have on supply chain and the role of AI and the tools that we have," said Subramaniam, who noted that FedEx will outline the data and AI strategy more in February.

Exxon: Leveraging its project data

Exxon is using AI to leverage its knowledge management knowledge that takes all the lessons learned from every project, both large and small, and store them for future use. Exxon built its database on projects well before AI.

However, generative AI was the big unlock.

Speaking at the recent a recent energy investment conference, Exxon Senior Vice President Jack Williams said: "A lot of the advantage of AI is in how good your data set is, how good is the data that AI model is learning from. And we have some great data that's built on the world's largest project database. And so, we're very optimistic that's going to make a big difference long term. It just make us that much more productive and that much better in terms of making sure that we're leveraging every single lesson, ever single bit we've learned in the past and bring that to every single project we do."

Exxon also has an internal platform that takes historical data and makes it available for AI applications. This data complements a large ERP transformation that will provide a consistent data architecture.

Speaking on Exxon's second quarter earnings call, CEO Darren Woods said cost efficiency from AI is a second priority compared to driving effectiveness. At Exxon, saving a million here and there can quickly add up to billions of dollars saved.

"A bigger value lever is frankly on the effectiveness side of the equation. We're looking better at how we can take advantage of AI to make the products that we make at much a lower cost and with much better performance parameters, find oil cheaper," said Woods. "You can just kind of go through the list of things that we do to produce the products that we make."

Intuit: AI, data investments lead to "system of intelligence"

Intuit has been ahead of emerging technology curves for nearly a decade. By building out its data platform, Intuit made a transition to generative AI. Now that Intuit has its AI model game down it's starting to leverage AI agents. Now Intuit CEO Sasan Goodarzi is looking to AI to reinvent the company's SaaS business, deliver a unified platform for business and accelerate growth.

Goodarzi, CTO Alex Balazs and other executives outlined a bullish vision for the company. As noted previously, Intuit is gunning for the midmarket enterprise and sticking with customers as their businesses grow.

"We believe that every SaaS company, anybody that makes software is either going to get disrupted or they're going to be the disruptors. And that's because of what's possible with AI," said Goodarzi. "We believe that SaaS players must become the system of intelligence, which means you have to be great at data, data models, data ingestion and AI capabilities to ultimately architect learning systems that learn from customers and deliver the experiences that they are looking for, which means business logic, workflows and the app layer will completely get disrupted."

- Intuit starts to scale AI agents via AWS

- Intuit embraces LLM choice for multiple use cases

- Intuit sees 'green shoots' from its generative AI strategy

- Intuit’s bets on data, AI, AWS pay off ahead of generative AI transformation

Six years ago, Intuit bet the company on data and AI. Now the pieces are in place for Intuit become the "system of intelligence" it wants to be. In July, Intuit launched a bevy of AI agents to go along with its AI-enabled human experts. This intersection is what Intuit calls AI and HI (human intelligence).

Balazs said: "Data, data services and AI are durable advantage. And as we evolve from a system of record to a system of intelligence, our all-in-one platform and agentic capabilities fuel customer growth."

Goodarzi said that Intuit's platform can eliminate 80% of the apps customers use, collapse data silos and lower costs for them.

"We are building our systems in a way where we're disrupting business logic. Ultimately, the customer can engage with us and ask for, how do I grow my business, how do I sell wine that's over $50 versus other competitors? Which customers are most profitable? Let me give you my POS data. Can you tell me which areas I should focus on? Whatever you want to engage with the platform on, we, ultimately, our data, AI and HI capabilities deliver that experience. That is a system of intelligence. That is our strategy," said Goodarzi.

Intuit has three big bets: Creating done-for-you experiences for everything from payroll, accounting, taxes and marketing to name a few. Money and cash flow services are the other big bet. And finally the midmarket will give Intuit more growth.

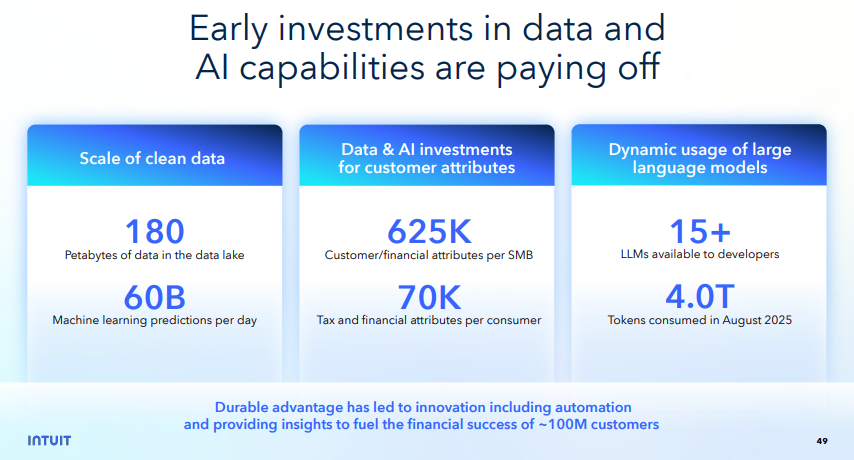

The data assets are impressive. Intuit has:

- 625,000 data points per business with insights on specific businesses and insights.

- 70,000 data points for consumers.

- 1,300 engineers actively building AI agents.

- Insights on more than $1 trillion in money moved.

- More than 15 large language models are orchestrated by Intuit's internal financial LLMs. Balazs added that Intuit takes a balanced approach in applying genAI, and traditional and classical AI techniques.

- Intuit's GenOS enabled 9,800 model deployment events in the last fiscal year.

Intuit will outline how it's putting these parts together at Intuit Connect in October.

FICO and Equifax: From credit scoring to decisioning platform

Fair Isaac Corp. (FICO) launched its own LLMs for financial services designed to deliver accurate and auditable outcomes and trust scores.

FICO launched a series of foundational models for financial services including FICO Focused Language Model for Financial Services (FLM) and FICO Focused Sequence Model for Financial Services (FSM).

In a nutshell, FICO is taking its data and training foundational models to address specific tasks or business problems. FICO's models require up to 1,000x fewer resources than general models.

FICO CEO William Lansing said the company's investment in its data and AI platform is designed to enable enterprises to make decisions and apply intelligence across customer lifecycles. The company also inked a deal with AWS for greater adoption of its FICO Platform.

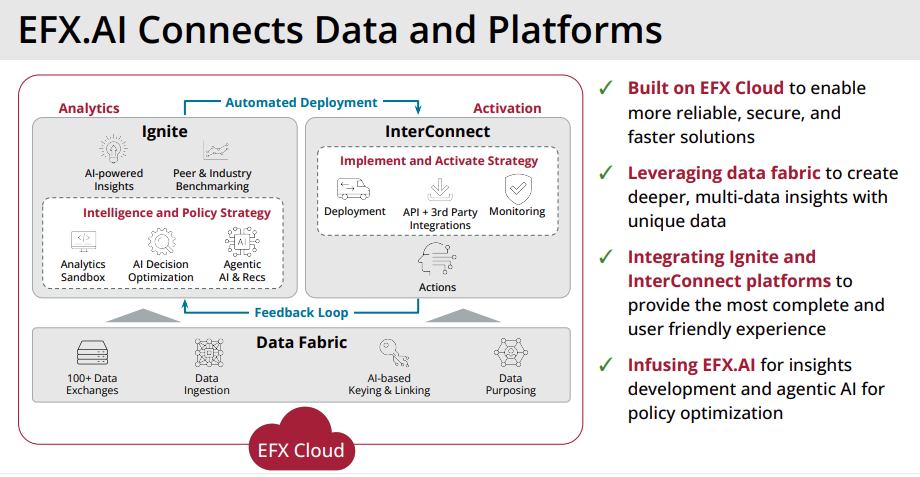

Equifax is another company that has completed a long transition to the cloud, leveraged its data sets and now is releasing new products at scale. That focus on cloud and data platforms have enabled Equifax to also leverage AI well.

CEO Mark Begor said at a recent investment conference: "The power of the AI allows us to ingest more data and we have more data than our competitors. We believe we can deliver products that are differentiated versus our competitors because I think everyone in the room knows when you use more data in this decision, you generally get a higher predictive solution. And higher predictability means ROI from our customers and it means either market share or price for Equifax."

- Equifax bets on Google Cloud Vertex AI to speed up model, scores, data ingestion

- With Equifax's cloud transformation at finish line, AI scale comes into focus

Begor added that Equifax has proprietary data that it can only use. The differentiation in an emerging enterprise AI market is leveraging your own data. "The moat is the aggregation of the data that means only we can apply AI to it," said Begor.