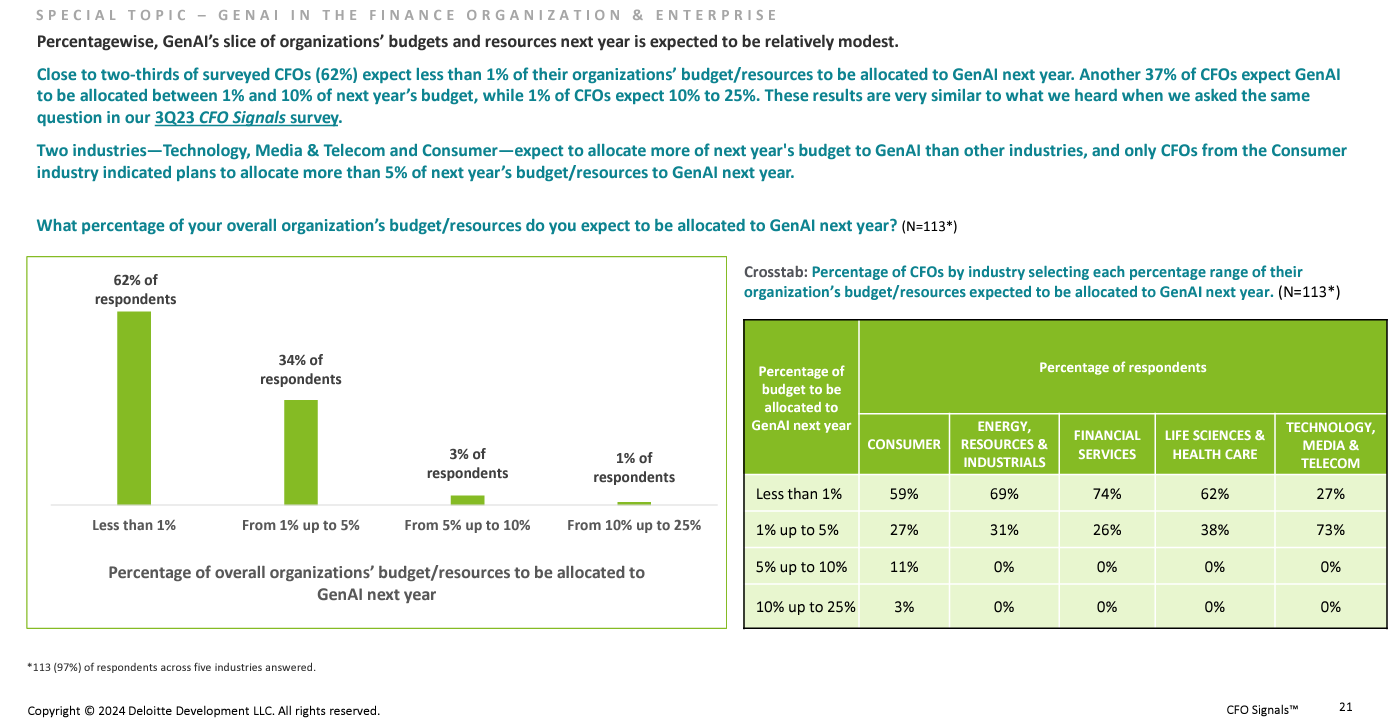

Sixty-two percent of CFOs say their organizations are allocating less than 1% of corporate budgets to generative AI next year, according to Deloitte's CFO Signals survey for the first quarter. Another 37% of CFOs expect 1% to 10% of budgets to be allocated to generative AI.

The findings, based on 116 respondents, are notable because they highlight how actual enterprise movement on generative AI has trailed headlines and vendor proclamations. Consumer companies plan to allocate more than 5% of their budgets to generative AI. Another notable takeaway is that 58% of CFOs say their boards are somewhat or very much encouraging genAI adoption in the enterprise.

Accenture: Enterprises focused on transformation, data foundation, genAI and punting on smaller projects | Data leaders bullish on generative AI, but multiple challenges remain, says Informatica | Here's why generative AI disillusionment is brewing

Here's the breakdown from the report.

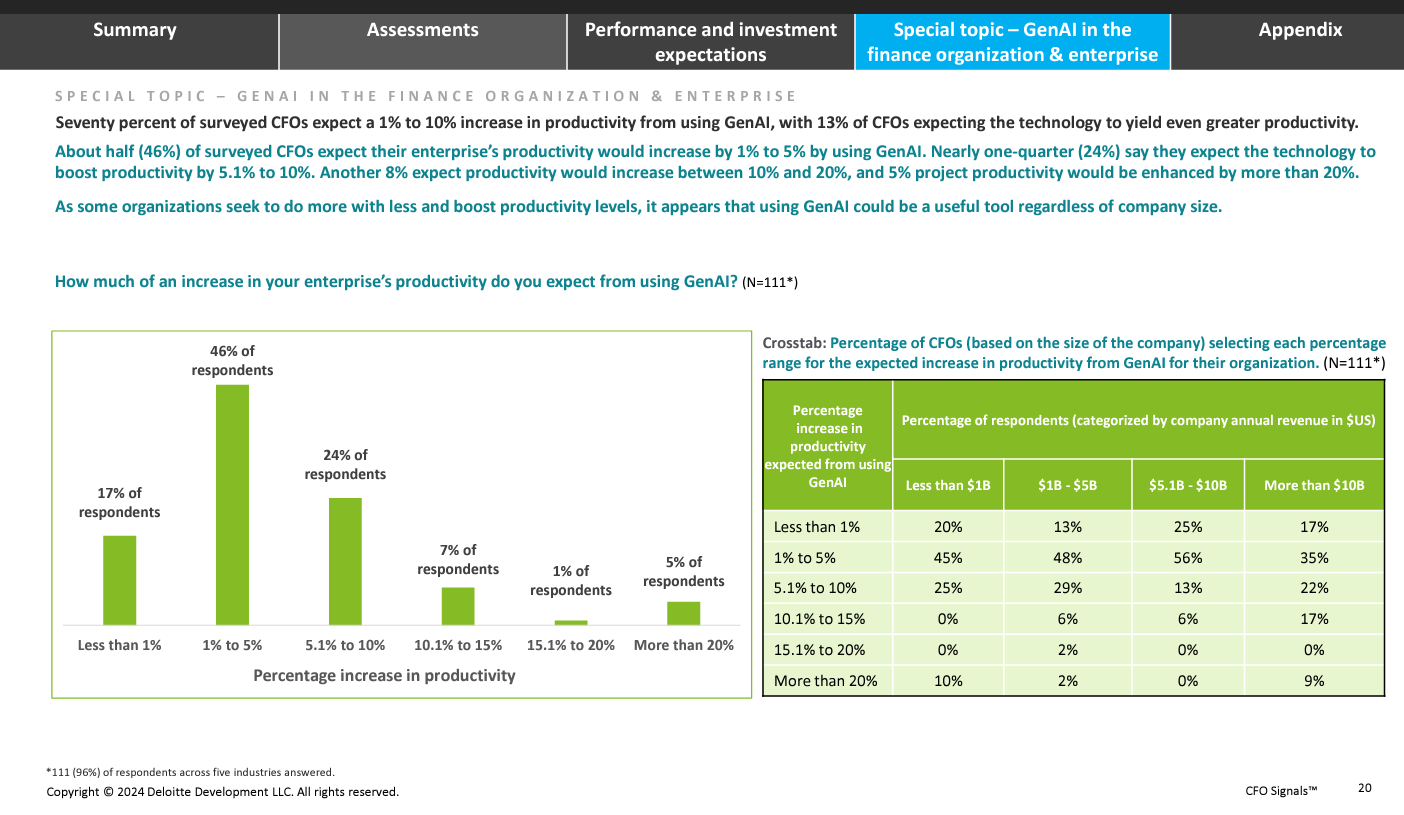

The budgets may move once the returns on generative AI become clearer. Seventy percent of CFOs expect a 1% to 10% increase in productivity from using genAI with 13% of CFOs seeing higher gains. Productivity is the return metric of choice among CFOs. CFOs from larger companies expect the biggest generative AI productivity gains.

For instance, 9% of CFOs from companies with more than $10 billion in revenue are expecting productivity gains of more than 20% from genAI. Five percent of CFOs surveyed expect productivity gains of more than 20%.

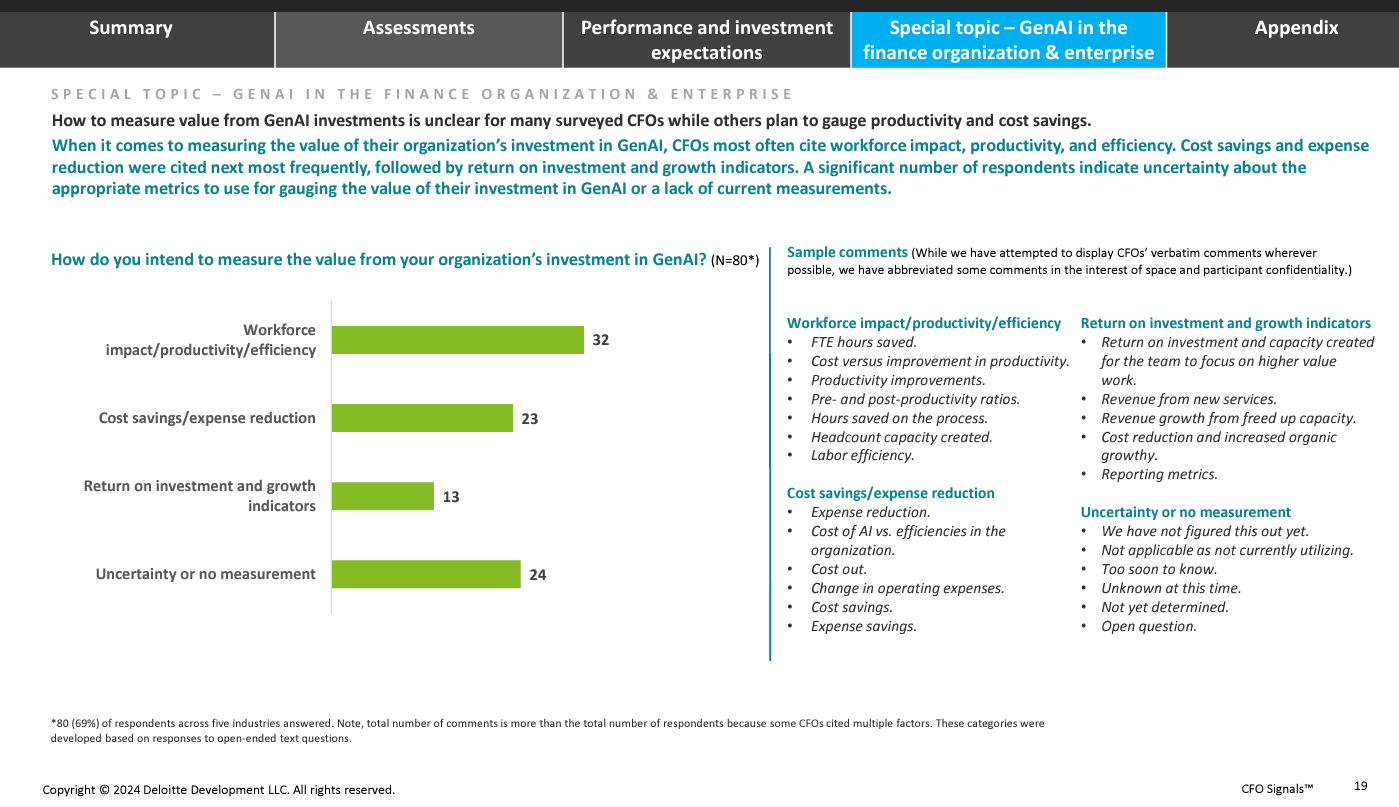

Going forward, CFOs are valuing generative AI on workforce productivity and cost savings. A big chunk of CFOs surveyed, 24%, are uncertain how to value generative AI or had no measurement.

Across the enterprise, CFOs say IT, business operations, customer service, finance and sales and marketing are the top functions ripe for generative AI transformation.

The generative AI data from the CFO Signals survey come amid other key themes. Other takeaways include:

- 40% of CFOs say now is a good time to take greater risks and the remainder are risk averse.

- 65% of CFOs say they believe the US equity markets are overvalued.

- 42% of CFOs say they were more optimistic about their own companies' financial prospects.

- 59% of CFOs saw North American economic conditions as good or very good, but 12% of CFOs saw Europe that way. Just 3% of CFOs China economic conditions as good.