Here are my top 3 takeaways:

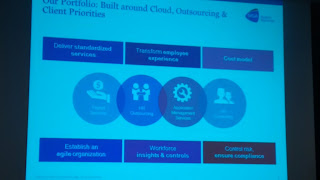

Clearer Positioning – For the longest time NGA struggled with positioning in the different HR markets where it operates. The one stop shop for all things HR seems like a simple message at first, but is not so trivial when you consider that NGA plays in HR Consulting, Payroll Services, HR Outsourcing and Application Management Services (the maintenance of mostly local HR systems). Then spread that across multiple partner and own products, multiple regions and it makes NGA a different vendor in each market. The overall challenge that NGA faces is that HR Consulting, that is implementation services, is undergoing a massive transformation due to the shift to SaaS. Implementation timelines, budgets and revenues are under immense pressure, very few traditional on premise implementations remain and SaaS implementation revenues are very small in comparison.

The good news a year ago was that management acknowledged the challenge, the strategy then was to partner with SaaS properties and become their respective implementation partner. Fast forward 12 months and only the partnership with SuccessFactors has been flourishing, implementation partnership ambitions with other SaaS vendors have been scaled back or stopped.

The challenge for NGA is a shrinking HR Consulting business in the short term and in the long term the deriving reduction of the Application Management Services. Maybe making a virtue out of necessity, SVP of Global Enterprise Sales Sternklar made it crystal clear (pun intended) that the future will be in HR Outsourcing, heavily global payroll focused. That’s welcome clarity that should help position NGA in many markets.

|

| The 4 NGA Business Fields |

Payroll Exchange live – A year ago NGA shared its ambitions around the Payroll Exchange, a software layer that allows NGA to operate global payroll customers in an efficient way. Not only does Payroll Exchange connect between NGA products (e.g. euHReka, ResourceLink and Preceda), but also to partner products (e.g. Workday Payroll, the SAP Cloud Payroll) and further 3rd party payrolls. It also gives visibility and access to payroll status and processes to customers, a very good level of transparency, especially if considering running payroll for a global employee population. Payroll Exchange is now available since January, 2 NGA customers are live and many more implementing. It is good to see NGA delivering on what it said it would deliver, now it needs to drive adoption to the platform.

|

| A glimpse at Payroll Exchange Analytics |

US targets mid-enterprise – NGA walked us through its renewed plans for the US SMB market, which the vendor calls mid-enterprise. It has pained NGA since many years that it did not have a solution for the considerable amounts of employees it needs to service in the US as part of global BPO contracts, but that by themselves were too small to warrant an individual setup of a euHReka system. So NGA has decided to use either the Workday or SuccessFactors Talent Management, partner with a local payroll provider and offer this as a mid-enterprise solution. Such an offering needs amounts of standardization, and NGA decided e.g. that paychecks would only be electronic, the language is only English etc. to share a few. Executives shared that there is substantial interest in the market, but it is too early to see customer adoption.

MyPOV

It is not the easiest of time for NGA with two (HR Consulting and Application Management Services) of its four businesses undergoing major market changes. We think the focus on global HR, complex payroll for global employee populations and deliver via BPO remains the sweet spot for NGA. The vendor has captured a signiificant share of payroll business, operating both Workday and SAP / SuccessFactors' payroll. It is good to see more focus on that business. We think NGA could be more aggressive in this market, and should start taking market share from competitors who are less committed since a few years. NGA certainly had to wait for the Payroll Exchange product to be ready, now it will be interesting to see how aggressively NGA can sell, deliver and operate global BPO.We received a more North American update than at least year’s summit, but NGA promised to give us more insight on its business beyond North America, and more details on the roadmaps of its IP around euHReka, ResourceLink and Preceda. On the concern side NGA in under pressure to grow, and it will be key for the vendor to find those growth potentials and realize them in the next quarters. Prospects, clients, ecosystem, influencers and employees don’t want to see shrinking vendors, and frankly there is no reason for NGA not to grow – or at least maintain revenue levels.

Overall good progress for the North American region that this analyst summit was all about. But given its global capabilities and ambition, it will be good for NGA to have their global leadership present at the next analyst summit (again). Regardless we will be watching on developments, stay tuned.

More on NGA HR:

- Progress Report - NGA moves on - but in many directions - read here

- NGA executes - but what is the ultimate positioning? Read here