CFOs lose appetite for risk in Q2 amid economy worries, says Deloitte

Chief financial officers are paring expectations for the economy, revenue, earnings and capital investments for the second quarter as they become more risk averse, according to Deloitte's latest CFO Signals report.

Deloitte's quarterly report showed that CFO sentiment fell in the second quarter as the CFO confidence score was 5.4, indicating medium confidence, down from 6.4 in the first quarter. The first quarter tally indicated high confidence among CFOs.

By the numbers:

- 23% of CFOs rate the North American economy as good now. In the first quarter, half of CFOs said the North American economy was good.

- 46% of CFOs said the US stock market was undervalued with 41% saying it was overvalued.

- 53% of CFOs said debt financing was attractive.

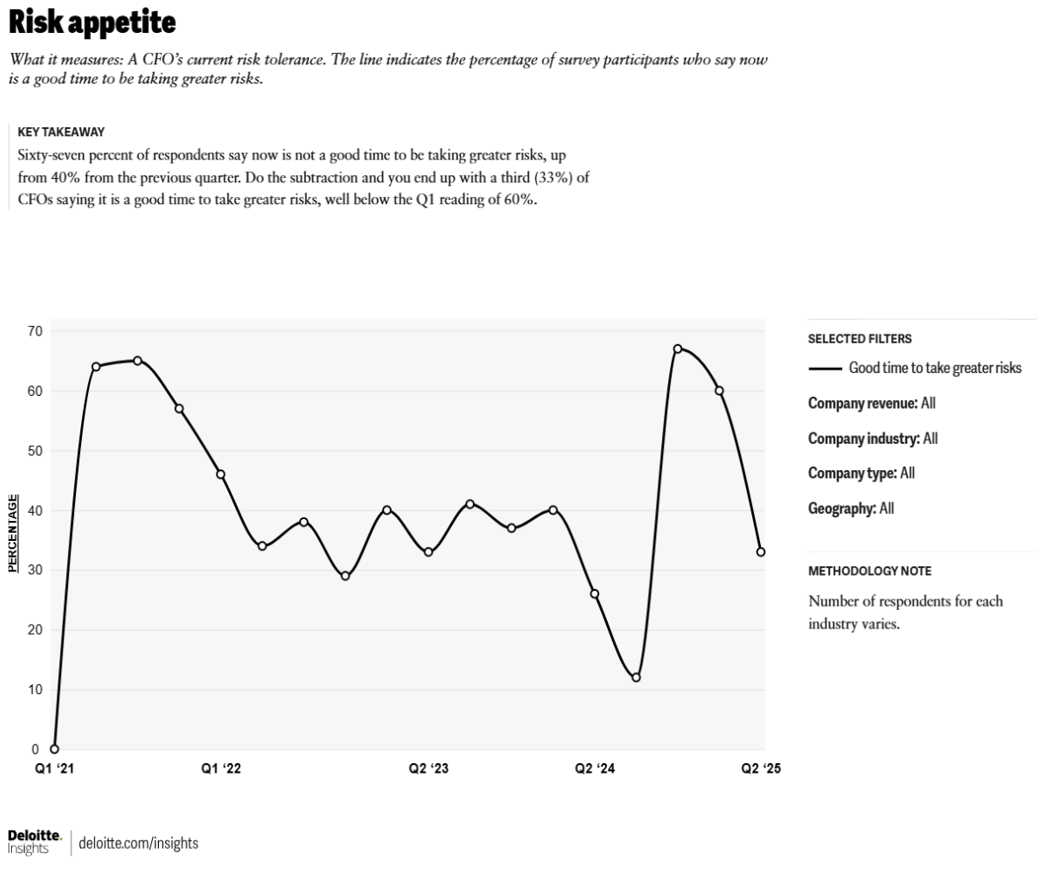

- One in three CFOs believe it's a good time to take on risk. That reading is the lowest since the third quarter of 2024 and well below the 60% of CFOs who thought the first quarter was a good time to take risk.

The top external and internal risks for CFOs were worth noting. CFOs were worried about the following external risks.

- 53% of CFOs said the economy was top external risk.

- 51% cited cybersecurity.

- 43% said interest rates.

- 42% supply chain disruptions.

- 42% said inflation.

- 37% said geopolitics followed by 32% who cited taxes.

The top internal risks included the following:

- 46% of CFOs were worried about talent.

- 46% were worried about lack of ability and resilience.

- 45% cited cost management.

- 43% cited efficiency and productivity.

- 43% cited data compatibility and accessibility.

- 43% cited technology deployment including AI.

- 36% cited strategy execution.